A Growing Push Against Expanding Fossil Fuel Production

We’ve been talking about the wider menu of tools available to slow down the greenhouse gas emissions that cause climate change by scaling back fossil fuel exploration and production, and replacing fossil fuel consumption with clean energy sources. See "To Solve Climate Change, Use the Right Tool for Every Job"

It’s a big, tough job. But more and more large, influential organizations and key decision-makers are embracing the challenge with a combined focus on drawing down fossil fuel demand and consumption and curtailing the supply of coal, oil, and natural gas.

In our last post, we reported on a March 2018 article in the journal Climatic Change, in which economists Fergus Green of the London School of Economics and Richard Denniss of the Australia Institute argued for restrictive supply-side (RSS) policies as part of a wider policy toolbox. While Green and Denniss are among the most recent and detailed proponents of a more robust focus on fossil fuel exploration and production, they aren’t alone.

- The World Bank announced during the Macron Summit last December that it would stop financing upstream oil and gas projects after 2019, apart from “exceptional circumstances”.

- In late May 2018, 60 global investment managers representing more than $10.4 trillion in assets called on fossil companies to address climate risk and greenhouse gas reductions at their upcoming annual meetings.

- In late May 2018, Norway’s $1-trillion sovereign wealth fund moved closer to divesting its oil and gas assets, based on its assessment of the financial risk it would face by staying. “The world’s biggest sovereign wealth fund dumping oil and gas investments could have a ripple effect on other large institutional investors at a time in which investors have yet to show renewed confidence in energy stocks and in which some shareholders and investors are calling upon Big Oil to start taking climate change seriously,” Oilprice.net reported.

- Axa, one of the world’s biggest financial services companies, announced at the Macron Summit that it would stop investing in and insuring 25 tar sands companies and three of the pipelines they depend on to get their product to market. “The pipelines will also be stranded assets at some point, so we don’t want to invest,” said CEO Thomas Buberl. Axa subsequently took a lead role in shareholders’ climate advocacy at the Royal Dutch Shell AGM in May.

- HSBC, the biggest bank in Europe and the world’s seventh-largest, decided in April to stop funding Arctic drilling, tar sands/oil sands development, and most new coal-fired power plants. “We recognize the need to reduce emissions rapidly to achieve the target set in the 2015 Paris Agreement…and our responsibility to support the communities in which we operate,” said Daniel Klier, the bank’s group head of strategy and global head of sustainable finance.

- The Royal Bank of Scotland announced in late May that it would stop investing in new tar sands and Arctic oil projects and put tighter limits on loans to companies that profit significantly from coal. “If we’re going to support our customers in the long run, then it means addressing the challenge of climate change and the risks and opportunities it presents,” said RBS’ director of sustainable banking, Kirsty Britz.

- In November 2017, a letter from 80 leading economists called for “an immediate end to investments in new fossil fuel production and infrastructure,” alongside “a dramatic increase in investments in renewable energy.” They specifically warned that simply encouraging renewable energy without also constraining fossil fuel supplies would be insufficient to drive the low-carbon transition.

- The pressure on international institutions is becoming intense enough that the European Bank for Reconstruction and Development was at pains to explain itself in May 2018, when consultants at E3G identified it as the laggard among international development banks at aligning financial flows with the goals of the Paris Agreement.

- In September 2017, more than 220 organizations from 55 countries signed on to the Lofoten Declaration, calling on countries to embrace reductions in fossil fuel production meanwhile pursuing a planned transition to clean energy.

NRDC’s Strategy Toolbox

NRDC is hard at work to rapidly increase energy efficiency and clean energy and to limit emissions of carbon pollution. NRDC also has a long, proud history of engaging in campaigns that advance policy to encourage limits on dirty fossil fuel development.

- We’ve played a central role in the epic (and ongoing) battles over the Canadian tar sands and the Keystone XL pipeline and helped to successfully establish a cap on expanded production.

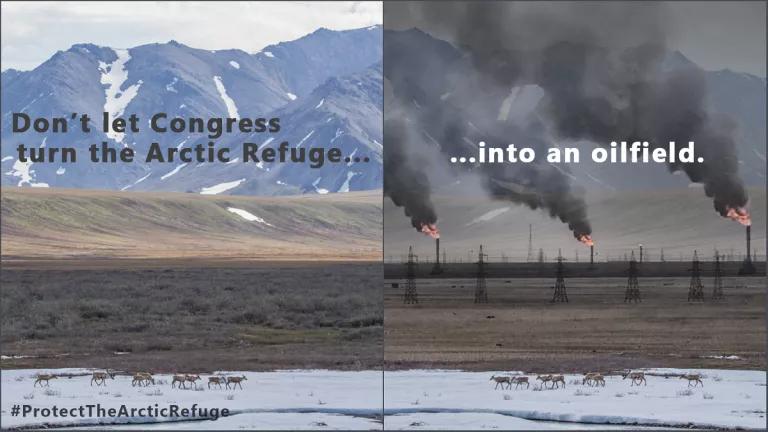

- We have waged a long-term effort to protect the Pacific, Arctic, and Atlantic oceans from oil drilling and are now challenging efforts by President Trump to open our oceans to more offshore development.

- We are challenging oil and gas development on America’s public lands and have called for a moratorium on coal development for public lands. Our President Rhea Suh has said, “Over the long haul, we need to phase out the production of all fossil fuels on our federal lands and in federal waters, as part of a larger strategy to fight global climate change. Putting the brakes on fossil fuel production on [public] lands is an essential first step.”

- Because the impacts of fossil fuels impact communities, water, air, and land, we are standing up for communities across North American and internationally who are facing the devastating impacts of fossil fuel development. Here are just a few examples:

- We are partnering to support citizens in Los Angeles to stop and limit urban oil drilling.

- We are standing with communities in the northeast to support a fracking ban in the Delaware River Basin.

- We are leading efforts in Florida to stop oil and gas exploration in the Florida Everglades.

- We are challenging the Trump administration plan to open up more than 125 million acres in the Arctic and Atlantic oceans.

- And we are calling for a complete review of coal leasing on America’s precious public lands by joining California and New Mexico in an effort to reopen a loophole allowing oil and gas companies to pay proper royalties for coal, oil, and gas including successfully challenging mining in the Powder River Basin in Wyoming and Montana.

NRDC’s leadership in these campaigns is driven in large part by its history as a tireless defender of wildlife and wild places, as these same species and habitats face a severe, existential threat from climate change that is accentuated as temperatures rise towards 1.5°C and 2.0°C above historic global averages. Defending species and their ecosystems, in turn, could have a helpful secondary impact on atmospheric carbon dioxide levels—for example, by protecting forest carbon sinks that are an essential cornerstone of the effort to stabilize the global climate.

NRDC has also fought for years against subsidies to companies that are exploiting and extracting fossil fuels from public lands at below-market prices, and against oil and gas exploration in our oceans and most pristine terrestrial environments.

The point is not to shut down all fossil fuel production tomorrow. What responsible advocates and practitioners across the global climate and energy community are calling for is an urgent but stepwise approach for transitioning off fossil fuel sources and avoiding the lock-in of expensive long-term fossil fuel infrastructure investments that would take our long-term commitment to emissions reductions in the wrong direction. We must also ensure a fair transition for work forces and communities affected by the necessary scaling-down of the resource their livelihoods depend on.

But by the same token, with atmospheric carbon concentrations rising fast, no rational actor would suggest the global climate can be stabilized if fossil fuel production continues to expand. At a moment when U.S. government leaders are indeed intent on increasing fossil fuel output, for export as well as domestic use, and actively seeking to dismantle other climate policies, NRDC continues to decisively embrace the wider toolbox of supply- and demand-side strategies that are already being deployed by many other groups across the United States.

It’s a big, tough, complex job. But still more realistic and responsible than the common, business-as-usual assumption in the fossil fuel industry that continuing production increases through 2040 can be consistent with any realistic low-carbon scenario. The years since the Paris Agreement have shone a spotlight on the work that must still be done to match the world’s supply of energy services with the reality of climate change. That effort becomes even more urgent with the growing recognition that the 1.5°C stretch goal in the Paris text, not the 2.0°C target, is what must really be achieved to maximize the odds of holding off the worst effects of runaway climate change.