As the controversy around the proposed Keystone XL tar sands pipeline continues to intensify, a narrative has appeared in stories by the New York Times and the Washington Post that suggest the proposed Keystone XL tar sands pipeline has become nothing more than a symbolic issue - one way or another tar sands will be developed. Unfortunately, this narrative utterly ignores the major developments in the tar sands industry over the last year. Faced with pipeline constraints, tar sand companies have chosen to cancel expansion projects rather than shift to rail. Companies that pioneered tar sands by rail in early 2013 are on the verge of bankruptcy today. And contrary to a series of stories, including a Washington Post Editorial, Canadian crude by rail is not undergoing a North Dakota-like surge. Some commentators have noted that Keystone XL's symbolic power has fostered a broad movement with expanded power to tackle climate challenges beyond the pipeline make this a fight worth having in its own right. But even these stories miss the fact that in 2014, the tar sands industry cancelled or deferred over one million barrels per day of expansion projects. Almost half of these cancelations happened when oil prices were still well above $90 a barrel. With tar sands expansion projects hitting the brakes due to lack of cheap transport capacity and a new study showing that tar sands expansion doesn't have a place in a world serious about climate change, it is obvious that Keystone XL is far more than a symbol.

Stories touting the symbolic nature of the Keystone XL debate tend to ignore profound developments in the tar sands industry over the last year. Here are a few:

Tar sands companies have responded to pipeline constraints by canceling expansion projects rather than turning to rail. When oil prices were still above $90 a barrel, tar sands companies facing pipeline constraints all made the same choice - to cancel or defer their major expansion projects. Shell withdrew its application for its 200,000 bpd Pierre River Mine in February 2014, Total put its 160,000 bpd Josyln Mine on indefinite hold in May 2014, and Statoil canceled its Corner in situ facility in September 2014, stating:

"Costs for labour and materials have continued to rise in recent years and are working against the economics of new projects. Market access issues also play a role - including limited pipeline access - which weighs on prices for Alberta oil, squeezing margins and making it difficult for sustainable financial returns." Statoil Statement, Sept. 25, 2014 [emphasis added]

The tar sands industry has been remarkably candid in describing the role that new pipelines play in its business plan - and it's not a symbolic one. Greg Stringham, Vice President of Canadian Association of Petroleum Producers, acknowledged on June 9, 2014:

"The biggest uncertainty in this forecast is the timing associated with this [pipeline] capacity and whether or not they can deliver the capacity on the timelines they now propose."

Falling oil prices have further undermined the feasibility of tar sands expansion. As we detail in a factsheet, even the State Department's environmental review concluded that Keystone XL would enable substantial tar sands expansion if oil prices fall below $75 a barrel. In early December, when oil prices were still trading at the level, Raymond James analyst Chris Cox indicated that tar sands expansion could stop unless prices rose above precrash levels (or $90 a barrel). As prices have continued to descend below $50 a barrel, a raft of projects that would have produced nearly 600,000 bpd in coming years have been delayed or cancelled by Cenovus, MEG and Suncor.

Simply stated, recent market developments have burst the aura of inevitability around tar sands expansion and highlighted the fact that tar sands is expensive to produce and only makes sense in a world of high cost oil and plentiful, low cost transport infrastructure.

Tar sands by rail to the Gulf is a bust. The forecasts predicting a North Dakota like crude by rail boom in Canada haven't panned out - particularly in the tar sands. State predicted Canadian crude by rail exports would approach half a million barrels by 2015 - the most recent National Energy Board data puts them at about a third that level. Only a fraction of those shipments are tar sands to the Gulf.

The companies testing the water around the viability of tar sands by rail to the Gulf are proving a cautionary tale for the rest of the industry. The first tar sands producer to sign long term contracts to ship tar sands by rail to the Gulf was Southern Pacific Resources in 2012. By mid-2014, that company had lost 98% of its share value and was on the verge of bankruptcy - in no small part because their high transport costs were severely undermining any value they received from their product by the time it reached the Gulf.

Rail companies trying to make a go at tar sands by rail haven't fared much better. One of the pioneers of that business has been Canexus. Canexus too has lost the majority of its share value after suffering a series of setbacks from its tar sands by rail terminal - technical setbacks, cost overruns, and producers backing out. Expected by the State Department to ship 150,000 bpd of tar sands in 2014, it is moving less than 10% that amount. Soured on the tar sands by rail model, the company is now trying sell the terminal.

Examples like these explain why major companies like Shell, Total and Statoil would rather cancel their expansion projects (and citing pipeline constraints as a rationale) rather than shift to crude by rail is a major indicator that moving tar sands by rail to the Gulf's heavy crude refineries is not an economically attractive option. As a point of reference, in North Dakota pipeline sponsors Oneok and Koch Industries cancelled two major pipeline proposals because light crude producers there were more interested in rail.

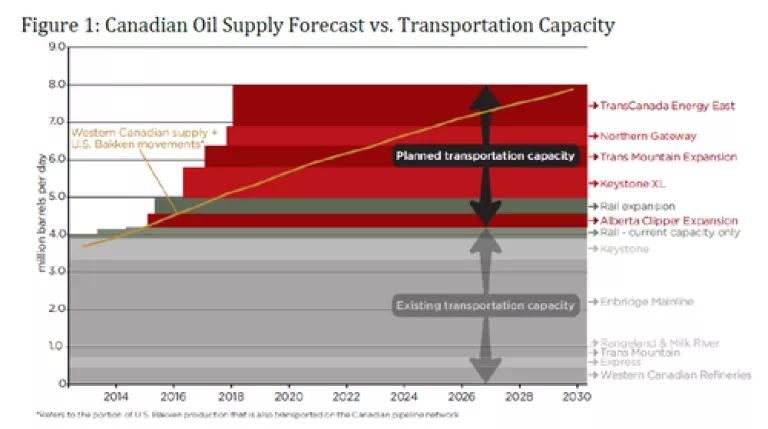

Alternative pipelines are facing significant opposition. Other pipeline proposals in both the United States and Canada face significant opposition and have uncertain prospects at best. Additionally, the conventional wisdom that industry could pursue its expansion plans with other pipelines instead of Keystone XL ignores the fact that industry clearly requires all of the currently proposed pipelines and rail to reach its expansion goals (see Figure 1). In other words, it is not a matter of building Keystone XL or Energy East or Northern Gateway. It is about each pipeline incrementally helping industry access new markets, opening new acreage and unlocking new high carbon tar sands.

Tar sands development is an environmental catastrophe. Its production requires the destruction of large stretches of the Boreal forest, contaminates the air, water and food supply with cancer-causing chemicals which are poisoning the region's indigenous peoples. Tar sands spills have proven particularly hazardous and damaging to water resources. And it is carbon intensive to produce. Simply displacing conventional crude with the tar sands in Keystone XL would generate 27.4 million metric tons of additional carbon dioxide emissions annually, or 1.4 billion metric tons over the project's lifespan. It's clear that in most scenarios we're likely to see, building Keystone XL would allow tar sands projects to move forward that wouldn't without the pipeline. In fact, the State Department concluded that Keystone XL would have a substantial impact on tar sands production at oil prices below $75 a barrel, potentially larger than the pipeline's capacity itself. That is a tremendous amount of carbon for a single project - it's the equivalent of the carbon savings from the fuel efficiency standards for heavy duty trucks in 2020; it's over twice the carbon savings from the Northeast and Mid-Atlantic Regional Greenhouse Gas Initiative (RGGI) to reduce emissions from power plants; and more than a thousand times what is needed to require scrutiny under the Whitehouse's guidance on environmental reviews. That's a big deal. Under any reasonable measuring stick, the Keystone XL pipeline is far more than a symbol. It's the kind of project we're going to have to say no to if we're serious about address climate change.