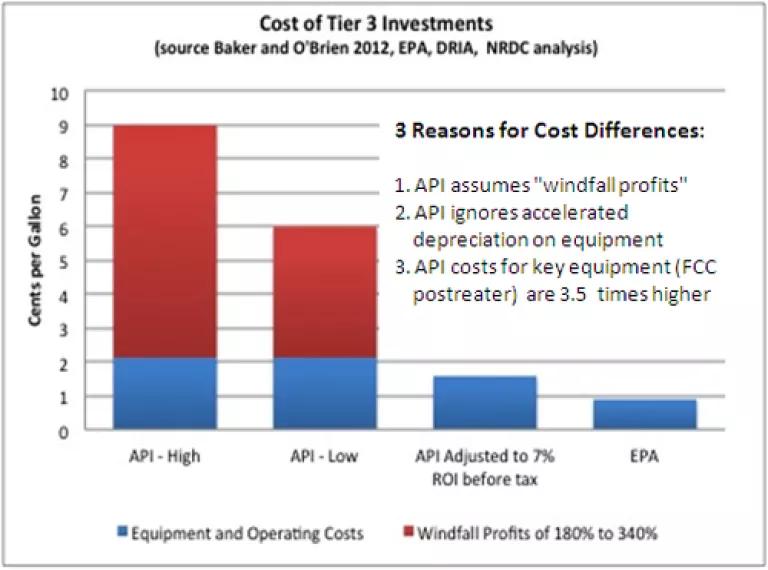

It’s not a surprise that EPA and the oil industry disagree about the cost of cleaning up gasoline to meet proposed “Tier 3” low sulfur standards. EPA estimates less than a penny a gallon but the oil industry claims 6 to 9 cents. While I’m used to seeing over-inflated industry cost estimates to comply with new pollution standards, even my jaw dropped after we asked our financial expert, Andy Stevenson, to dig a bit deeper into the source of the disparity. It turns out the oil industry’s study inflated their return on investments to 180 to 340 percent, equivalent to “windfall” profit of $4 to $8 billion per year.

That’s right. An industry that made almost $120 in profits in 2012 and still takes $8 billion in federal tax subsidies has the chutzpah to claim it wants to make $4 to $8 billion in windfall profits to protect public health.

And as Andy points out in his blog, oil companies are backing away from its own inflated investments. Valero, the largest independent refiner in the U.S., is telling investors its cost will be what Andy calculate as just 0.63 cents/gallon, or at least 10 times lower than what the industry has been claiming. And there is little question Valero along with the rest of the oil industry can afford to make this investment since the cost is just 2% of the $4.45 billion it made in pre-tax earnings on refining in 2012.

Three Reasons for Cost Differences between EPA and API

As Andy notes in his blog, there are essentially three reasons for the difference in EPA’s and API’s estimates:

- The vast majority of the difference between the cost estimates is due to the American Petroleum Institute (API) commissioned study (by energy consulting firm Baker & O’Brien) effectively assuming an enormous “windfall” profit margin equivalent a 180 to 340% rate of return. In its Draft Regulatory Impact Analysis, EPA found that the API commissioned study estimate of 6 to 9 cents per gallon increase assumes a profit margin of 4 to 7 cents per gallon, or $4 to $8 billion annually in profits. In contrast, the EPA assumed a standard rate of return (after taxes) of 10 percent.

- In addition to the windfall profits, the API commissioned study assumes an additional 10% rate of return on investment (ROI) but ignores refiners’ ability to depreciate their investments so implicitly assumes a higher ROI than normal. In contrast, EPA assumes the industry requires a 10% ROI after tax deductions are considered which is equivalent to a before tax ROI of 7%. EPA estimates when the API estimate is adjusted to a 7% before tax ROI, the API cost would be 1.58 cent per gallon.

- The remaining 0.69 cents per gallon difference can be attributed to differences in annual costs to install and operate the desulfurization equipment. The API commissioned study estimated a total annual cost of $2.4 billion compared to the EPA estimate of about $1.3 billion due to differences in equipment costs. As EPA notes in its analysis, API’s claimed cost for a key piece of equipment to desulfurize oil (called a “FCC postreater”) is 350 percent higher than EPA’s estimate.

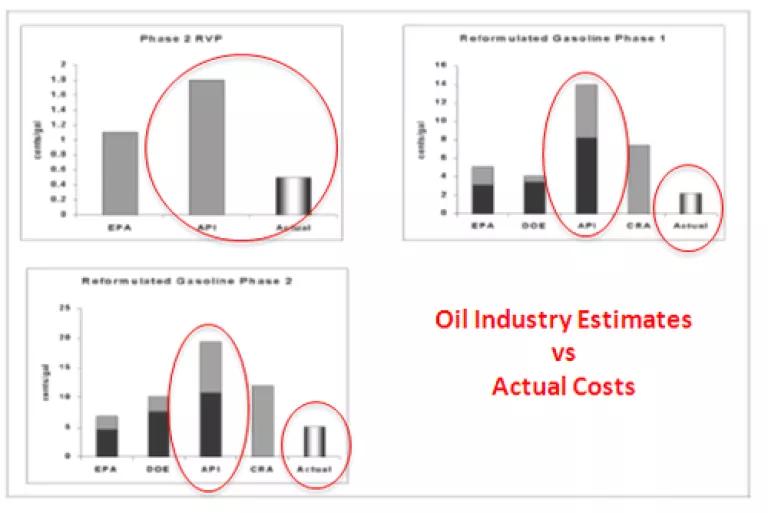

Oil Industry’s History of Inflated Cost Estimates

The oil industry lobbying primary lobbying associations, API, has a history of inflating cost to make cleaner gasoline. As shown in the charts below, EPA’s peer-reviewed analysis of actual costs to meet previous standards shows that the oil industry’s claims have been 3.6 to 6.8 times higher than actual costs.

Taking sulfur out of gasoline is a common sense, cost-effective necessary way to cut air pollution. It will provide huge public health benefits which exceed the costs by a factor of seven. The oil industry already produces 10 ppm sulfur gasoline globally, including Europe, Japan, South Korea and even in California. The largest five oil companies made almost $120 billion in profits last year. Isn’t it time they use their enormous wealth to be part of the solution rather than the problem?