FEMA Flood Data: What We Still Need to Know

“What’s actually included in that data release?”

I’ve been asked this question a lot since June 11th, when the Federal Emergency Management Agency (FEMA) published millions of claim and policy records from the National Flood Insurance Program (NFIP). When the release was announced, I wrote that it represents a significant step forward for transparency of flood risk in the United States—but that there is still a lot of work to be done.

What does that mean, in practice? Unfortunately, it means that there is still a lot of flood risk information that isn’t readily available, leaving us in the dark in the face of sea level rise and climate-fueled flood disasters.

What FEMA used to share

First, let’s take a step back and review what we could know before the recent data release. Historically, FEMA has made the following information publicly available:

- The locations of flood zones and other spatial data shown on FEMA flood maps (accessible at FEMA’s Flood Map Service Center).

- Summary statistics on NFIP policies and payments, such as the number of claims filed in a given year (for example, see the Policy & Claim Statistics on Flood Insurance website or the NFIP Residential Historical Claims dataset).

- Claim history for your own home, but only if you are a current NFIP policyholder.

This means that, for example, you could create a map like this one (created by FEMA):

It’s interesting to see the claim numbers broken down by state. For the general public, though, it would be more useful to know how many claims were filed in a particular town or after a particular flood event.

In some cases, individual states or local governments may make additional information available and, depending on your state’s flood risk disclosure laws, you might learn more about a home’s flood history before you purchase it (but odds are that you wouldn’t). And researchers who have gained access to more detailed FEMA data have published their findings in journal articles and policy reports. However, until now, there was no central place to access claim-level information.

What FEMA recently shared

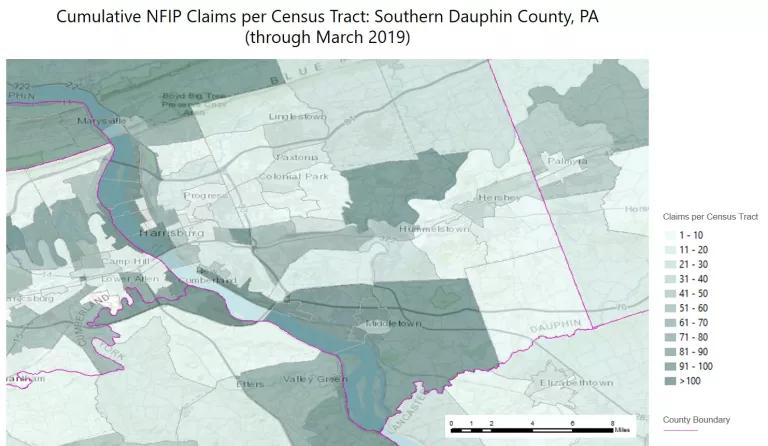

The recent data release is the first time that the public has been able to access the entire program’s claim history at an individual claim level. This allows us to do things like see how many NFIP claims have been filed in each Census tract (a Census tract is a subdivision of a county that U.S. Census Bureau uses for analyzing populations; it’s usually home to about 4,000 people). Here’s my home state of Pennsylvania, for example:

This is a much finer resolution than was possible previously. For example, the Census tract-level information lets you see how the Susquehanna River and its branches create an inverted triangle of claim density across central Pennsylvania, where I grew up. Using FEMA’s newly released dataset, we can make similar maps showing payment amounts or the age or flood zone of properties with claims—which is hugely valuable for local, state, and national policy decisions. However, it still leaves some important knowledge gaps.

What we still need to know

Let’s take a look at my hometown, in south-central Pennsylvania. This is approximately the southern third of Dauphin County, with the Susquehanna flowing from northwest to southeast:

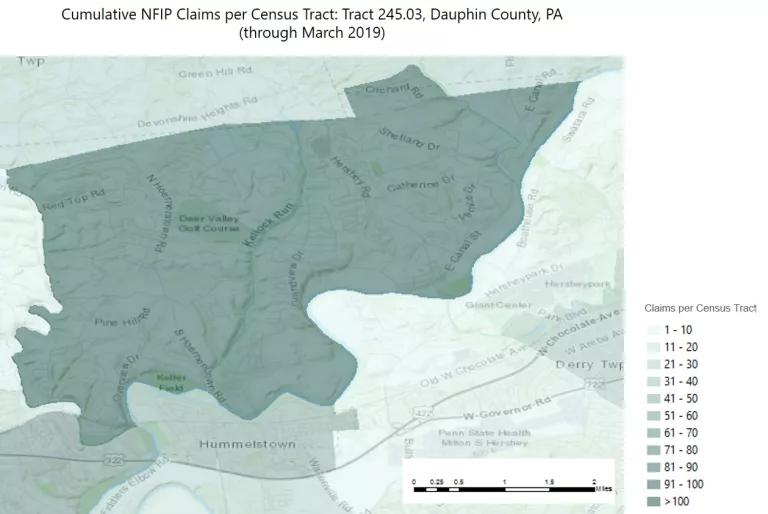

Unsurprisingly, tracts close to the water and/or in more developed areas have more claims. The dark green tract in the center of the map (just north of the word “Hummelstown”) contains a flood-prone creek alongside some residential subdivisions. It also borders the Hersheypark/ZooAmerica/Giant Center entertainment complex, which, along with much of the region, was seriously flooded by Tropical Storm Lee in 2011. This is an area with rolling hills, a variety of land uses, and widely varying flood risk.

Here’s the problem: the geographic precision of the data means that zooming in doesn’t provide you with much additional information. Identifying claims by Census tract rather than a more specific location preserves individuals’ privacy, but it also limits the value of the data for anything that requires high geographic specificity. There are over 2,000 households in that tract and, if you’re one of them, knowing the overall number of claims isn’t terribly helpful.

The other problem is that the dataset just reports individual claims, not the claims’ relationship to each other. There is no way to tell the claim history of a particular neighborhood or address, and FEMA does not provide any way to link claims together, or to link claims to policies. Tract 245.03 has 143 claims, but we can’t tell if it represents many homes flooding one time each or a single cul-de-sac flooding over and over. Knowing the number and location of repeatedly flooded properties is an important component of understanding an area’s flood risk.

Finally, there is other essential information that is outside the scope of claims and policy data. For example, you can’t use the dataset to find out whether your community is failing to properly enforce the floodplain building and zoning codes required by the NFIP. You can’t find out whether a property has ever received federal disaster assistance after a flood (which comes with the requirement to purchase flood insurance going forward). And you can’t find information about flooding on uninsured properties or properties insured under private policies.

The day after FEMA’s data release, the House Financial Services Committee unanimously passed a bill that would give homeowners and home buyers the right to know their property's flood insurance history. This information would be available even if residents are not current NFIP policyholders and (because of a mechanism for mutual data-sharing between FEMA and private insurers) even if the property was covered by non-NFIP flood insurance.

Hopefully, Congress, FEMA, and the states work to make even more flood-related data publicly available. In a world where climate change is increasing the frequency and intensity of heavy rainstorms, it’s more important than ever that people have access to relevant, timely, and specific flooding information.