Yesterday, the Farm Foundation announced the winning essays for it's 30-Year Challenge Policy Competition. One of two winners in the "Climate Change" category is Loni Kemp of Kemp Consulting, whose winning essay is titled: Greener Biofuels Tax Credits: A Policy to Drive Multiple Goals. As Loni kindly acknowledges in her essay, she developed the ideas in the essay while working with yours truly. Jeremy Martin over at UCS also deserves lots of credit.

As I wrote about earlier this week, the GAO released a report last Friday that points out the multiple environmental risks posed by biofuels in general and corn ethanol in particular and how the existing ethanol tax credit is probably unnecessary. What I have proposed in the past and what Loni has gone a long way to making concrete is reforming the myriad biofuel tax credits into a single, technology-neutral, performance based tax credit.

Read Loni's essay for details but the basic idea is very simple:

- Replace existing biofuel tax credits that simply pay more money for more volume, with a new tax credit that would pay up to $1.00 per 76000 Btu (the number of Btu in a gallon of ethanol) of fuel for any fuel that receives top ranks in two performance categories--GHG reductions and ecosystem services.

- For GHG reduction, a 100% reduction compared to the petroleum alternative would win a fuel $0.50/76000 Btu; obviously a lot can be said about how this would be measured, but ideally this would be based on the same methodology that EPA is developing to implement the RFS2.

- For ecosystem services, a perfect score would win a fuel another $0.50/76000Btu, it is challenging to find a single existing tool, but through research that Loni did, we propose using the Soil and Water Evaluation Tool as the core metric. This was developed by USDA for the 2008 Conservation Security Program. It would need to be augmented with monitoring and verification and features to account for forest management and wildlife--currently it is a purely voluntary, self reporting tool that only looks at soil and water impacts on crop land. Algae's performance would also need to be worked in.

Again read Loni's essay for more details, but that's the basics--technology neutral, pay for GHG and ecosystem service performance. It's time we stop throwing tax payer money at mature technologies that in many if not most cases are doing more harm then good. If we're going to give out subsidies in addition to the huge federally mandated market created through the RFS2, it's time that tax payers got something more for their money. It's time to reform the biofuels tax credits to a greener biofuels tax credit.

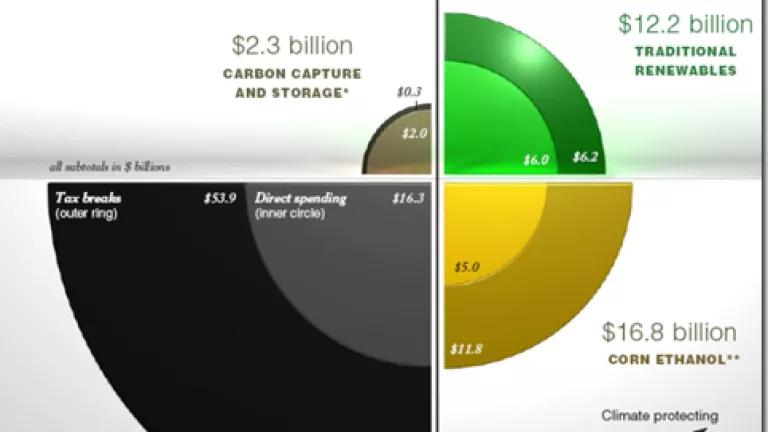

If clarity of Loni's essay, the simplicity of the idea of paying for performance, or the wastefulness of mandating and bribing at the same time aren't enough to convince you of the urgency of reforming our biofuel tax credits, then I leave you with one more powerful image that I hope will. Below is an image from the Environmental Law Institute at the Wilson Center that shows the balance of energy subsidies between fossil fuels, corn ethanol, all other renewables, and carbon capture and storage from 2002-2008. Corn ethanol alone got 40% more than all other traditional renewables. We can and must get more for out money!