I just wrote about Canada's prices at the pump that have mirrored ours for years in spite of their status as a net oil-exporter.

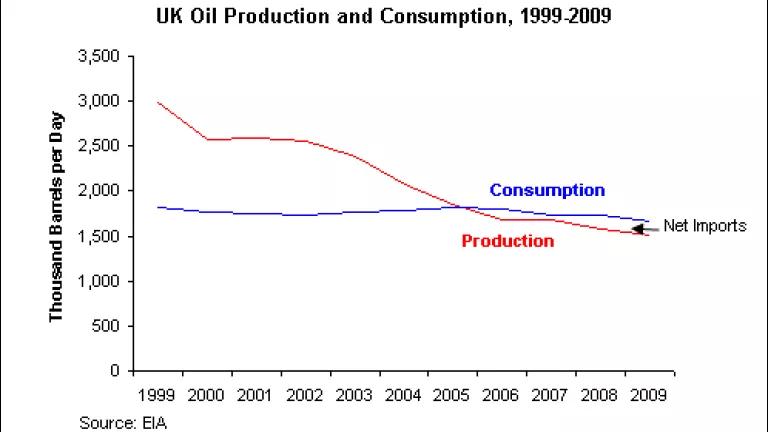

A friend of mine mentioned another, similar example to me today -- the United KIngdom. As you may know, the United Kingdom has benefited from the discovery of oil offshore in the North Sea, which has made it a net oil-exporter for many years (for an overview click here). It still produces a lot of oil at 1.5 million barrels daily which just puts it in the top twenty producers. However, as of 2005 its consumption and production lines criss-crossed; the U.K. seems to be experiencing peaking of production much like we did in the 1970s. Here's what that looks like, courtesy of the Energy Information Administration:

The "drill here, drill now, pay less" fanatics would presumably claim victory if we were to somehow double our already huge 9 million barrel a day production rate so that it is almost level with our consumption, similar to the U.K.

And yet, guess what? Britons are furious about rising fuel prices. And in 2008, the year the global price of crude oil surpassed $140-per-barrel. there were mass demonstrations by truckers against rising diesel fuel prices. Here's a youtube video showing some of the action in 2008:

The United Kingdom is shackled to a globally driven oil-price roller coaster, just like us.

We can't drill our way out of this. Time to get serious about breaking our oil addiction.