It’s tax time again, and as you file your return you should be aware of a “tax” that’s hidden in plain sight. The average price of regular gasoline is pushing $4-a-gallon, threatening the economic recovery, and may even have reached that level in your neighborhood.

Just how much more are we paying as a consequence of the latest runup in prices?

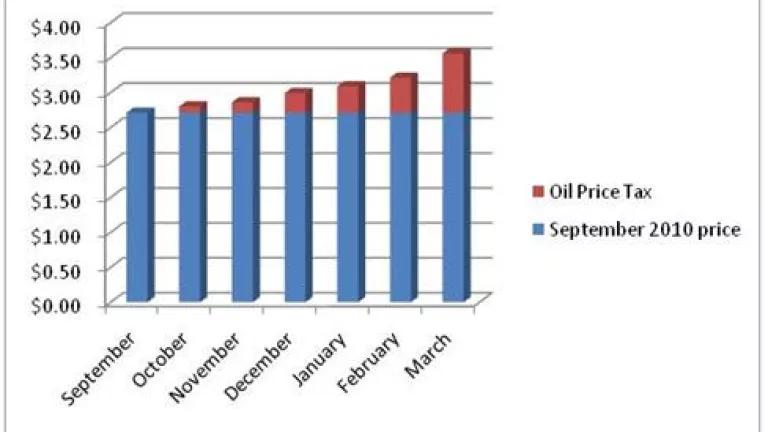

To get an idea, I went back to a time when prices were a lot lower – September of last year. Believe it or not, we were paying on average $2.71 for regular gasoline (prices are from Energy Information Administration or EIA data sets). I then looked at the two quarters that have elapsed since then. The price has gone in one direction, on average: Up, so that by last month we were paying on average $3.56-a-gallon.

Okay, let’s say that we freeze the price at the September level. What’s been pulling it up since then is volatility in the global oil marketplace, and theoretically the difference is a “tax” we’ve all paid for being shackled to it.

What’s that tax look like? The bar graph below shows it, in red.

Ouch. And yet, data from EIA also shows that we kept right on buying a lot of gasoline. Demand is “inelastic” in transportation, as economists say. Which means that you and I and 200 million or so other registered drivers have to keep filling our tanks so we can make our daily rounds. We don’t have a lot of choice when it comes to fuels or mobility in this country.

So what does it all add up to, in terms of a tax? Well, in just the last two quarters we’ve poured about $23 billion dollars more into gas pumps than if gasoline had stayed at September’s level. That’s about $108 in added fuel costs per registered driver, in just the past six months. Just imagine what we might pay the rest of this year (to help you imagine here's an image from the recent past courtesy of Greg Woodhouse photography).

The worst news about this is that the money doesn’t go to the bad old federal government, where it might at least get recycled in the form of a road or bridge repair. It goes to OTHER governments, including members of OPEC which own most of the world’s proved reserves.

And of course it goes to Big Oil. And as it happens the big international oil companies – BP, Chevron, ConocoPhillips, ExxonMobil and Shell – raked in $76.24 billion in profits in the 2010 alone. This includes a remarkably fat fourth quarter, and according to press reports they’re about to report even higher profits for the first quarter of this year (given prices at the pump this winter and spring, this is not at all surprising).

The way out of this is not to dig our hole deeper by doubling down on drilling. This won’t set America free, just as it hasn’t set Canada or the UK free. Instead, we need to adopt a multi-pronged plan to drive down our massive 19-million-barrel-daily demand for the black stuff, as my colleague Luke Tonachel describes.

This includes efficient cars and trucks, more fuel choices (advanced biofuels such as ethanol as well as electricity) and more mobility choices (“drilling on Main Street,” as I call it).

Now is the time to put an honest-to-goodness plan to break our oil addiction in place. Let’s get to work.