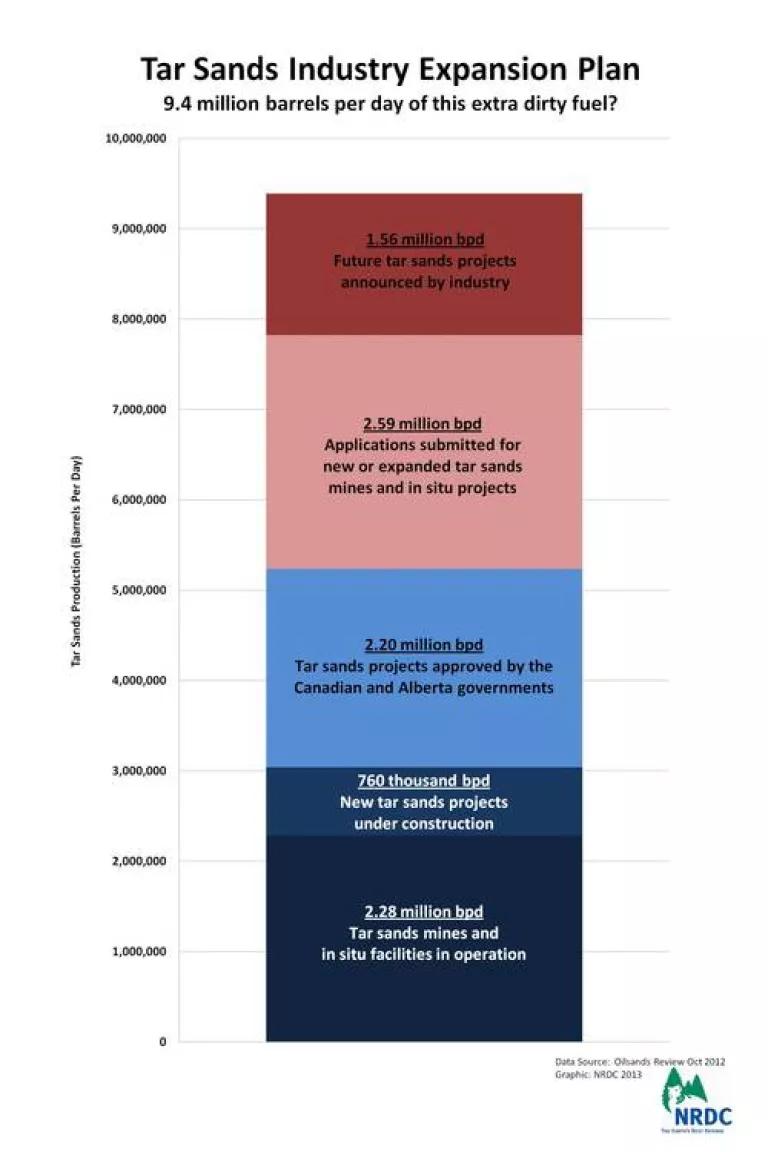

A key issue in the debate over the Keystone XL tar sands pipeline is about the impact it would have on climate. The Keystone XL tar sands pipeline is a fundamental element in the oil industry’s plan to triple production of tar sands oil from 2 million barrels per day (bpd) to 6 million bpd by 2030, and in the longer term to hike production to more than 9 million bpd. A backgrounder on the climate impacts from Keystone XL released by the Natural Resources Defense Council details how the U.S. decision on whether to approve the Keystone XL pipeline will have a direct bearing on whether the tar sands industry can attain those goals, with their attendant increases in carbon pollution. Keystone XL would lock the U.S. into a long-term commitment to an energy infrastructure that relies on dirty oil.

The tar sands industry has proposed expansion plans that would triple production by 2030 which would lead to an increase in carbon emissions to over 900 MMT by 2030. This growth requires a massive expansion of capacity to transport tar sands oil. But as NRDC outlines, the tar sands industry’s production targets would necessitate the construction of every new pipeline currently proposed plus millions of barrels worth of additional transport capacity. The Keystone XL pipeline is an absolutely necessary step for tar sands expansion, and given current pipeline capacity constraints is also significant as the first test of whether such expansion can move forward. In other words, Keystone XL would enable a significant amount of tar sands expansion that otherwise would not occur.

Some have argued that the Keystone XL pipeline won’t carry enough oil to have a major impact on climate.

The direct emissions associated with the amount of oil Keystone XL itself would carry are more significant than they may at first appear. EPA has estimated that Keystone XL would increase annual carbon emissions by up to 27.6 MMt CO2e annually - the equivalent of seven coal-fired power plants operating continuously or having 6.2 million cars on the road for 50 years.

And new research by Oil Change International shows carbon emissions associated with tar sands are higher than currently estimated. Tar sands refining produces significant volumes of petroleum coke (petcoke), a high-carbon refining byproduct that is increasingly being used as a cheaper, more carbon-intensive substitute to coal. According to Oil Change International, Keystone XL will produce enough petcoke to fuel 5 U.S. coal plants. These carbon emissions from this petcoke have not been previously factored into a climate analysis of the pipeline and will raise total emissions of the pipeline by 13 percent.

Approval of the Keystone XL pipeline and its operation would have an impact on tar sands production (and emissions) far beyond the specific amount of oil the pipeline would carry.

The pipeline’s effect on prices and market expectations would prompt a significant expansion of tar sands production. This can be seen, in part, by the current effect the absence of the pipeline is having. The lack of capacity to move tar sands oil from Alberta to other markets has significantly reduced tar sands prices relative to similar international crudes, at times bringing them to below $50 a barrel. These low prices are diminishing investment in new tar sands expansion projects.

What is even more compelling are the words of the tar sands industry and financial community who acknowledge that Keystone XL in particular – more than any other pipeline – critical to enabling rapid expansion of tar sands production. Other proposed tar sands pipelines have not reduced the central role Keystone XL plays in unlocking future tar sands production. In fact, there is clear evidence from the past year that Keystone XL has already affected production.

Expanding the exploitation of tar sands would significantly undermine efforts to reduce carbon pollution. The International Energy Agency’s World Energy Outlook includes scenarios with different levels of Canadian tar sands production in 2035. In the scenario that keeps atmospheric carbon at 450 parts per million (which results in a 50 percent chance of keeping the average global temperature below the 2 degree C threshold), tar sands production is 3.3 million barrels a day. The scenario with production at 4.6 million barrels a day -- still below industry’s 2030 goal -- estimates that global temperature will rise by 6 degrees Celsius with catastrophic results.

An essential point here is that concerns about tar sands impacts are not premised on tapping total tar sands reserves over centuries. Rather, tar sands production levels in line with industry’s explicit goals could have disastrous consequences.

Others argued that tar sands development is inevitable

Industry insiders and even pro-tar sands government officials in Canada understand that the expansion of tar sands production is not inevitable. They have publicly acknowledged that they need the building of pipelines to access international markets for expansion.

Even if you build every single pipe that's on the table right now...you're still short pipeline capacity … For the growth to continue, all the proposed export pipeline capacity and more will need to be built, and soon. Andrew Potter, Managing Director, Institutional Equity Research at CIBC World Markets, Jan. 1, 2013

Current alternatives to the Keystone XL for transporting tar sands oil are on a much smaller scale, in much earlier stages of development, and in many cases face such significant opposition that they are unlikely to move ahead in the next five to 10 years if at all.

- Pipelines to the Canadian West Coast such as the proposed Enbridge and Kinder Morgan pipeline have been proposed but are not likely to move forward. CIBC, a major Canadian financial services firm, recently concluded that there is a less than 50 percent chance that the West Coast pipelines – proposed by Enbridge and Kinder Morgan – will be built. The pipelines are opposed by a significant majority of British Columbians, and aboriginal communities have refused to grant necessary easements for the one pipeline that has officially sought a permit, the Northern Gateway.

- U.S. alternative pipeline projects: There are proposals that would enable more tar sands to be transported to the U.S. Midwest and that could potentially enable new routes to the Canadian and U.S. east coasts. However, these projects are much smaller in size compared with Keystone XL and/or in the very early stages of development. They are therefore not likely to enable major expansion of tar sands in the near term if at all.

- Rails options to move tar sands are limited: In 2011, only 20,000 barrels of crude oil per day left western Canada on rail, and less than 5,000 bpd was exported to the United States. The high cost of shipping tar sands by rail to Gulf Coast refineries or even to the Candian west coast will not likely support prices to justify new tar sands projects.

- Claims that China will take Canadian tar sands are exaggerated: While China has made considerable investment in the tar sands, the growing demand for tar sands investment opportunity does not translate to an actual interest in importing the oil. China does not currently have refinery capacity to take tar sands product and there are no indications they will do so in the near future. If China were demanding tar sands then the Northern Gateway pipeline would have binding long-term commercial support for the pipeline. There are no binding agreements that have been adopted for the pipeline and the only non-binding agreements have been signed by tar sands producers.

This blog was jointly written with Anthony Swift at NRDC