Which do you like better: Clean Energy & Your Money or PJM's Proposed Capacity Market Reforms?

In response to last winter's Polar Vortex, which stressed much of our nation's power grid, PJM, the grid operator for 61 million customers in 13 Mid-Atlantic and Midwestern states and the District of Columbia, has proposed changes to how it secures enough electricity to meet future demand. Unfortunately, these proposed changes go beyond what's necessary to fortify its system against extreme cold weather impacts - and will reach deep into consumer pocketbooks and create barriers to clean energy.

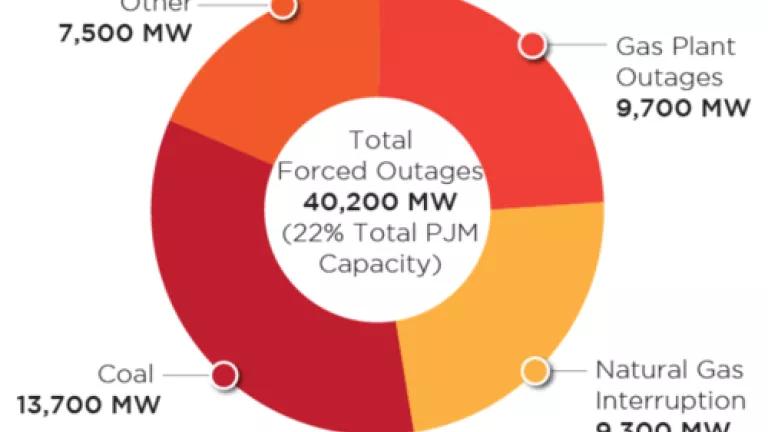

During the worst of last winter, on January 7, more than one-fifth of power plant generation could not deliver power as committed. This is seen in PJM's chart below, when extreme winter conditions (projected to happen once every 10 to 24 years) forced a record number of gas and coal plants offline. Basically, it was so cold that coal piles and insufficiently weatherized plant equipment froze. And gas-fired power plants, which do not typically store gas onsite but rely on real-time natural gas delivery, had not contracted for a sufficient supply of natural gas to run when needed.

(Source: PJM)

Even so, PJM was able to keep the lights on, with the help of wind and demand-side resources, which include energy efficiency and demand response (where customers are paid to reduce their energy consumption when electricity demand is highest). Unlike fuel-based power plants, these clean energy resources don't experience winter fuel or related performance problems.

As a regional grid operator, PJM is justifiably worried about maintaining electric reliability in coming winters, especially since climate-change induced extreme weather is becoming more common. A solution to this problem that we and many other PJM stakeholders support is to target the specific issues encountered by coal and gas generators and expand market opportunities for renewable and demand-side resources that are especially valuable during winter. After all, many of the power plants that went offline during the January 7 cold snap have already addressed some of their cold weather problems and were able to bounce back for the remainder of the winter, and other efforts underway will further improve power plant performance in the extreme cold. However, instead of this targeted approach, PJM is proposing a sweeping overhaul that will be costly to consumers, detrimental to demand response, energy efficiency, and wind and solar energy, and unnecessary to ensure reliability.

PJM's Proposal

PJM is proposing major changes to its multi-billion dollar capacity market, which could use a side explanation. PJM established its capacity market to help procure sufficient electricity supply to meet future demand in the region. PJM annually holds an auction to secure energy resources for a period three years in the future. Coal, gas, and nuclear resources can offer into the auction as sellers, as can demand response, energy efficiency, and wind and solar power. The least expensive resources are bought first and commit to deliver power (or curtail consumption in the case of demand response) when PJM calls on them to do so. This continues until PJM has secured sufficient resources to satisfy electricity demand, plus a safety margin. In general, allowing more resources in the auction increases competition and tends to lower prices, and capacity market rules help determine which resources we invest in.

Currently, PJM's capacity market resources - coal, gas and nuclear plants, energy efficiency, demand response, and wind and solar power - are like the team of protagonists in the Lord of the Rings: everyone (hobbits, wizards, humans, elves, etc.) has different strengths and weaknesses, but as a diverse team, they overcome all sorts of obstacles. PJM's proposal seeks to ensure that every team member can more or less individually triumph over another Polar Vortex by requiring nearly all resources to be available every day of the year even though these types of events happen only once every 10 to 24 years for a few hours. This proposed all-year availability requirement would largely eliminate from the team (drive out of the capacity market) renewable and demand-side resources with availability dependent on weather and consumer behavior. But these were the very resources that helped preserve reliability last winter, and their elimination is a casualty of requiring year-round availability for seasonal needs.

While ensuring grid reliability during the most adverse of conditions is desirable, the proposed capacity market overhaul does it at a much higher price than a solution focused on fixing the power plants with winter problems. It will largely eliminate seasonal demand response and energy efficiency, which will increase annual costs to consumers by roughly $2 billion, and upgrading nearly all capacity resources to ensure year-round availability has the potential to double capacity market prices. At double the price, one would expect at least double the benefits. But from PJM and its independent market monitor's calculations, the cost of the market overhaul will exceed its benefits - by between $1.4 and $4 billion over three years.

In short, PJM's proposal increases consumer costs by reducing the ability to save money through cutting energy use and also requiring that consumers pay for more upgrades in gas and coal plants than necessary.

What's next?

PJM's proposal has yet to be approved by PJM's board of managers and the Federal Energy Regulatory Commission. The Sustainable FERC Project coalition filed two sets of comments (on 9/17 and 10/28) in PJM's stakeholder process urging an approach focused on addressing specific causes of coal and gas power plant failures (such as fuel supply and equipment weatherization) while encouraging participation from cleaner resources that perform well in winter. These measures would preserve reliability through another extreme winter at reasonable cost. The North American Electric Reliability Corporation, in its report, takes a similar position in recommending solutions tailored to problematic generation. We hope PJM will consider our recommendations so that we may choose to continue investing in affordable and reliable clean energy.

Update: In January 2015, PJM filed a pared-down version of its proposal at FERC, incorporating some of the improvements our coalition had suggested. PJM also proposed further changes that would substantially diminish the ability of demand response and energy efficiency resources to participate in the capacity market. We submitted two sets of comments in response to PJM's two FERC filings. In the first set of comments, we asked FERC to reject PJM's proposed capacity market changes or direct PJM to further improve its proposal. In the second set of comments, we asked FERC to reject PJM's proposal to remove the ability for demand response and energy efficiency to directly compete in PJM's capacity market alongside generation resources. FERC ultimately granted this second request.