In its recently released draft environmental review of the Keystone XL pipeline that would bring tar sands from Canada to the Gulf Coast for export, the State Department attempts to make the case that rail could be a viable alternative. The State Department argues that Keystone XL would have little effect on tar sands production because rail could provide an equally feasible and economic transportation option for tar sands. This is a critical element of the draft environmental review because while State determined that tar sands is dirtier than conventional oil, it concludes that Keystone XL would have little impact on the expansion of tar sands and therefore policymakers and the public needn’t consider the impacts of that expansion. However, State’s assumptions are on the wrong track. The Keystone XL tar sands pipeline will drive tar sands expansion. Expansion depends on tar sands being able to reach the high prices of overseas markets. But pipelines to the east and west are stalled and rail – as we will show here – is not an economically viable alternative to Keystone XL. And without Keystone XL, financial analysts are already saying that the tar sands industry’s expansion plan will go off the rails.

In its most recent environmental review, the State Department is repeating its argument that the Keystone XL tar sands pipeline will have limited impact on greenhouse gas emissions because rail transport is an economically feasible alternative. State made several flawed assumptions in its environmental review, including 1) an unrealistically low cost for transporting tar sands by rail from Alberta to Texas, 2) an inaccurate estimate of tar sands production costs and 3) an unrealistic assumption that tar sands production costs will not increase with rising labor, material and energy prices. In its analysis, State relies on statistics that pertain to rail transport of shale oil from North Dakota but that do not apply to Alberta’s tar sands. Given the infeasibility of transporting large quantities of tar sands by rail and the massive opposition to tar sands pipelines to the East and West coast of Canada, Keystone XL is the lynchpin for significant expansion of the tar sands – and industry analysts agree. Tar sands is expensive to extract and process – with breakeven prices approaching $100 per barrel – and cheap transportation is required to make new projects profitable. Without Keystone XL and the cheap transportation it provides, the tar sands industry will not reach its goal of tripling production by 2030 and the significant climate emissions that come with it.

A cornerstone of State’s conclusion that rail is a feasible alternative to Keystone XL is the example of rail use by oil producers in North Dakota and Montana. In that region, oil producers facing price discounts and transportation constraints have turned to rail to move their crude to market. However, State doesn’t account for the reason that rail has exponentially grown in North Dakota while it has remained a highly marginal option for tar sands producers.

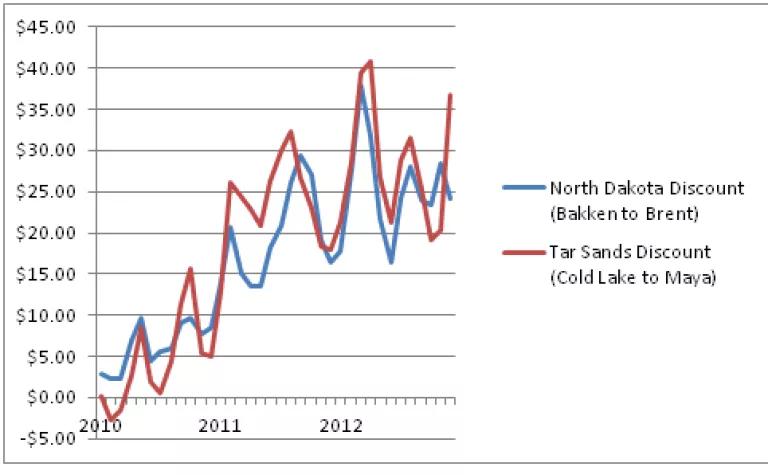

Since 2010, transportation constraints have created significant discounts in prices that producers in both North Dakota and Alberta receive for their oil production. These discounts have caused producers in North Dakota to turn to rail to move their product to market. In 2009, rail only supplied enough capacity to move 30,000 bpd out of North Dakota. After significant investment in new rail terminals, rail supplied over 730,000 bpd by 2012. When folks talk about the upsurge of rail transport in the United States and Canada, this is what they’re talking about.

Meanwhile during the same time period tar sands producers have actually faced greater transportation constraints and higher price discounts than those in North Dakota – and yet, they have not seen a similar upsurge in rail.

Figure 1. Discounts between North Dakota’s Bakken crude and Alberta’s Cold Lake crude and similar international crudes (comparing Mexican Maya with Cold Lake tar sands and Bakken with Brent).

State Department’s 2011 Predictions about Rate of Rail Expansion from Alberta Have Proven False

In its August 2011 environmental review, the State Department’s market analysis argued that “shipment of conventional or oil sands crude in Canada is arguably just now reaching a take-off point… the implication is that we could see a growing scale of shipment of WCSB [Western Canadian Sedimentary Basin] crude by rail in the next one to two years.” In both its 2011 and 2013 environmental reviews, the State Department has noted that rail capacity can be expanded in relatively short time spans – taking at most a year to expand existing facilities.

Nearly two years since State’s 2011 prediction, there has been little evidence of a North Dakota trajectory for tar sands to the Gulf by rail. The two measures available to evaluate this are 1) how much Canadian oil is moving across the U.S. border by rail, and 2) how much Canadian crude is being processed in Gulf Coast refineries (which are also served by a number of pipelines from the Midwest).

In 2011, less than 5,000 bpd of Canadian crude moved into the United States by rail while 150,000 bpd of Canadian crude was processed in Gulf Coast refineries. While rail data for crude oil across the Canadian border isn’t available for 2012, there is no evidence of significant volumes of tar sands being shipped by rail to Gulf Coast refineries. Gulf Coast refineries processed less than 100,000 bpd of Canadian crude in 2012. In December of that year, the month in which there were discounts in excess of $60 per barrel for tar sands compared to international benchmarks, only 50,000 bpd of Canadian crude was processed in the Gulf.

State’s new market analysis for rail does not explain why a rail boom has happened in North Dakota and has failed to do so in the Alberta tar sands. In fact, State’s environmental assessment uses many of the same assumptions for rail transport that it did in 2011, without either explaining or acknowledging the failures of those assumptions to accurately predict the lack of rail growth for tar sands producers thus far.

Transportation of tar sands by rail from Alberta to Texas is too costly to support expansion

The reason why rail isn’t a feasible alternative to Keystone XL is that it is simply too expensive to support tar sands expansion. State’s conclusions to the contrary are due to their substantially underestimating the cost of rail transport. In 2011, State assumed that rail to the Gulf would cost producers $9 to $12.50 per barrel. Now they estimate that it will cost them about $15.50 a barrel.

In reality, the only tar sands producers which are successfully getting crude from Alberta to the Gulf via rail and barge are doing so at a cost of over $30 per barrel. The State Department’s rail prices are estimates – and the fact that producers are currently paying twice as much to move their product to the Gulf suggests State is significantly underestimate the cost of rail from Alberta.

| Figure 2. State Department rail cost estimates compared to actual costs | ||||

| Pipeline cost $/bbl (EnSys 2011 forecast) | Rail cost $/bbl (EnSys 2011 forecast) | Rail cost $/bbl (State 2013 draft SEIS) | Actual Rail cost $/bbl (2013) | |

| To Gulf Coast from Edmonton/Hardesty | $7 | $9 - $12 | $15.50 | $31 |

The reason that this is important is because the high breakeven price for new tar sands projects cannot bear the high cost of rail. New tar sands mines require oil prices of up to $95 per barrel simply to break even. The projects are uneconomic after tacking on an addition $30 in transport costs. However, there is currently a steep discount for tar sands crude which has brought tar sands prices down to between $50 and $60 per barrel. These discounts are expected to persist and deepen over the next few years.

Figure 3. The discount between Cold Lake tar sands and Mexican Maya crude (prices in $ / bbl)

Companies with new tar sands production projects have three options. First, they can sell their tar sands in Alberta at less than $60 per barrel – a $40+ a barrel discount and significantly below the breakeven price of most new projects. Second, they can opt to spend $25 to $30 per barrel to ship their crude via rail to the Gulf Coast in order to sell it at the price of comparable heavy crudes (right now around $90 a barrel). This nets them $65 to $70 a barrel, which is still below the break- even price for many tar sands projects. Third, they can cancel or postpone their project. The only option here that doesn’t lose money for new producers is the third one.

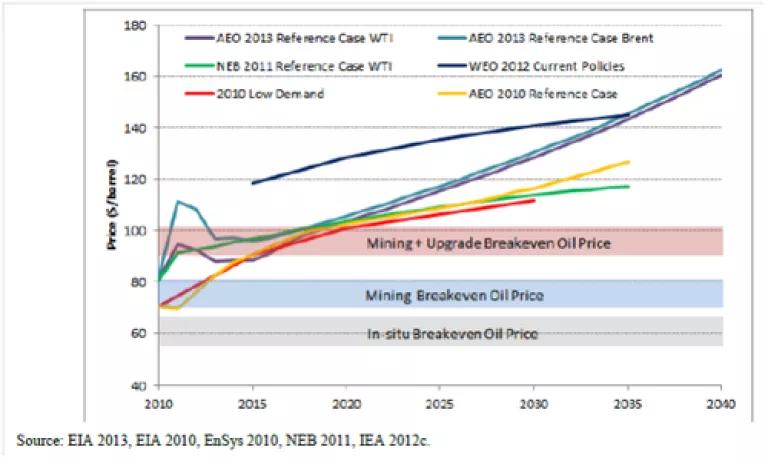

New tar sands projects are likely to continue to face tight profit margins

State’s conclusion that rail is an economically feasible option is also based on a fundamental flaw in its analysis of the long term profitability of tar sands production. While State acknowledged that many new tar sands projects are economically challenged, it assumed that oil prices would increase through 2035 and concluded that if production costs stay constant, new tar sands projects would be able to bear slightly higher transport costs. State expresses this argument in the graph below in which it adds its low estimate of the cost difference between rail and pipeline to NEB’s 2011 breakeven price and assumes that these new production costs will stay constant through 2040:

Source: State Department draft SEIS for Keystone XL, 1.4-53.

There is fundamental flaw in this assessment. It would be generally poor advice in any industry to assume that production costs will remain constant – and that is particularly true with the tar sands industry. Tar sands production is dependent on the cost of labor, material and energy, and these costs have been rapidly increasing and are likely to continue to do so if industry pursues its plan to triple production by 2030. In fact, it appears that the 2011 breakeven prices that are State used are already significantly lower than those faced by tar sands producers today.

| Fig. 4. Increasing Costs of Tar Sands Production | |||

| NEB 2011 (Baseline for State’s 2013 draft SEIS) | Alberta 2011 (ERCB) | Alberta 2012 (ERCB) | |

| New In Situ | $51 - $61 | $47 - $57 | $50 - $78 |

| New Mining (no upgrading) | $66 - $76 | $63 - $81 | $70 - $91 |

| New Mining w/ upgrading | $86 - $96 | $88 - $102 | NA |

Tar sands production prices have been rapidly increasing and are likely to continue to do so. The upper bound of tar sands breakeven prices appear to have increased by about $15 a barrel across all types of projects from 2011 to 2012.

Getting the production and transport costs right is critical to understand the impact that Keystone XL will have on tar sands production and climate because relatively small changes have a significant impact on production. Even in its flawed estimates, State forecast if rail increased transport costs by $2 per barrel, it would lead to a reduction of 84,000 bpd of tar sands production, while a $7.50 per barrel increase in cost will lead to a reduction of 315,000 bpd of tar sands production. In reality, State’s underestimates current rail costs by about $15 a barrel and current production costs by up to $20 a barrel (while assuming they will not continue to increase in the future).

If every $2.50 in higher costs reduces tar sands production by 100,000 bpd, underestimating the costs of production and rail transport by $35 per barrel ignores the very substantial impact that a rejection of Keystone XL would have on tar sands production and climate emissions.

Keystone XL is “a key supply chain link” and a driver of tar sands expansion and climate change

Industry analysts generally recognize this - and this is why they have come to fundamentally different conclusions that the State Department did in its most recent draft SEIS. Banks, financial analysts and industry experts underestand that the event of a rejection of Keystone XL, new tar sands production projects will likely be canceled or postponed. In a recent short term market analysis, RBC Dominion Securities Inc., called Keystone XL “a key supply chain link” and estimated that in the event of a rejection of Keystone XL, tar sands production growth would be reduced by 450,000 bpd by 2017, as production projects are deferred. CIBC forecasts that by 2030, market constraints will reduce tar sands production by as much as 2.4 million bpd by 2030. Goldman Sachs, TD Economics, Standard and Poor, Wood MacKenzie and others have published financial analysis indicating that importance of Keystone XL to tar sands pricing and production.

"If Keystone XL doesn't happen or gets delayed a full year plus, you're talking about projects having to be put on the shelf," Phil Skolnick, analyst at Canaccord Genuity, March 5, 2013

Infrastructure is needed for tar sands expansion, and it is clear to most observers that the permit decision for Keystone XL plays a critical role in the future of tar sands production and the greenhouse gas emissions associated with it. The first step in addressing climate change is to stop making the problem worse – and that means rejecting the Keystone XL tar sands pipeline and the higher carbon emissions associated with it.