Second in a two-part series

Although recent studies clearly show huge benefits if the California Independent System Operator’s (CAISO) footprint is expanded across more of the West, a closer look indicates the results were considerably understated because entire categories of benefits were not quantified and overly conservative assumptions made the reported advantages seem smaller than they should have.

In other words, if the organization that coordinates the operation of California’s electricity generation and transmission becomes a regional grid system operator, the state will experience enormous financial and other advantages.

Our initial review of unquantified benefits from the consultants’ SB 350 studies (named after the state law that required them) indicates that additional financial bonuses to California across all three scenarios—current practice, regional market with in state procurement, and regional market with regional procurement—could range between $150 million in 2020 with a limited footprint for adding just PacifiCorp (the first utility to propose expanding the footprint over a year ago) to approximately $700 million dollars in 2030 in a West-wide regional system operator (RSO) footprint (Western Interconnection [WECC], whose service territory includes the Canadian provinces of Alberta and British Columbia, the northern portion of Baja California in Mexico, and all or portions of the 14 western states in between.excluding the federal power marketing administration's Bonneville Power Administration and the Western Area Power Administration).

Working with colleagues from the Western Grid Group and Western Clean Energy Advocates, (former Western Interstate Energy Board Executive Director Doug Larson and former National Renewable Energy laboratory researcher Brian Parsons), we have taken a swing at putting ranges of value on the unquantified benefits. The vertical axis in the chart below is in millions of dollars annually for California, alone.

Here is what we found:

Grid utilization: The improved use of the electrical system due to the centralized market “dispatch” (turning generation on and off and utilizing the capacity of the existing transmission system more efficiently to meet customer demand at any given hour) under a larger footprint is not fully accounted for in the studies. Similarly, the studies do not quantify the improvement in grid reliability that will flow from having one grid operator over a broad area rather than the current 38 fragmented operators who don’t have visibility into the entire grid necessary to quickly diagnose a problem, such as a transmission line or power plant unexpectedly failing, and don’t have the full range of tools to respond. Better use of the system results in lower costs, greater reliability, fewer emissions and avoided infrastructure development costs and related environmental impacts.

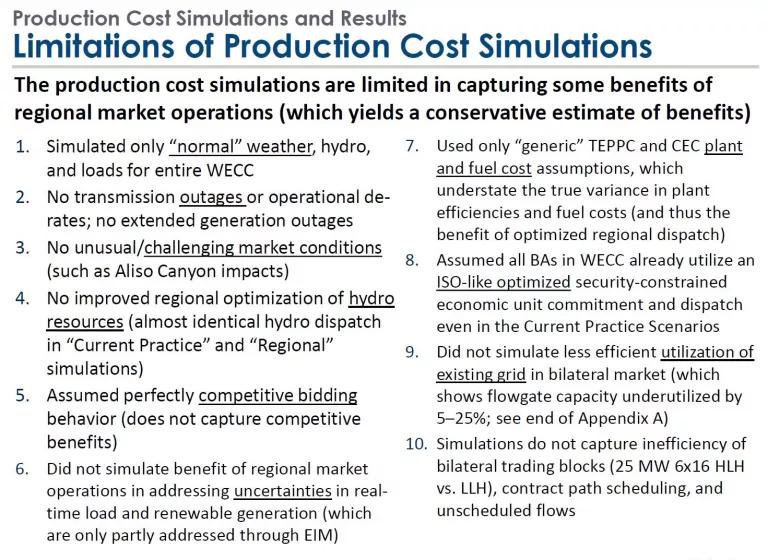

SB 350 modeling assumes a much higher level of efficient dispatch outside the regional market than actually occurs. The result is a significant understatement of benefits in the SB 350 studies. As noted in the slide below, production simulations assumed a level of operational efficiency that does not actually occur in current fragmented grid operation. Overstating the efficiency of current operations results in understating the benefits an RSO can bring.

For example, we estimate that a regional system operator’s ability to make more efficient the use of the existing wires would up benefits to California by $0-10 million in the first year of operation climbing to more than $50 million per year in 2030. Improving reliability would yield up to $40 million in the first year and much higher benefits in 2030.

Our estimate of the unquantified system reliability benefits may be conservative given MISO’s (Midwestern Independent System Operator) experience. For example, this graph from MISO’s 2015 Value Proposition shows reliability benefits of between $145 million and $217 million. No reliability benefits were quantified in the SB 350 studies.

GHG compliance: A regional market creates the platform that California and the rest of the West need for low-cost, deep greenhouse gases reductions in the power sector. Any evaluation of the costs and benefits of a regional market should be made in the context of actions needed to achieve climate stabilization in 2050. The goal is not emissions reductions by 2020 or even 2030. Decarbonizing the economy by 80 percent in 2050 is California’s goal, and what the Intergovernmental Panel on Climate Change forecasts is needed to keep global temperature increases below two degrees celsius. The SB 350 studies did not consider this as thoroughly as they could have. Policy drivers to meet this goal will have a profound effect on the type of generation the RSO uses to operate the electricity system.

Some commenters raised a concern that because the modeling results showed a tiny uptick in carbon emissions in 2020, that this was an indication of likely worsening emissions under the regional market. But the result they are apparently concerned about is so small it is considered in the statistical “noise” of the modeling (statistically insignificant). The footnote on slides 152 and 153 of Brattle’s May 24 presentation explains that: “These simulation results likely overstate impact on coal dispatch due to the generic CC-based CO2 hurdle rate applied to all imports into California. Contrary to the hurdle that would actually be imposed, this simplification artificially advantages coal in the simulations.” (Emphasis Brattle).

In the SB 350 modeling, the assumed emissions coming into California (called a CO2 hurdle rate by the modelers) were applied to all imports, including to renewables. That is why model results show this increase (but only in 2020, when the RSO is assumed to have been in operation for just 12 months). As the market rolls out and predictably expands, reductions are forecast to grow. As expected regulatory requirements are added they will inevitably grow even more. We are seeing non-RPS renewable development occurring in other markets now, an excellent early indicator of the market’s effect on renewable energy development and dispatch over conventional resources.

The studies assume no new carbon reduction regulations in California or in other states beyond those in current law or required by the Clean Power Plan. Reality is that greater carbon constraints are likely and an RSO offers the benefit of lowering cost of integrating new low-carbon generation. The study also omits the GHG benefit from reduced upstream methane leakage due to lower natural gas burn with a regional market. It is likely, particularly by 2030, that the nation will experience additional limits on carbon emissions, beyond existing limits in California and those required by the Clean Power Plan. For that reason we believe omitted benefits will exceed $50 million in the CAISO + PAC and West-wide scenarios in 2030.

Effects from expanded market on the use of the hydroelectric fleet and including the Bonneville Power Administration and the Western Area Power Administration (Western): The SB 350 studies do not account for the significant benefits from more efficient hydroelectric dispatch that would accrue to an RSO, particularly if the Power Marketing Administrations like Bonneville participated. Instead of selling power in large blocks over many hours (16-hour blocks for example), an RSO could use the region’s hydroelectric facilities for “ramping” generation; planning ahead of time to fill in expected gaps in renewable production. Our estimate of California’s gains from more efficient dispatch of hydro generation (less than $10 million for California in the 2020 and 2030 cases and $10 million to 50 million west-wide) would increase significantly if the Power Marketing Administrations (WAPA and BPA), which dispatch most of the hydro in the U.S. portion of the Western Interconnection, were included in the analysis. While immediate participation is unlikely, eventual participation may be. Western, which also operates in the eastern interconnection, participates in one of the Regional Transmission Organizations (the equivalent of the proposed RSO) located there, the Southwest Power Pool. Bonneville controls approximately 70 percent of the Northwest’s grid. Their engagement in a western RSO should be studied.

In conclusion, I did not present our analysis of every category of unquantified benefits here—there is simply not enough space. However, our initial review of unquantified benefits from the SB 350 studies indicates that additional annual financial bonuses to California across all three scenarios could range between $90 million in 2020 with a limited (PacifiCorp-CAISO) footprint to well over $500 million dollars in 2030 in a West-wide RSO footprint with regional procurement.

Any way you look at it, the benefits of regional expansion are enormous. The rewards are initially large, and grow significantly over time as participation by other balancing authorities increases.