"Keystone XL: A Tar Sands Pipeline to Higher Prices,’’ a report that NRDC released on May 22, 2012 along with Oil Change International and ForestEthics Advocacy, has began to generate significant objections from oil industry lobbyists and other proponents of the Keystone XL tar sands pipeline.

And it’s easy to see why – many of these interests have been trying to sell Keystone XL to the American public as a way to lower U.S. oil and gasoline prices.

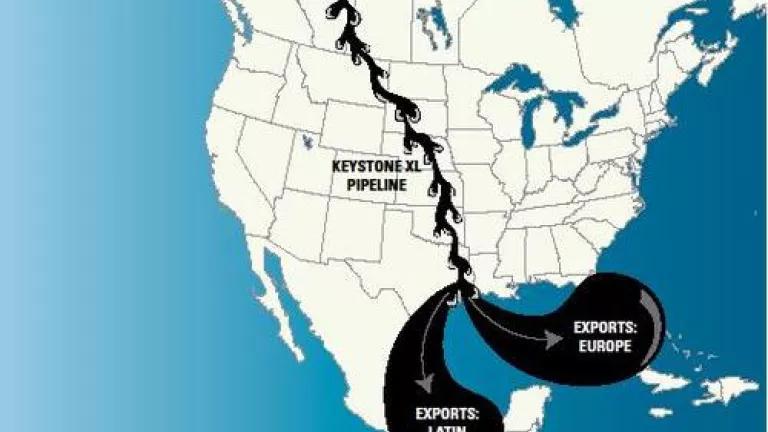

Instead, the report found that the pipeline would divert oil from the Midwest, where refineries maximize gasoline production, to the Gulf Coast, where refineries produce less gasoline and more diesel – much of which they export internationally. Thus, the Keystone XL tar sands pipeline would reduce the volume of gasoline available to consumers, increasing prices at the pump. Oil industry lobbyists and politicians are making up facts to respond.

Here are the facts:

Fact 1: There is no EIA report on Keystone XL and gas prices

During a recent debate I had with American Petroleum Institute’s (API) Vice President Marty Durbin, Mr. Durbin cited a mythical report that the Energy Information Administration (EIA) did on Keystone XL’s impact on gasoline prices. To be clear, the EIA report that API continually cites on this issue simply does not exist.

Neither the EIA nor the Department of Energy (DOE) has evaluated Keystone XL’s impact on U.S. gasoline prices. When API lobbies on this issue, they present a white paper on the issue written by a DOE staffer (who doesn’t actually work at the EIA). DOE did not review, approve or issue the white paper. It’s an important distinction to make – there’s a big difference between analysis approved by an agency through its review process and a paper written by and representing the views of one of its staffers.

Fact 2: Keystone XL will not increase U.S. oil supply – only shift it to the Gulf

Proponents of Keystone XL claim that the pipeline will increase the total supply of crude available to domestic refineries by more than 830,000 barrels a day. That’s simply not true. Canada can’t fill the pipelines it’s already got to the United States – Keystone XL won’t add to the U.S. crude oil supply for years. Meanwhile, it will simply divert oil from the U.S. domestic market in the Midwest to the internationally focused Gulf Coast.

That will decrease crude oil dedicated to the U.S. market. Moreover, that crude oil will produce less gasoline in the Gulf than it would in the Midwest.

Fact 3: If we don’t build Keystone XL, tar sands won’t just go to China

There are a lot of problems with this argument. It is completely out of touch with the political reality on Canada’s western coast. Two thirds of British Columbians oppose a tar sands pipeline through their province. Moreover, First Nations communities in Canada have strong constitutional powers and they oppose the project. In fact, the Yinka Dene turned down an offer from Enbridge valued at more than a billion dollars in exchange for easements for the Northern Gateway pipeline.

Also, it’s important to remember two things about pipeline projects to Canada’s western coast. The tar sands industry has been trying to push these things forward regardless of the outcome of the Keystone XL debate. And most maps would agree, California and its refineries are a lot closer to Canada’s western coast than China.

Finally, and perhaps most importantly, the rationalization that if we don’t press forward with tar sands development, then another country will is morally bankrupt and has been behind many of humanity’s most grievous errors. It’s fair to objectively discuss the impacts of tar sands development. However, the possibility that that development might happen independent of our action is not a legitimate reason to ignore those impacts. We are not absolved from the damage we do in this world simply because someone else might have done it.

Fact 4: Tar sands have significantly higher emissions than conventional drilling

In a recent press release, one notable proponent of the Keystone XL tar sands pipeline argued that because 80% of new development in the tar sands will be “in situ”, or by drilling, it will have similar emissions to conventional driller. That’s simply not true – in fact, the Congressional Research Service issued a report this month which showed that “in situ” wells actually have greater emissions than surface mining and that Keystone XL would have the same impact on U.S. emissions as adding another 4 million cars on the road.

Fact 5: NRDC’s Gas Price report was peer reviewed by economists

NRDC’s report was reviewed and positively received by several independent economists. It is notable that industry’s attacks have focused on attacking the credibility of NRDC rather than countering the issues that the report raises. It should be noted, there are many reasons to oppose Keystone XL, and the likelihood that pipeline will raise U.S. oil and gasoline prices is not a major one. But it is simply disingenuous to sell this pipeline as a means to improve U.S. energy security and reduce prices.

One issue that all Americans should agree upon is the need for a serious discussion on how to meet our nation’s energy needs. The United States has the potential to be a global leader in innovation, efficiency and clean energy. Keystone XL isn’t a part of that future.