On November 1, 2014 the move toward a more coordinated Western U.S. grid took an extremely important step forward when the California Independent System Operator (CAISO) and PacifiCorp (a utility in the Berkshire-Hathaway Energy family) launched a six-state Energy Imbalance Market (EIM). The EIM facilitates rapid trading of the electricity needed to balance out the fluctuations from both renewable power plants and consumer demand, allows for the sharing of reserves between participating utilities, provides access to complementary renewable resources located far from each other (the wind is usually blowing somewhere in the West when it isn’t in others), and enables a much more efficient use of the transmission system in the western U.S.

The market is the first in the Western Electricity Coordinating Council footprint to include a utility outside of the CAISO control area. CAISO runs the grid operations for the California’s investor owned utilities. California utility customers use around a third of all the electricity consumed in the WECC.

To those who support a clean energy future and the deep renewable energy penetrations needed to make it happen, launching the EIM is a very big deal indeed.

Why? The reason lies in the way that the western electricity delivery system has evolved over time. Unlike much of the rest of the country, the West does not have regional transmission organizations that plan, and operate the grid, and which run energy trading markets. This regional approach (in the Midwest, Southwest, Mid-Atlantic and New England areas) uses a single regional grid operator to blend variable resources (like wind and solar) and conventional generation over large areas, better utilizes grid assets, energy efficiency and consumer demand controls, allows for sharing of flexibility and contingency reserves and otherwise promotes a more efficient and smoothly operated electricity delivery system.

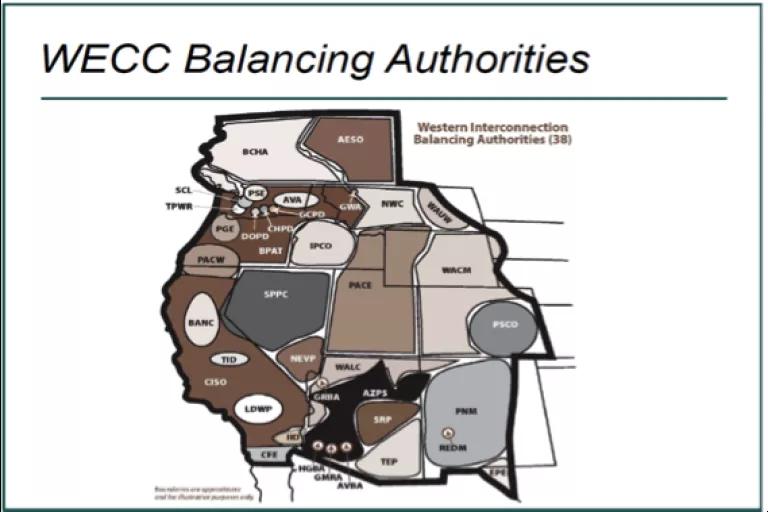

In contrast, the Western grid is organized (outside of CAISO that is) under a system of 38 different “balancing area authorities” that are responsible for controlling the system in their own specific footprints. Imagine a bus with 38 drivers and you can see why it is so difficult to coordinate and efficiently use the regional transmission system. Unsurprisingly coordination is awkward at best, and threatens reliability at worst. Bilateral contracts prevail in place of a real time market. The result is the costly development of duplicative infrastructure, inefficient use of the grid, a general lack of visibility between and among balancing area authorities, and poor “situational awareness.” Situational awareness is the ability to see, understand and react to what is happening on the system across balancing areas, avoiding disturbances that can lead to grid instability and even black-outs. While this clunky system worked just fine when we mainly ran a network of continuously operating “baseload” coal and gas plants, it masked system vulnerabilities that became increasingly exposed as cleaner, renewable energy began to appear on the system and dirtier coal plants began to be phased out. While steps are being taken to improve coordination across the system and address some of these shortcomings (such as the Northwest Power Pool’s market coordination initiative) many inefficiencies remain.

Enter the Energy Imbalance Market

By far the most ambitious effort to bring better efficiency and coordination in the Western Interconnection has been the CAISO-PacifiCorp EIM. The EIM emerged from a coalition of public utility commissioners meeting under the auspices of the Committee on Regional Electricity Power Cooperation of the Western Interstate Energy Board to explore ways to improve grid coordination and the integration of variable renewable generation into the system. This aptly-named “PUC EIM Group” began exploring the issue in 2011 and captured the attention of CAISO officials who operate an EIM for the California investor-owned utilities whose transmission system they control. CAISO leadership recognized that they already had the software, control technology and staff experience to run a regional EIM. Because of this CAISO could provide an EIM service more rapidly and at much lower cost than any other potential market operator could. Wheels began to turn.

PacifiCorp, for its part, was also keenly interested in a more efficient and coordinated grid, and given its multi-state platform, growing interest in renewable generation and high exposure to coal plant retirements didn’t especially want to wait around forever for an EIM to emerge. They became involved with the NWPP market coordination initiative but seized the opportunity to join forces with CAISO to take the EIM from endlessly studied concept to practical reality. Their decision has sent shockwaves through the West, and breathed new urgency into the NWPP market coordination initiative (now slated to “go live” with an imbalance energy trading platform of their own in the third quarter of 2017), and moved broader regional markets into the policy conversation in ways not seen in more than a decade.

Other utilities have either indicated their intention to join the CAISO-PacifiCorp EIM (Berkshire Hathaway Energy’s NV Energy in Nevada) or are considering it (Arizona Public Service). A key to expanding the market more broadly will be in constructing a market governance structure that provides the autonomy potential partners will expect while taking advantage of the CAISO market operations team and its institutional tariffs. Non-California utilities will want assurances that they will be fairly treated in the EIM and that their interests will be protected by the new governing body, whether part of (as in a delegated authority) or apart from CAISO’s Board of Governors. CAISO will be closely tracking the performance of the market and publishing quarterly benefits results as an added inducement to potential market participants.

What next? Toward an integrated grid

Will the EIM lead to even greater coordination in the western U.S.? Most stakeholders believe the answer is probably yes, though many who are still wedded to the old, balkanized baseload paradigm will not welcome the change.

One place to look for an inkling of what we might expect is the Southwest Power Pool Regional Transmission Organization whose membership includes public and private utilities large and small and which last March moved to an inclusive day-ahead energy market, expanding outward from what began as a limited market for imbalance energy. As the benefits to all participants in the SPP EIM became clear, the appetite for even more coordination and a broader market grew.

Can a similar evolution occur in the WECC? With a live EIM now operating in much of the region, we have taken the first step toward answering this question. Congratulations to CAISO and PacifiCorp for taking that step down the road to a cleaner, more flexible, more resilient and more reliable electricity delivery system.