Recently, the National Mining Association (NMA) released a map on its website, highlighting states where manufacturing industries contribute more than 10% of GDP, and where greater than 40% of electricity is supplied by coal. NMA used the map to assert that manufacturing jobs depend on cheap, coal-powered electricity. However, cheap and cheaper coal electricity rates may not be the solution if we want to build a strong, competitive U.S. industrial sector. That’s why we here at NRDC counter NMA’s claim, and make the case instead that investing in energy efficiency is a better way to reduce costs for industry, increase energy reliability, enhance industry competitiveness and create much-needed new jobs.

The NMA map selected states based on two arbitrary criteria—namely coal-powered electricity generation and manufacturing industry health. But while a correlation between these two criteria was assumed, a cause-effect linkage was never demonstrated. We believe that NMA’s argument was specious at best, and likely contrary to the factors actually driving manufacturing robustness.

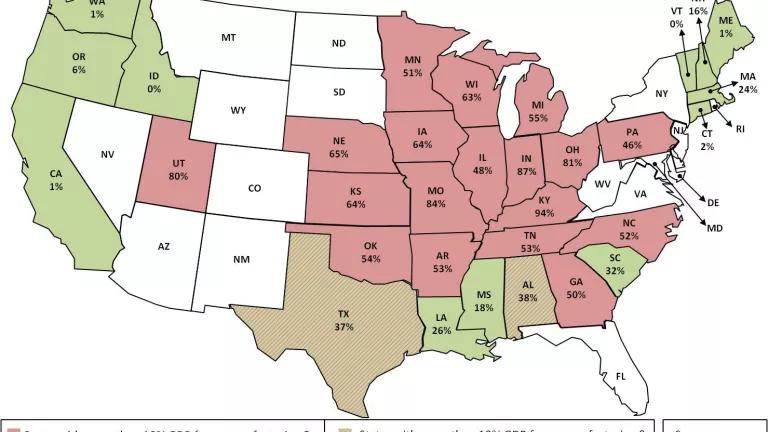

Let’s take a look at a more complete picture. The following map, based on NRDC analysis, uses data from the same sources as the NMA.

As indicated in red above, many states that earn more than 10% of their GDP from manufacturing do indeed derive more than 40% of their electricity from coal. However, clearly there are many other states with more than 10% of GDP from manufacturing that derive less than 40% of their electricity from coal (and many of these states use even less than 10% coal for their electricity needs).

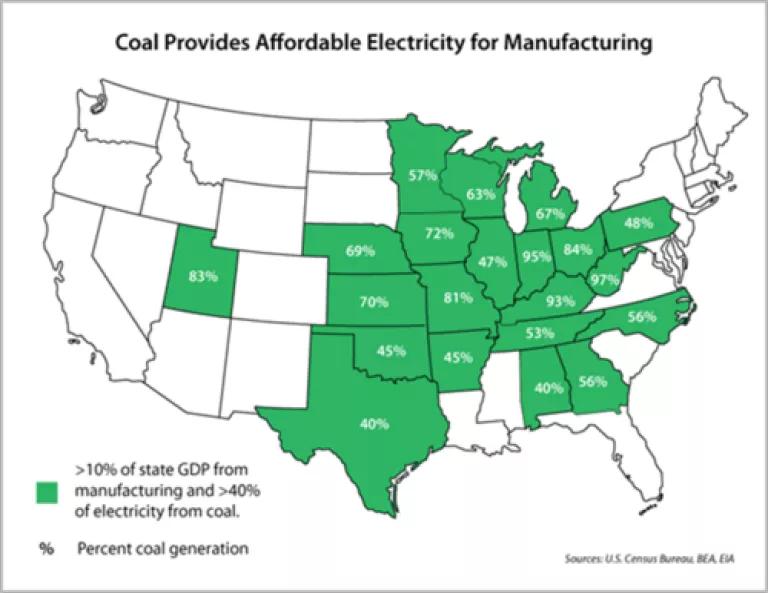

That’s quite a different – not to mention more complete and more accurate – story than the original NMA map the coal industry touted in its attempt to assert the indispensability of coal, shown below:

[As a point of clarification, Texas and Alabama in the NMA map were marked as having 40% coal generation. We here at NRDC could not find EIA data to support this. As far as we can tell, as per 2011 (and 2010 data, not shown) Texas and Alabama had less than 40% coal generation.]

Let’s now look at the robustness of the manufacturing industry in a slightly different and perhaps more relevant way. With a view toward incorporating trends in the manufacturing industry, and particularly its potential for future growth, let’s consider trends in GDP growth of the manufacturing industry over the last ten years.

Unfortunately, the map above paints a concerning picture for many of those states that depend on coal for their electricity. Many of these states have seen their manufacturing industries decline or grow only modestly at best. While there may be many contributing factors, we can be certain that coal-powered electricity has not helped achieve strong growth. This is especially apparent when compared with other states with strong economic growth that utilize sources other than coal for their electricity generation (more detail on industry growth by state is available from the Bureau of Economic Analysis). Also consider the analysis from the U.S. Department of Energy (DOE) showing that cheaper energy has been instrumental in the considerably higher energy-intensity (read energy-inefficiency) than the national average of many manufacturing sectors in the South and Midwest (the main regions highlighted in the NMA map), based on a sector-by-sector, apples-to-apples comparison. For example, the analysis found that chemicals manufacturing was about 84% more energy-intensive in the South than nationally, and primary metals was 59% more energy-intensive in the Midwest than nationally. This suggests that states dependent on coal, in general, have failed to adapt to more modern manufacturing methods.

But all is not lost, especially with foresight and smart planning. There are many ways in which manufacturing industries (and other sectors) can better adapt to future trends. One of the more significant growth opportunities is through greater energy efficiency. Energy efficiency has three crucial advantages:

- It reduces energy costs, especially in energy-intensive industries, making them more competitive in the global arena. It also limits their exposure to fossil-fuel price volatility.

- It reduces demand and thereby promotes energy reliability for the manufacturing facility. It also helps energy reliability regionally by making existing grid infrastructure more capable of handling reduced demand (and mitigating the need for new infrastructure).

- As a growth industry itself, industrial energy efficiency offers a strong platform for the creation of new jobs (e.g., in the construction/retrofitting of manufacturing facilities, or in the production and installation of manufacturing and heating/cooling equipment) and stimulation of the broader economy. This is especially relevant in the current economic climate and high unemployment.

Energy efficiency can be achieved in the manufacturing industry in multiple ways. One approach is through gradual but continuous improvements in process efficiency. Another approach is by replacing old or outdated equipment with newer, more efficient ones. A third approach is through more widespread use of Combined Heat and Power (CHP), a system that utilizes the energy content of fuels more fully (typically 70 – 80%), for both electricity and thermal needs. Contrast that with most coal-based electricity generation, which wastes more than 60% of the available fuel energy content.

In direct response to NMA’s claim, energy efficiency can in fact yield huge savings for the South and Midwest. The DOE analysis (referred to earlier) found that industrial facilities in these regions could save about $19 billion and $7 billion in energy costs respectively, just by making their inefficient manufacturing processes as efficient as the national average. Yes, these regions are large, but after standardizing for size differences, it is still clear that inefficient South and Midwest manufacturing can save respectively nine and four times more on energy than the Northeast.

Just to give you a sense of where such savings can be obtained from, here are some examples documented by the Energy Star for Industries program:

- ArcelorMittal, the world’s leading steelmaker, reduced energy-intensity by 7.3% in 2010 (compared to 2009) and saved many millions in energy costs, through initiatives like tuning boilers for reduced natural gas consumption, establishing improved procedures for shutting down and restarting equipment, and improving its steam distribution program.

- PepsiCo, the leading food and beverage company, reduced its energy-intensity by 8.5% and saved $100 million from energy management investments in 2010, including by replacing its old boilers and improving the efficiency of natural gas usage at its plants.

- 3M, the diversified technology company, improved global energy efficiency by 4.5% in 2010 and saved more than $18 million in energy costs.

- CalPortland, a major cement producer, reduced its energy-intensity by 4.6% in 2010, including by conducting 144 energy efficiency projects that saved about $2.3 million.

Notwithstanding these successes, for more widespread deployment of energy efficiency measures we’ll need to overcome several policy and market barriers. Stay tuned for follow-up blogs in which I’ll explore what can be done to promote industrial energy efficiency and CHP.