Countries have made repeated commitments to both fight climate change and end fossil fuel subsidies - particularly the G20 and G7 group of countries. And yet, billions of dollars' worth of government support continues to flow towards fossil fuels and, incredibly, towards overseas coal projects. If governments are serious about addressing climate change they must stop publicly financing the expansion of overseas coal projects. Some countries have joined the effort of late, but a few are still dragging their feet.

Our analysis - with the World Wide Fund for Nature (WWF) and Oil Change International (OCI) - finds that public finance has played a significant role in supporting overseas coal projects over the last 8 years. Between 2007 and 2014, more than $73 billion of public finance has been approved for overseas coal - an average of over $9 billion a year. Those are the findings of the NRDC, WWF, and OCI report - Under the Rug: How Governments and International Institutions are Hiding Billions in Support to the Coal Industry. [Note we also released a detailed publicly available database of all these projects so you can see a lot more detail on every project, including power plant size, location of the project, funding per project, and other data.]

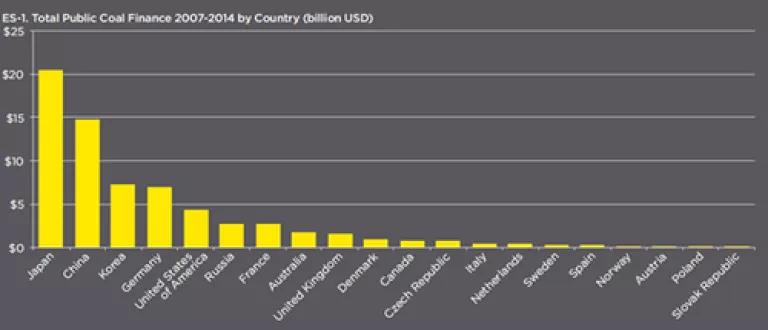

Japan had the largest amount of coal financing of any country by far, more than double any other OECD country's financing, with over $20 billion of financing from 2007 to 2014. In the OECD, Korea and Germany were the next largest sources of funding for coal (see figure).

Progress has been made in a few situations as leading international financial institutions and countries have begun to adopt restrictive new rules governing public financing of coal power plants. But a handful of countries are resisting pressure to end this public financing. Japan, Korea and Australia are actively opposing limits on coal finance in international discussions. Germany, as one of the largest coal financiers, has not committed to end its export financing of coal plants, although they have for their aid agencies, and are phasing out their own domestic subsidies for coal.

The vast majority of finance (77 percent) was for coal power plants, with remaining financing going to mining (15 percent) and other activities that directly or indirectly support coal investments. With long lives, these coal power plants subsidized with public finance will continue to emit carbon pollution for decades to come.

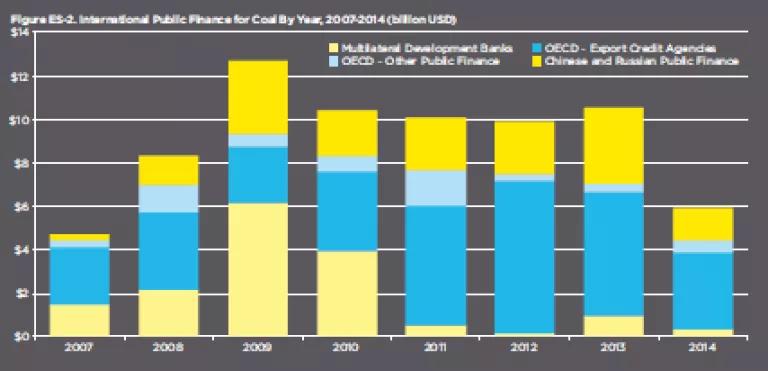

Export Credit Agencies are the biggest public financers of coal. Nearly half (47 percent) of the total OECD international finance for coal came through Export Credit Agencies (see figure). And these agencies are so secretive that even their official multilateral coordinating body, the OECD Export Credit Group, does not have access to adequate data on their lending.

At various international meetings in the coming months, the possibility of a coordinated international restriction on public finance of overseas coal projects is on the table. This report makes clear why such a ban is urgently needed. If governments are serious about addressing climate change in the run-up to the Paris climate meeting they should:

- Immediately end all international finance for coal, including via Export Credit Agencies, development banks and agencies, and state-owned banks, except for very rare circumstances to support energy access for the poor where no other option is available

- Immediately disclose exhaustive data on public finance. Such disclosure should cover all financing - on an annual, country-by-country, and project-by-project basis (including all project-level details necessary to provide a clear view of the climate and environmental impacts of each project).

----------------------------

A Note on the Database for this Report: In general, the gathering of data for the coal finance database revealed a real deficiency in the availability of public data on coal finance overall. While it is likely this database lacks information on a number of coal projects financed, this report still finds significantly more financing than has been previously revealed. Better data on public finance is a must.