The authors of the Congressional Budget Office (CBO) study released last week must have been sniffing gas fumes when they drastically overestimated the effects of the proposed fuel economy standards on the Highway Trust Fund. The study claims that proposed changes to the corporate average fuel economy (CAFE) standards would amount to a $57 billion loss, or a 13 percent reduction, to the Highway Trust Fund between 2012 and 2022.

To set the record straight, the correct estimate is a loss of $2.5 billion over those 10 years—a reduction of just one percent of the current revenues. The CBO actually noted this themselves in small print in a footnote on page six of the report: “The new CAFE standards would not take effect until 2017, so they would reduce gasoline tax revenues between 2012 and 2022 by less than 1 percent, CBO estimates.”[1]

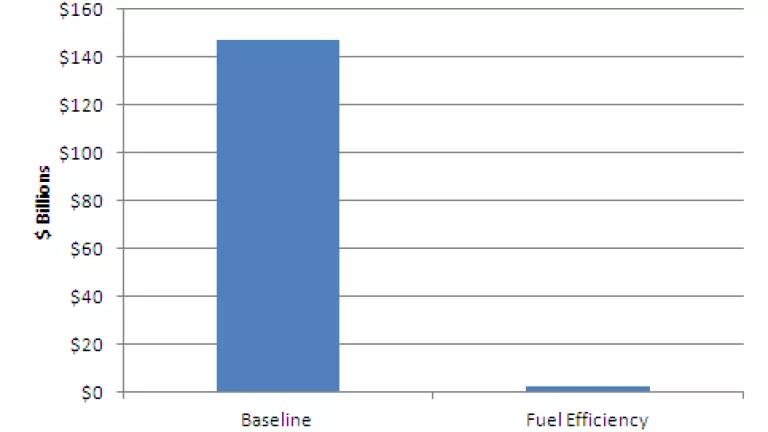

During 2012-2022, the actual fuel-efficiency-related revenue reduction pales in comparison to the shortfall of $147 billion that CBO estimates in their baseline case without the fuel-efficiency improvements. The $100 billion-plus gap between supply and need from the outdated revenue system is the real issue.

Federal Highway Trust Fund Shortfall

The CBO played shell games with the years 2022 and 2040, pulling the cord by 18 years, making the effects of the changes in fuel efficiency standards appear more dire than they are to the trust fund—our main mechanism to finance the federal government’s surface transportation programs.

CBO also omitted another fact in its retrospective look at receipts and outlays for transportation: The American Reinvestment and Recovery Act of 2009 (ARRA). This bill injected about $26 billion into the transportation program, helping to prop it up. CBO mentions a separate transfer of $35 billion over 2008-2010, but the grand total since 2008 is actually about $61 billion counting ARRA.

Consequently, it’s fair to say CBO understated the crisis in transportation finance when looking back and vaslty overstated the role of fuel economy standards on finance looking forward..

The simple truth is that the transportation program is broken, and going broke. The federal gasoline tax is set as a fixed amount per gallon (currently 18.4 cents)—an amount that hasn’t been increased since 1993! Congress needs to do its job and find other ways to finance transportation over the long run. In an interview I did last week for a Marketplace episode on fuel efficiency standards, I pointed out that for the past century we have relied on the perverse incentive to use more gasoline as a revenue tool for transportation at the state and federal level.

It’s high time to get serious about transitioning to revenue tools to supplement the gas tax, which politicians are fearful to touch. One suggestion I have raised is paying into the transportation program based on the number of miles you drive, instead of how much gas it takes you to drive them. This is not a new idea, and in fact a new study shows it is technically feasible and potentially popular (pay-as-you-drive makes a lot of sense for those of us who use our highway system).

Scare tactics by inflating the effects of fuel efficiency on the Highway Trust Fund will only fuel the fire of politicians clinging to their old ways and not seeking innovative and modern solutions to solving transportation funding. Stop sniffing fumes and get down to making some real changes.

[1] Total of $2.5 billion over 2012 to 20122 calculated using gasoline reductions from the fuel efficiency proposal for 2017 to 2025 multiplied by 18.3 cents per gallon consistent with the CBO analysis. Fuel savings from EPA and NHTSA, "Proposed Rule for 2017 and Later Model Year Light-Duty Vehicle Greenhouse Gas Emissions and Corporate Average Fuel Economy Standards: Notice of Proposed Rulemaking", 76 FR 74854, Table III-68.