The second round of 30% cash grants for renewable projects was awarded today by DOE and Treasury. I gave some context for these grants, as well as discussing potential concerns in a post a few weeks back covering the first round of grants. Essentially the grants provide renewable project developers (or subsidiaries) with a 30% cash grant based off project cost, and are designed to stimulate investment in renewables (and overcome some capital constraints brought on by our economic challenges). Environmental Capital has some perspective on most of the funding going to foreign companies, while additional insight is here and here.

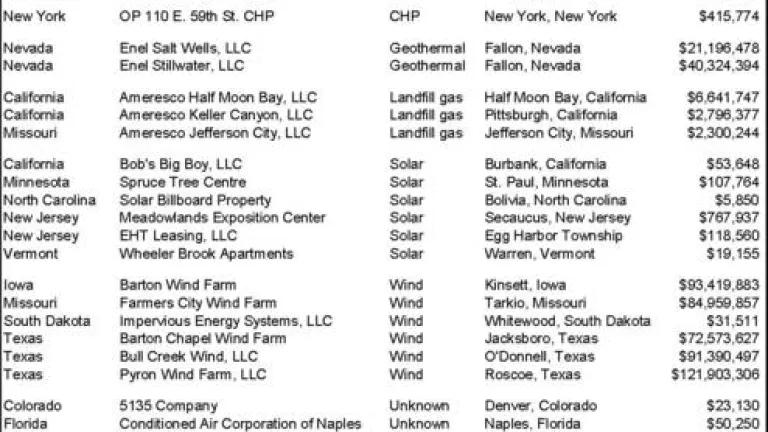

The second round of grants total about $550 million, similar to the first round ($502 million), but are spread across more technologies, including biomass, CHP, landfill gas, and geothermal. Wind still dominates in terms of overall funding (84% this round, and 91.5% of grants to date) which is to be expected given its level of deployment.

(*in the table above, "unknown" are grants I couldn't immediately locate information on, but I assume the smaller projects are solar. Total, "unknown" accounts for 1% of total grants funding).

So far, 18 states have received at least one grant, with Texas receiving the most to date (39% for a number of wind projects), with seven states receiving over 90% of the funding. The breakdown of funding among states should be entirely a function of natural resource potential, meaning that we should expect wind-rich states should receive most of the funding.

Per the release, DOE/Treasury turnaround time on applications was 30 days which is much better than its track record on some other programs (such as loan guarantees), but given the expectation of "thousands of applications" it could be a challenge keeping up this pace.

Finally - while the $1 billion in funding in a nice start, it represents a fairly small portion of the tax equity market it was designed to supplement/replace. Per Hudson Clean Energy Partners, the tax equity market in 2008 was $5.5 billion, with enough anticipated demand for $11.1 billion in tax-based investment in 2009. Hopefully, the Grants program, off to a good start, can continue to accelerate its efforts in order to maximize renewable energy potential over the next few years.

UPDATE: good first hand account detailing how one applies for the grants.