Andy Stevenson Guest Blog: 5 Reasons Why the State Department Gets Tar Sands Development Impacts Wrong in Keystone XL Review

Andy Stevenson is a Finance Advisor for NRDC

The State Department issued its draft environmental review of the Keystone XL pipeline on Friday. While this report was mainly an environmental review, the State Department's final conclusion that "approval or denial of the proposed project is unlikely to have a substantial impact on the rate of development in the oil sands, or on the amount of heavy crude oil refined in the Gulf Coast area" is completely at odds with the economic reality in Alberta at the moment.

The following are five reasons why Keystone XL is needed for tar sands development and why tar sands development is not needed for the US to achieve its energy independence.

1. Why does tar sands oil trade $45/barrel below the global price of oil? One word – Pipelines.

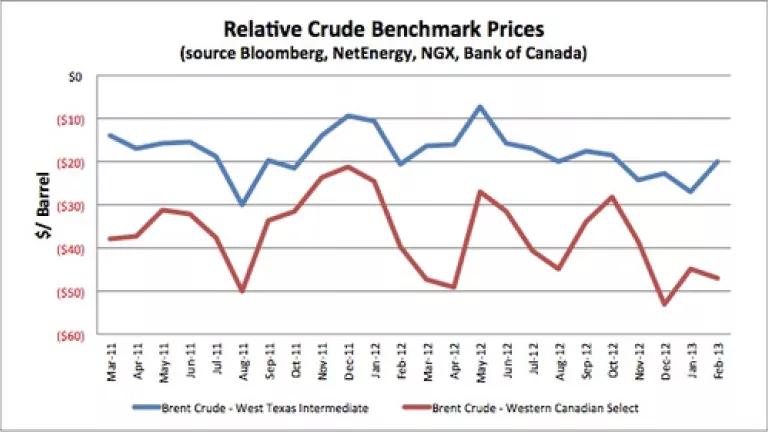

Record increases in US oil output and a lack of sufficient pipeline access to the Gulf of Mexico has contributed to supply glut at Cushing, Oklahoma. This supply glut has lowered the price for US oil production by $20/barrel relative to the global benchmark (Brent Crude) over the past two years.

As Alberta tar sands has to travel farther to arrive at Cushing (and costs more to refine) it trades at an even steeper discount ($45/barrel) to the global benchmark.

2. Lack of pipeline capacity is the why tar sands oil is expected to experience shut-ins this year and next.

With existing tar sands pipeline capacity already maxed out, new production is expected to push the prices they receive down even further this year. Industry analysts are now expecting low prices to force shut-ins of tar sands oil thru 2014 with the TAN grades (that trade at even a larger discount to West Texas crude) close to shut in levels already.

3. Without Keystone XL, tar sands oil output will likely stagnate beyond 2015 due to limited pipeline capacity.

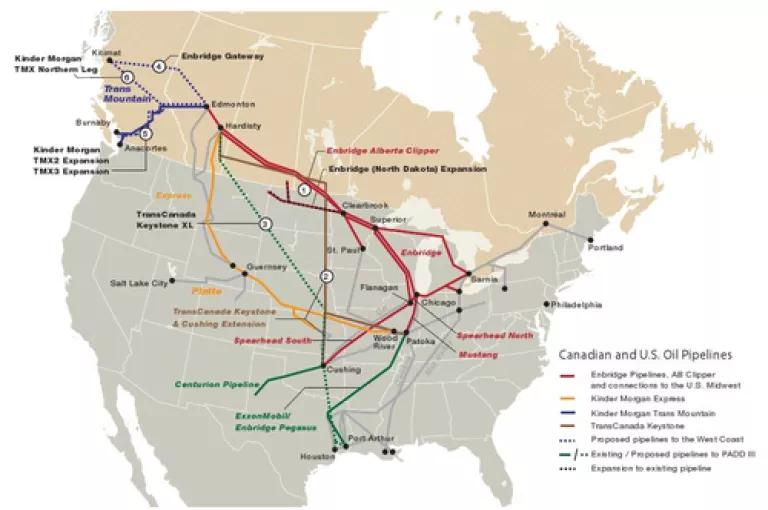

While the Enbridge Pipeline system (which in total will be able to move 1.2mln bpd of tar sands oil) is expected to push the prices back up in 2014, Keystone is still seen as critical to raising the price of tar sands oil back up to a price that will allow full exploitation.

Source: Canadian Association of Petroleum Producers

4. Rail is not really an alternative solution for tar sands transport

While rail transport has increased recently, as was mentioned in a recent article in the Washington Post, it is not expected to provide a significant uplift to tar sands oil production. This is largely due to the fact that tar sands oil requires special rail cars for transport, which are in even shorter supply than regularly rail cars. These coiled rail cars keep the bitumen heated during transport and currently have an 18 month to 2 year waiting list for delivery.

Although some incremental growth can be handled by rail, it is not likely to ever be a bankable form of transport for new large scale production projects.

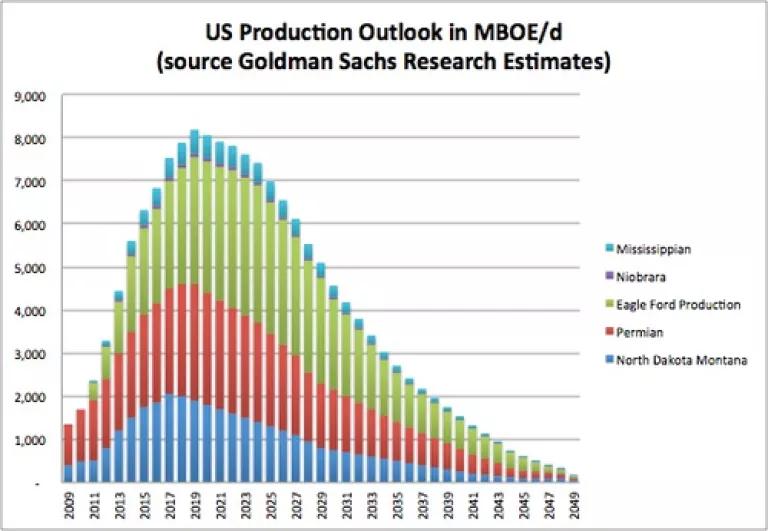

5. The US is well on its way to energy independence without tar sands oil production

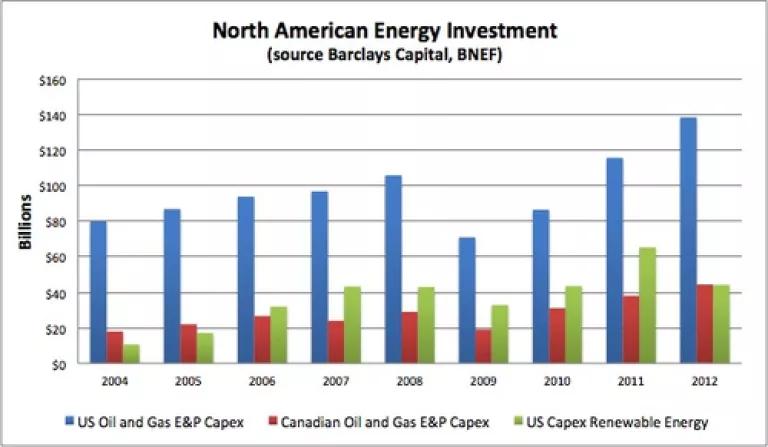

Capital spending in US oil and gas exploration and production (E&P) has been running at a annualized rate of over $100 billion per year for the past decade, the equivalent of 25 cents of every dollar spent globally in recent years.

These investments have put the US on a path to energy independence over the next decade that is not reliant on dirty tar sands oil.

Further if the US was able to raise its investment in renewable energy to even half of what it spends on oil and gas exploration and production (up from roughly one third as much today), the US could achieve its goal of US energy independence sooner.

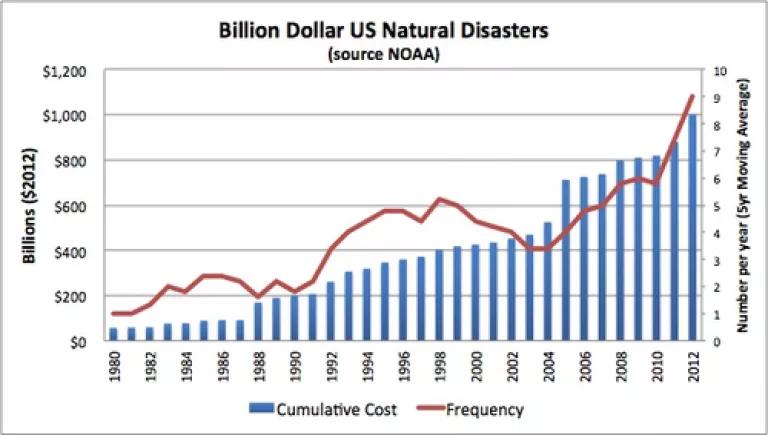

It could also be working to limit the cost that dangerous climate pollution is already having on our economy.