Another U.S. Public Funding Institution Will Get Out of Coal Power Plants: New Export-Import Bank Guidelines Adopted

The Board of the U.S. Export-Import Bank (U.S. Ex-Im) has just voted to shift its funding out of coal power plants. These new guidelines are very important as they close off funding from a major investor in coal projects and they add to the growing list of public finance institutions that will stop using public funding to support overseas coal power plants. Germany, Japan, the Asian Development Bank, and a couple of other public financing institutions are now the last holdouts.

These new Ex-Im guidelines respond to the call by President Obama in the U.S. Climate Action Plan to stop using U.S. funding for overseas coal projects. And they follow new guidelines from the Treasury Department that guide how the U.S. votes at the multilateral development banks. These two decisions formalize the President’s commitment. They are a very important step in the right direction. With clean energy booming around the world Ex-Im can now focus its scarce public investments on projects to build more wind, solar, and energy efficiency – not more coal projects.

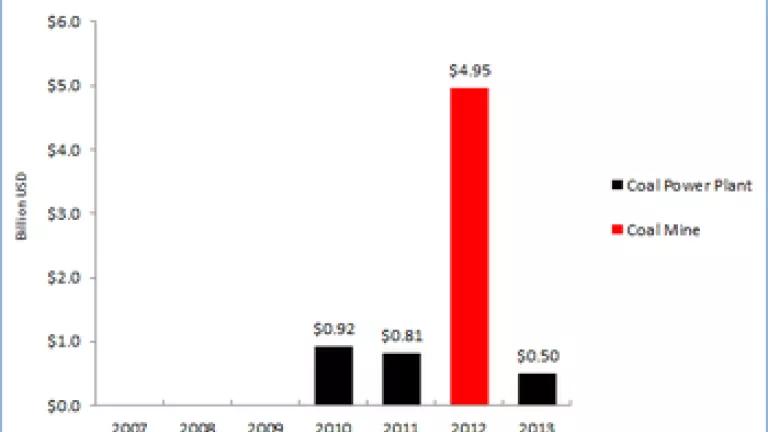

Since 2007 Ex-Im has financed almost $7.2 billion in coal projects, including investments in some of the world’s largest coal power plants (see figure*). This investment includes $0.9 million for the 3,900 MW Sasan power plant in India and $0.8 million for the 4,800 MW Kusile project. It also includes major investments in coal mines – totaling $5 billion since 2007.

The finalized guidelines are very similar to the draft guidelines proposed in September (see NRDC comments here). Few (if any) coal power plants will meet the tests outlined in these guidelines. Unfortunately the guidelines also missed a couple of opportunities to limit Ex-Im funding for coal projects. Here are the details.

KEY PROVISIONS SET OUT A VERY HIGH STANDARD

The Ex-Im guidelines are similar to the ones adopted by the Treasury Department, including with these four key provisions that set a very high standard for any project proposed by Ex-Im.

1. End funding for coal power plants in middle-income countries unless they capture the carbon. All but one coal funding project from Ex-Im has occurred in middle-income countries that would now be excluded unless they captured their carbon. The guidelines specifically require that any coal power plant project in these countries:

- have an emissions performance over 500 g-CO2/kWh (1100 lb/MWh) and deploy carbon capture and storage (CCS) within one year. It will be important for Ex-Im to set out such criteria in a legally enforceable contract that ties payment directly to meeting these criteria.

- transport and store the captured CO2 in an environmentally safe and permanent manner.

Even though these guidelines hadn’t yet gone into effect, Ex-Im recently rejected a coal power plant in Vietnam that would have failed these tests.

2. Require that projects will only be allowed in lower-income countries in rare circumstances. All but one of Ex-Im’s historic projects have occurred in middle-income countries, but there are a myriad of coal plant proposals in lower income countries that are at various stages of planning. In poor countries the new guidelines require that:

- an “alternatives analysis” occur before any coal project is even considered. This assessment must include analysis that clearly proves that there are “no other economically feasible alternatives”. Solar energy is already at grid parity in a number of countries and it is expected to be at grid parity globally by 2020. Wind energy and other renewable energy sources are also economically viable in many locations and the gap is expected to continue to decrease. And clearly the untapped potential of energy efficiency is economically viable as it saves money.

- the alternatives analysis include a social cost of carbon to reflect the damages of the carbon pollution from the plant.

3. Cover the broad scope of “power plants” – not just new “greenfield” plants. The Ex-Im guidelines correctly cover all types of coal plant projects including new greenfield projects (e.g., its Sasan and Kusile projects) and any portion of an integrated mine-mouth plant (e.g., its recent Mongolia coal mine/plant project).

4. Set a high-bar for any retrofit project by only allowing air pollution emissions controls. The Ex-Im guidelines don’t allow investments in life-extension retrofits of coal plants (e.g., install a new boiler or turbine). They rightly allow investments in air pollution control equipment given the damaging impacts that this pollution is already causing on people around the world.

WHERE THE GUIDELINES MISSED AN OPPORTUNITY (or are unspecific)

There are several aspects where the Ex-Im guidelines missed an opportunity or were too unspecific. Unfortunately the guidelines failed to:

1. Require that these banks stop funding coal mine projects. Since coal mines, coal export, coal import, and other infrastructure projects support the use of coal which is driving climate change it is unfortunate that these revised guidelines didn’t cover these projects as we had urged. Ex-Im has invested over $5 billion in coal infrastructure projects including $270 million for Xcoal Inc. to export coal from the U.S. and $1.8 billion for a coal mine project in Australia. This exemption could be tested as Ex-Im has been reportedly considering financing coal mines in Australia’s Galilee Basin and the corresponding coal export infrastructure in the Great Barrier Reef World Heritage Area (a project which a number of groups including NRDC have called on them to publicly oppose).

2. Require that the coal plant use the “best internationally available technology” in the poorest countries. Since advanced coal technologies are widely available throughout the world, the guidelines should have limited funding in these countries only to projects that utilize Advanced or Ultra-supercritical Combustion or Integrated Gasification Combined Cycle technology.

3. Enhance transparency by requiring that all documentation be made publicly available, subject to comments, and provided at least 120 days before a decision is presented to the Board.

4. Tighten the provisions on alternatives analysis. The guidelines failed to require that the alternatives analysis include a quantification of the cost of carbon or the cost of human health and environmental damage from the project. The guidelines also failed to specify that the alternatives analysis include the rising cost of fossil fuels.

5. Mandate that the project must be in line with international commitments and low emissions development strategies of the country. With over 90 countries committing to explicit emission reduction targets – at the strong push of the U.S. – it is unacceptable to fund projects don’t align with this agreement that the U.S. strongly supported. The guidelines aren’t as strong on this provision as should have been included.

------------------------

These Ex-Im guidelines set strong standards against which all coal power plant projects must be judged. They should have been extended to cover coal mines and other projects that support coal power plant expansion. The guidelines don’t mean less investment in energy from Ex-Im. Instead they free Ex-Im to use its scarce public resources in the right kind of energy – ones that don’t drive carbon pollution or cause damage to human health and communities. They clearly can do it as they have invested in a number of wind, solar, and energy efficiency projects over the years.

These are common sense guidelines that should be extended to other export-credit agencies such as the Japanese Bank for International Cooperation and Development (JBIC), Nippon Export Investment Insurance (NEXI) of Japan, Kreditanstalt für Wiederaufbau (KfW) in Germany, and others. The remaining holdouts look quite obvious as even Ex-Im – not historically the greenest bank in the world – is getting out of coal financing. It is past time for these public institutions to stop financing coal.

------------------------------

* Based upon data in a forthcoming NRDC report.