A major issue in the decision around the proposed Keystone XL tar sands pipeline is the extent to which this project will drive expansion of tar sands extraction and the associated climate change. This dirty energy project will make climate change worse, threaten our communities and is not in our national interest. Yet, we often hear Keystone XL dismissed as insignificant. This misses the point that a decision on Keystone XL is a decision about whether the tar sands production will more than triple over its 2010 levels by 2030. It is a decision that is significant for our climate.

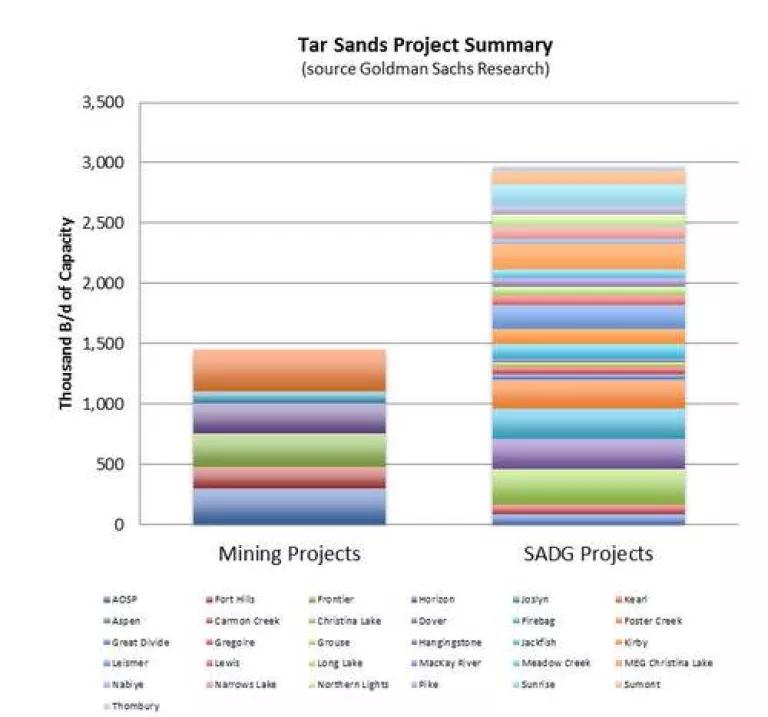

Tar sands crude is already considered a risky investment as “marginal oil” and it’s become apparent that uncertainty over the Keystone XL project has started to slow investment. Weak cash flows tend to make oil companies vulnerable to the Keystone XL decision as they face lower tar sands prices and higher costs transportation alternatives. Financial analysts have clearly said that Keystone XL is important to tar sands expansion. The oil industry has clearly said that Keystone XL is important to tar sands expansion. The President’s decision whether to build Keystone XL is critical to an industry which is considering whether to greenlight over 6.5 million bpd worth of new tar sands expansion projects – many of which have already been approved by Albertan regulators. That’s why the CEO of tar sands producer Cenovus recently told reporters that “if there were no more pipeline expansions, I would have to slow down” his company’s tar sands expansion plans. It is why the Canadian Minister of Natural Resources has tried to make the “dire consequences” of not having enough pipeline capacity clear. The International Energy Agency agrees on the importance of Keystone XL to the oil industry. Bottom line: the tar sands expansion envisioned by the oil industry and the Canadian government requires not just Keystone XL but all the major pipeline and rail proposals in order to move forward. This is not a choice among pipelines or between pipeline and rail. Keystone XL is a critical part of the oil industry’s plan to expand tar sands production.

NRDC has pulled together key investment numbers that tell the story of how Keystone XL would significantly increase investment in tar sands extraction, driving increased production and carbon emissions.

Uncertainty over Keystone XL has started to slow investment.

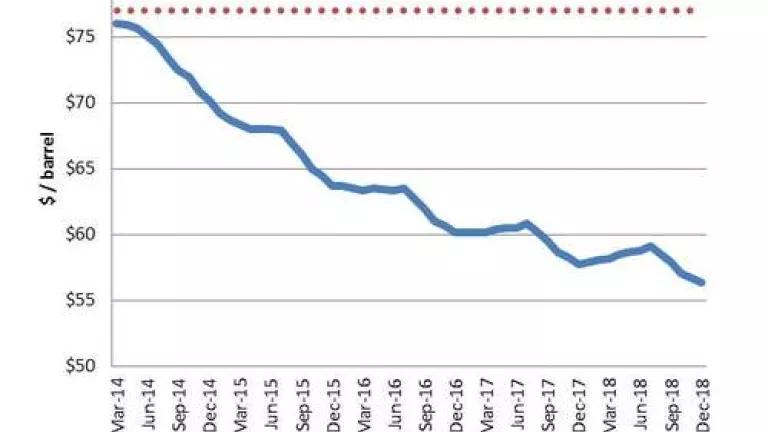

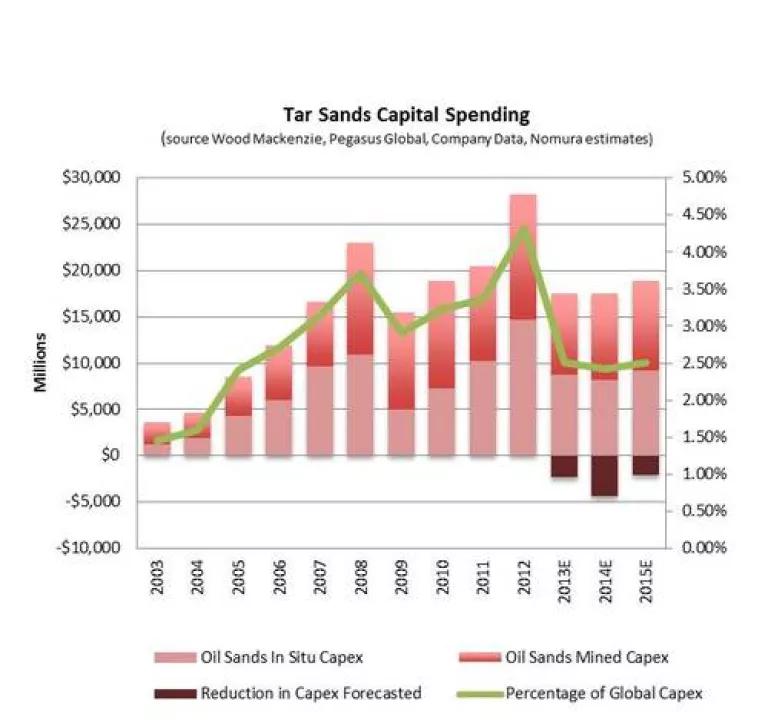

A lack of progress on Keystone XL and a glut of new US production has pushed prices for tar sands (WCS) oil down to $57/barrel for delivery in December 2018, well below the average breakeven price for a new project of $77/barrel. Tar sands capital spending dropped from $28bln in 2012 to $17bln in 2013 and is forecast to remain largely flat thru 2015 as lower prices and lack of export capacity has delayed new investments in green-field projects.

Weak cash flows make tar sand companies vulnerable to the KXL decision.

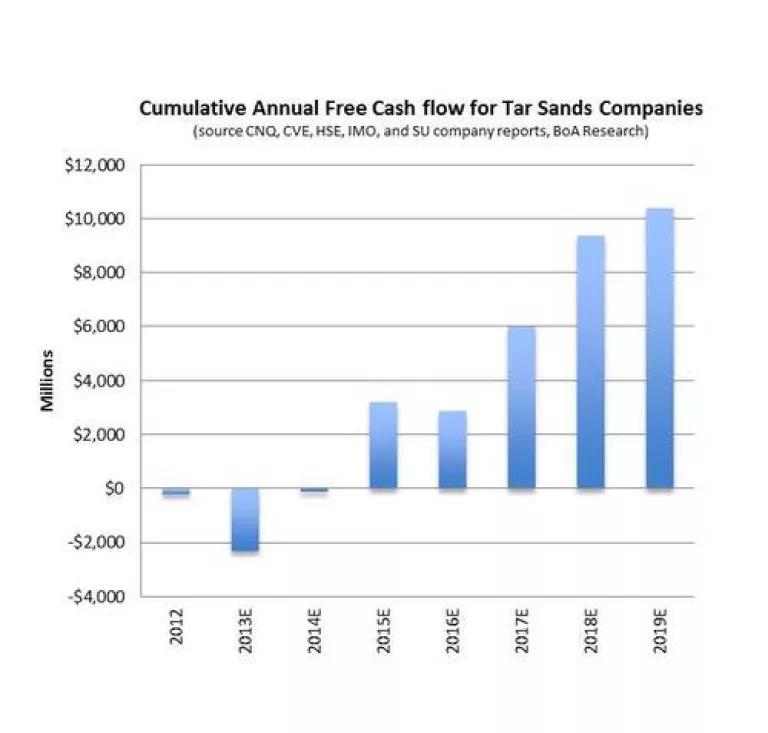

If Keystone XL is not approved, tar sands companies will not have the positive free cash flows needed to invest in new projects until the 2016-19 timeframe, giving far less certainty to the amount of production that will ultimately come online. If Keystone XL is approved, investors are expected to re-emerge in the tar sands space.

New pipelines will drive new investment.

Tar sands output is not constrained by supply but by access to refineries. If all proposed pipelines are built, analysts expect the discount for tar sands oil to stabilize around $14/barrel and provide the long-term certainty needed for companies to invest in new projects. This means that to achieve its planned expansion of more than tripling tar sands production from 2010 levels by 2030, the tar sands oil industry needs all of its proposed pipelines and more.

|

Existing Tar Sands Takeaway Capacity 2013 (source Company report, Goldman Sachs Research estimates) |

|

|

US Midwest via Enbridge |

810 Mb/d |

|

South via Express & Western Corridor |

210 Mb/d |

|

South via Keystone Phase 1 |

375 Mb/d |

|

West Coast via Trans Mountain |

60 Mb/d |

|

Total Dedicated Heavy Oil Export Capacity |

1,455 Mb/d |

|

Proposed Tar Sands Takeaway Capacity 2014-2017 (source Company reports, Goldman Sachs Research estimates) |

|

|

Alberta Clipper Expansion I and II |

350 Mb/d |

|

Keystone XL Northern Leg |

660 Mb/d |

|

Northern Gateway |

265 Mb/d |

|

Trans Mountain Expansion |

475 Mb/d |

|

Total Proposed Heavy Oil Export Capacity |

1,750 Mb/d |

Join NRDC in our efforts to stop tar sands expansion and take action to stop the Keystone XL tar sands pipeline at: www.stoptar.org