"War on coal" or something else entirely?

Big Coal's Nemesis: Bad Bets on the Market

For years now, Big Coal has tried to blame its woes on a government "war on coal" but the truth is the market and a series of bad decisions by coal producers are what has put coal stocks in the toilet. Since we can expect more "war on coal" hype next week when EPA announces its landmark Clean Power Plan, now is a good time to lay out the facts.

The biggest cause of Big Coal's loss of value is that Big 3 management bet big on a global coal boom and lost big when it went bust.

Here are the five reasons why Alpha Natural, Arch Coal, and Peabody Energy are on the brink of bankruptcy:

1. Bad bets

As recently as 2011 the Big 3 coal companies were doing very well indeed. The market cap of Peabody Energy, Arch Coal, and Alpha Natural was a combined $35bln, coal was powering 46% of US power plants, and a global commodities boom was lifting the value of US coal exports to an all time high of $15.8bln.

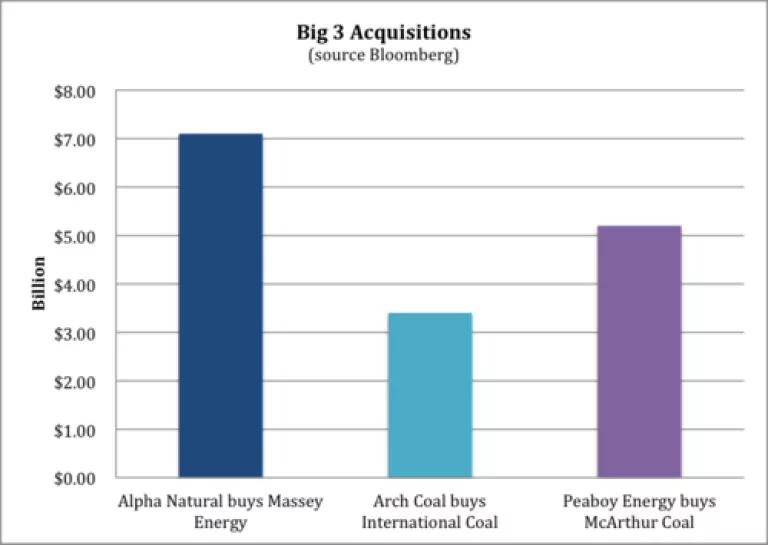

Betting on large growth in coal demand, the Big 3 decided to go on a buying spree. Peabody Energy bought Australia's McArthur Coal, Arch Coal acquired International Coal, and Alpha Natural Resources purchased Massey Energy. In total the Big 3 spent $16bln at the top of the market in 2011 on acquisitions to add 1.7bln tons of metallurgical (met) coal and 4.3bln tons of thermal coal to their reserves.

Before long, the big bets made by the Big 3 looked like a big mistake. By late 2011, the supply/demand imbalance that had lifted prices to record highs started to reverse due to rising supply out of Australia and Indonesia and slowing demand in China. By early 2012 global coal prices were in free fall, forcing Alpha Natural Resources to write down the $1.7bln premium it paid for Massey Energy by the end of the year and all three companies suffering due to their ill-timed purchases.

2. Big debts

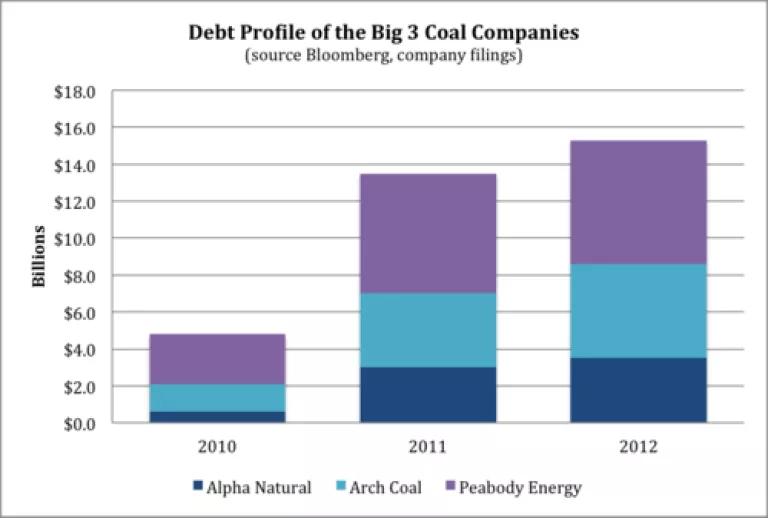

In order to purchase competitors for $16bln, the Big 3 needed to borrow a lot of money. In total Peabody Energy, Arch Coal, and Alpha Natural Resources borrowed $11bln to fund their purchases, nearly tripling their outstanding debt and locking themselves into a "growth at any cost" strategy that would prove to be their undoing.

In order to justify the large debt they were incurring, these companies needed to projected large growth in revenues. But as it turned out, this growth did not happen.

3. Weak Mets

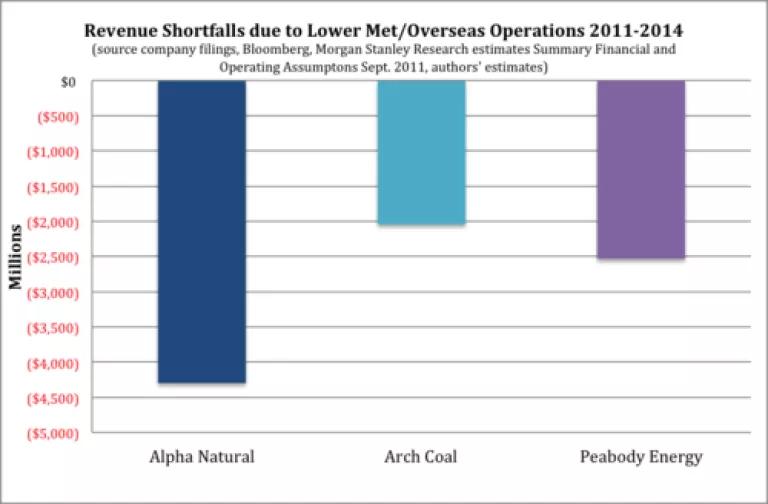

The Big 3's acquisitions were primarily all-in bets on the future of met coal, which had increased to 55% of US coal company earnings in 2011.

After spending $16bln on acquisitions to help bolster their met coal reserves, however, the Big 3 watched as the bottom fell out of the met coal market. Prices collapsed from $350/ton in 2011 to a low of $125/ton in 2014. Revenues from met coal sales and overseas operations underperformed forecasts by an estimated $8.9bln.

The distinction between met coal and thermal coal is critical. Thermal coal is burned in power plants, while met coal is used in steelmaking. While EPA safeguards to cut deadly coal power plant pollution have had some impact on domestic thermal coal markets, the biggest single driver of the Big 3's woes is the collapsing met coal market, which has nothing to do with EPA's power plant standards.

4. Cheap Gas

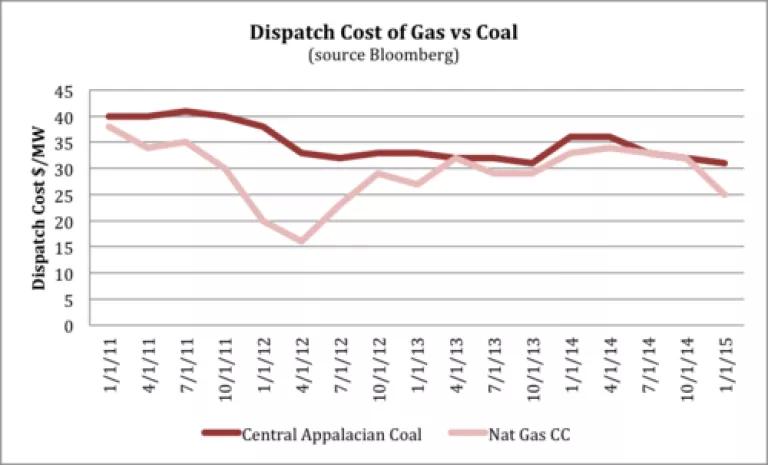

In addition to the bad bets made by Peabody Energy, Arch Coal, and Alpha Natural Resources on strong met coal growth, the Big 3 were also betting their futures on the price of natural gas.

In early 2011, natural gas prices were nearly $6.00/MMbtu and Congress had failed to enact limits on carbon pollution. So the Big 3 bet there would be clear sailing for continued growth in thermal (power plant) coal demand.

By the end of 2011, however, the math had changed as a surge in US natural gas output had lowered the price of natural gas to $4.00/MMbtu and cut the power dispatch cost of natural gas to roughly half that of coal.

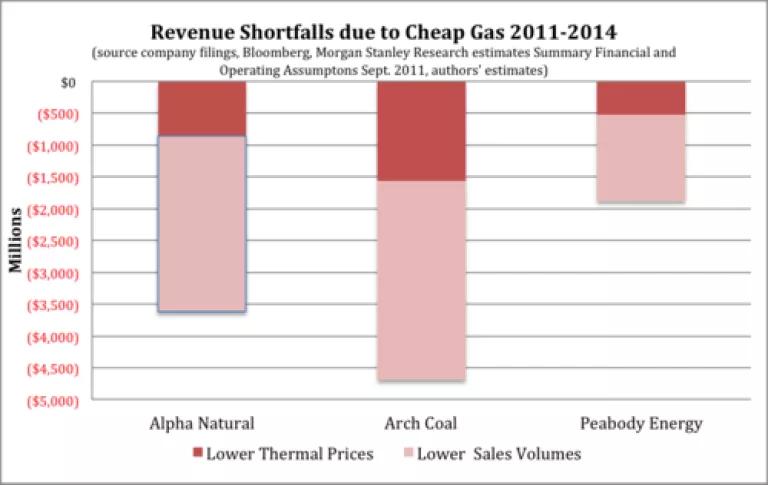

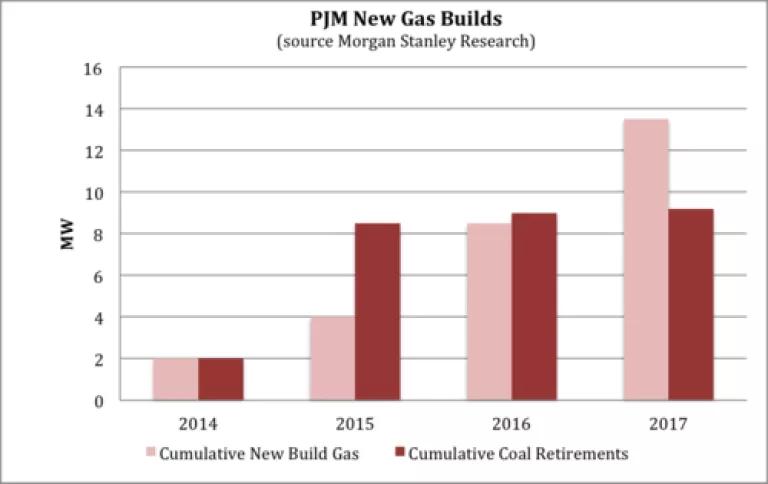

From the 2011 high to the end of 2014, natural gas prices fell by nearly 50%, reducing cumulative forecasted coal revenues (which had already included some reductions from coal retirements in response to EPA's air toxics standards) by an estimated $10.3bln; with $7.3bln coming from lower thermal coal volumetric sales and $3bln coming from lower thermal coal prices.

5. Energy Efficiency (or "Stopping Waste Is a Terrible Thing for Mines")

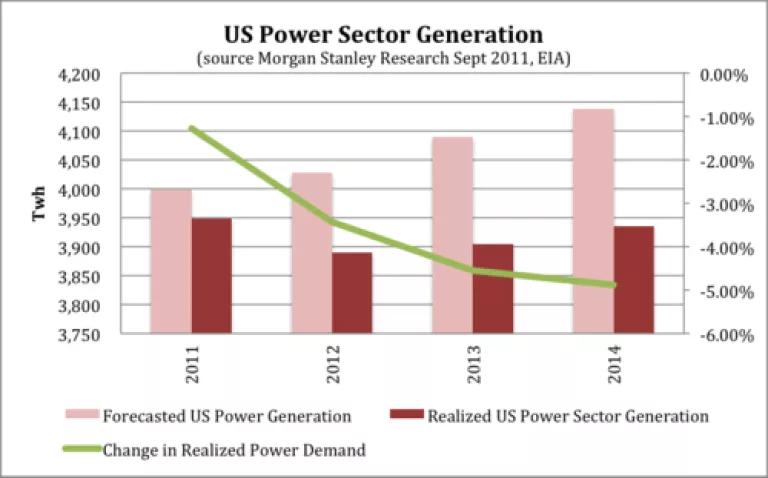

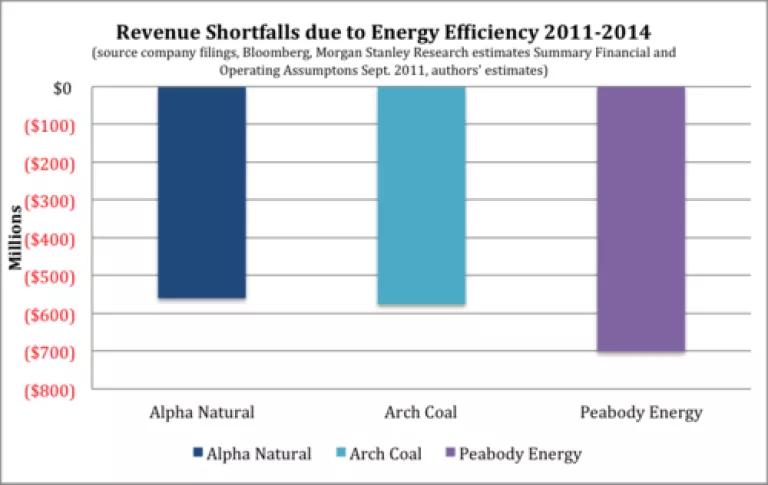

In 2011 industry analysts were looking for US power demand to grow by a modest 1% annually from 2011 to 2014. Relying on these forecasts was another Big 3 mistake, as significant investments in energy efficiency kept power demand largely unchanged during this timeframe.

Conclusion

In sum, bad bets at the top of the market, weak met coal prices, cheap natural gas, and lower power demand due to energy efficiency reduced cumulative forecasted coal revenues for the Big 3 by approximately $21bln over the past four years. This is a big hit for companies as highly leveraged as Alpha Natural, Arch Coal, and Peabody Energy and the reason why these companies are struggling to stay afloat today.