Reuters investigation deflates State Department's argument that rail can fuel tar sands growth

In a critical investigation, Reuters has debunked the State Department’s argument that industry’s expansion plan for tar sands production, and the substantial climate emissions associated with it, can be fueled by rail if Keystone XL is rejected. Commentators in both the tar sands industry and financial community have repeatedly noted the role of Keystone XL as a linchpin for tar sands expansion. Reaching out to many of the same industry sources the State Department cited in its draft Supplemental Environmental Impact Statement (SEIS), the Reuters investigation demonstrates the errors in State’s analysis that led it to dramatically overstate the potential of rail to move tar sands. The Reuters investigation demonstrates that without Keystone XL, tar sands expansion and the environmental impacts associated with it, will be substantially reduced.

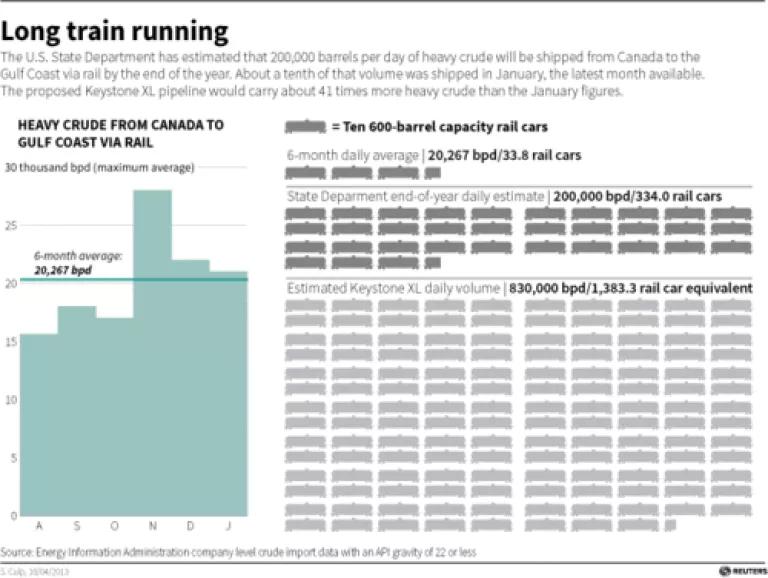

State’s prediction that 200,000 bpd of heavy Canadian tar sands would reach the Gulf by rail by the end of the year was based on a misinterpretation of industry data, according to the sources that State cited. As the Reuters story notes:

The State Department report cites two industry studies to predict that 200,000 barrels a day or more of Canadian heavy crude oil will reach Gulf Coast refiners by train by the end of this year. Officials used that figure to bolster their argument that the oil industry has already decided rail is a good option for moving oil sands crude. ‘Limitations on pipeline transport would force more crude oil to be transported via other modes of transportation, such as rail, which would probably (but not certainly) be more expensive,’ the State Department said.

However, the story goes on to show that State’s industry sources disagree:

But one of the sources for the 200,000 barrels per day estimate, Calgary investment bank Peters & Co, says its forecast was misunderstood as being for just Gulf Coast-bound oil when it included shipments to Eastern Canada and other refiners. ‘We haven't tracked exactly where those barrels are going,’ said Tyler Reardon, a spokesman for Peters & Co.

Where that 200,000 bpd is likely to go and whether its light or heavy is very important. Keystone XL would bring heavy tar sands from northern Alberta to the Gulf Coast where refineries have the equipment to handle heavy crude. Refineries in the East Coast of the United States and Canada only have a very limited capacity to process heavy crude – totally less than a quarter of the potential volume of Keystone XL.

The key question is whether it’s economically feasible to move heavy tar sands crude to the Gulf Coast refineries by rail. The answer appears be no. In a year when Gulf Coast prices for heavy Canadian tar sands were up to $50 a barrel higher than those in the Midwest, heavy Canadian crude movements to the Gulf by rail only increased from 15,000 bpd to 25,000 bpd between 2011 and 2012 – still around 1% of total production.

Image courtesy of Reuters

The Reuters story goes on to explain why State’s assumption that light crude by rail from North Dakota isn’t in any way analogous to moving heavy crude by rail from northern Alberta. Reuters confirms that significant quantities of light crude are indeed being moved by rail from North Dakota using large unit trains:

The use of unit trains - about 100 tank cars linked together on a dedicated route - is what pushed BNSF's North Dakota crude-by-rail volumes to about 500,000 barrels per day at the end of 2012 from about 70,000 barrels per day 18 months earlier.

But a comparison between light crude from North Dakota and heavy tar sands crude from northern Alberta is hardly apples to apples. Northern Alberta’s tar sands are 900 miles farther from Gulf Coast refineries than North Dakota, and when moving commodities by rail, distance makes a big difference for economic feasibility. The Reuters story also observed:

A standard tank car can carry about 700 barrels of light oil, but the fuel wrung from oil sands is so dense that it must either be diluted by about 20 percent or move in a specialty car that can hold only about 550 barrels, according to Jarrett Zielinski, an executive with Torq Transloading, a Canadian company that advises oil sand producers on such shipments.

All of these differences add to the cost of rail. According to Reuters:

While the State Department says in the report that moving a barrel of heavy crude through a Keystone pipeline would cost no more than $10 a barrel, oil sand producers say they are facing costs closer to $30 a barrel by train.

As we’ve noted, tar sands is some of the most expensive crude in the world to produce, and many new projects are unlikely to move forward with substantially higher transportation costs. Another State Department industry source interviewed in the Reuters story discussed the economics of rail transport for tar sands:

Those economics are tenuous, said Sandy Fielden, director of energy analytics with RBN Energy LLC in Houston, who has studied crude-by-rail. "If rail were such a terrific option now out of Western Canada, why haven't more producers switched from pipeline to rail?"

The truth is that Keystone XL is the primary driver to expand tar sands production in Canada and the U.S. State Department must consider how building this pipeline will lead to a substantial increase in US climate emissions. Fortunately, the State Department is still at the draft stage with its environmental review. The Reuters investigation provides the basis for State to go back to the drawing board on Keystone’s climate impacts.

The cheapest way to get from point A to point B is a pipeline. That is why Keystone has got to go ahead" Steve Hansen, Analyst and Raymond James, April 18, 2013