A series of recent industry announcements is pouring cold water on the argument that tar sands development will happen at the same pace and scale with or without major infrastructure projects like Keystone XL. In recent months, two major tar sands mines have been canceled, the Canadian Association of Petroleum Producers (CAPP) have substantially reduced their forecasted rates of tar sands expansion, and rising costs have caused an investor exodus for a number of proposed projects. Even as increasing breakeven costs push tar sands expansion projects beyond the realm of economic viability, tar sands by rail to the Gulf Coast continues to prove to be more expensive than predicted. Industry recognizes that its production forecasts cannot be realized unless it gets all of the major proposed tar sands pipelines it currently proposes as well as an expansion of rail infrastructure. These recent revelations demonstrate many of the flawed assumptions behind the State Department’s environmental review of Keystone XL. It is increasingly clear that Keystone XL will enable a substantial expansion of tar sands production and the climate impacts associated with that expansion.

“The biggest uncertainty in this forecast is the timing associated with this [pipeline] capacity and whether or not they can deliver the capacity on the timelines they now propose,” Greg Stringham, Vice President of Canadian Association of Petroleum Producers, June 9, 2014

New tar sands projects have already proven far more economically marginal than the State Department assumed in its environmental review of Keystone XL. Two major proposed tar sands mines have been cancelled due to deteriorating market conditions, including Shell’s 200,000 barrel per day (bpd) Pierre River Mine and Suncor and Total’s 160,000 bpd Josyln mine. After announcing the cancelation of the Josyln mine, Total’s CEO observed:

“Costs are continuing to inflate, when the oil price -- and specifically the netbacks for the oilsands -- are remaining stable at best, thus, squeezing the margins. We see that this situation cannot be sustainable in the long term," Andre Goffart, Total CEO, May 29, 2014

The tar sands industry doesn’t expect the problem of growing costs to go away any time soon. In its most recent forecast, CAPP reduced its projection of tar sands expansion in 2030 by nearly half a million barrels per day over last year’s estimate, citing increasing costs and pipeline constraints.

Of particular interest, the majority of the reductions come from new in situ production projects. In situ production projects, which use steam and other chemicals to access deeper tar sands reserves, are even more carbon intensive that tar sands mines but are typically lower cost. However, in situ projects are now facing a double blow from rising capital costs and increasing natural gas prices. CAPP is now forecasting that over 300,000 bpd of planned in situ projects won’t move forward by 2030.

Facing rising costs and lackluster returns, several major in situ proposals are already facing challenges. Huksy’s 80,000 bpd Sunrise in situ project has faced significant cost inflation and serious difficulty obtaining the necessary financing to move forward. The problem with declining financing can be seen across the industry, as investment in tar sands expansion in 2013 was little more than half that in 2012. As increasing costs continue to squeeze already thin margins, the problem of declining investment is likely to contiune.

This is a dramatically different picture of the industry than that painted in the State Department’s analysis of the Keystone XL. In its assessment, State assumed that in situ expansion projects would not be impacted by constrained pipeline capacity unless oil prices declined below $70 per barrel. In reality, in recent months many tar sands projects – both mines and in situ projects – have proven economically marginal with global oil prices well in excess of $100 per barrel. Meanwhile, the tar sands industry recognizes that rising production costs are likely to reduce rates of tar sands expansion in coming decades, as is reflected in CAPP’s 2014 forecast. As Peter Tertzakian, the Chief Energy Economist at ARC Financial Corp. in Calgary noted:

“A barrel of oil priced at $110 (U.S.) in world markets sounds high, but paperwork filed by chief financial officers is not convincing shareholders that investing ten-plus billion dollars into far-flung oil fields is worth the growing risks.”

For an industry for which rising production costs are already pushing proposed expansion plans beyond the edge of profitability, higher transportation costs are not a feasible option. And there is little doubt that tar sands by rail has proven substantially more expensive than moving tar sands by pipeline. According to RBN Energy, shipping tar sands by rail “costs a minimum of $15/Bbl more than by pipeline – resulting in lower netbacks for the producer versus pipelines.” That’s a minimum for $15 per barrel from the bottom line for projects that are already proving unable establish they can make a profit shipping by pipeline.

Perhaps that’s why tar sands by rail shipments to the Gulf Coast haven’t taken the trajectory of crude by rail from North Dakota or that predicted by State in past environmental reviews. After years of pipeline constraints, shipments of heavy Canadian crude to the Gulf by rail have failed to reach substantial volumes. An analysis of the Energy Information Administration’s crude import data shows that heavy Canadian crude shipments to the Gulf by rail and by barge only reached 50,000 bpd in April. For the most part, those volumes were being shipped by smaller tar sands producers that would not have access to Keystone XL and therefore would not be taken off the rails by the proposed tar sands project.

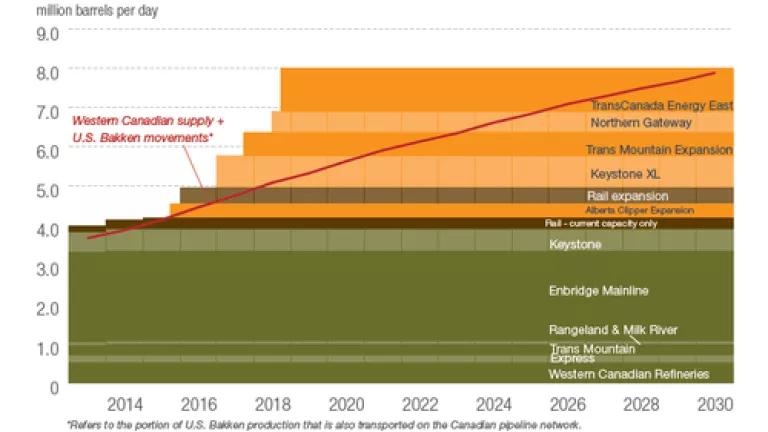

It’s important to note that even CAPP’s lowered forecast assumes that all of the major proposed tar sands pipelines move forward and a substantial amount of rail infrastructure is added. As shown in the graph below, CAPP assumes that all tar sands expansion projects will be approved and built over the next three and a half years. There are significant obstacles to each of these projects moving forward – and CAPP’s forecast shows that the failure of any one of these projects is likely to have substantial impact on tar sands expansion. With both Keystone XL and the Alberta Clipper expansion providing over 1.2 million bpd of capacity in the shortest amount of time, it is difficult to argue that these projects aren’t critical for enabling the tar sands industry’s expansion plans. In fact, CAPP recognizes that the proposed Keystone XL tar sands pipeline is the linchpin for the expansion of the tar sands and the associated carbon emissions:

“The biggest uncertainty in this forecast is the timing associated with this [pipeline] capacity and whether or not they can deliver the capacity on the timelines they now propose,” Mr. Stringham, Vice President, CAPP

Source: CAPP, Crude Oil Forecast, Markets and Transportation, June 2014, pg. 34

Of course, CAPP’s forecast illustrates a fundamental problem with our pipeline approval process. Earlier last week, eight leading scientists and economists published an opinion article in Nature magazine calling for a moratorium on tar sands expansion and the highlighting the need to consider proposals to build long term tar sands infrastructure based on their collective global impacts to climate, water and local communities.

Recent events have shown that the reckless expansion of the tar sands planned by industry is far from inevitable. Even at today’s high oil prices, many tar sands expansion projects are already economically marginal at best. Keystone XL and other major pipeline proposals are necessary to enable the tar sands industry’s expansion plans and the significant carbon emissions associated with those plans. Keystone XL represents a long term commitment to the expansion of some of the world's most carbon intensive crude. It is inconsistent with our nation's climate goals and would only further enable Canada's failure to honor its international climate commitments.

As the economists and scientists calling for a moratorium on North American tarsands development write, "decisions made in North America will reverberate internationally, as plans for the development of similar unconventional reserves are considered worldwide.”