US International Climate Finance Fails to Rise to the Moment

The final funding allocation falls pitifully short of what is needed to make a real difference in mobilizing necessary climate action and supporting the most vulnerable countries. This short-changed investment leaves the U.S. severely lacking the leadership the world needs in this critical moment.

Source: Joe Thwaites, WRI

The U.S. final fiscal year 2022 (FY22) “omnibus” appropriations funding bill is a major disappointment in terms of international investments to tackle the climate crisis. The bill allocates more money than the previous year’s budget (under the previous administration) for international climate action, but by just one percent. The final funding allocation falls pitifully short of what is needed to make a real difference in mobilizing necessary climate action around the world and supporting the most vulnerable countries to cope with the mounting climate impacts they already face. This short-changed investment leaves the U.S. severely lacking the leadership the world needs in this critical moment.

International climate finance is directly appropriated by the U.S. through the “State and Foreign Operations Program” (SFOPs) budget (see summary text), which funds bilateral programs (e.g., at the State Department and U.S. Agency for International Development) and multilateral climate action (e.g., through the global funds that support the Paris Agreement). Additional climate investments are mobilized as a part of the general U.S. government investment in other U.S. organizations such as at the International Development Finance Corporation (DFC), the Export-Import Bank (Ex-Im), the Millennium Challenge Corporation (MCC), and through the programs at other agencies of the U.S. government (e.g., in their agency budgets). While those other latter investments are critical, the directly appropriated climate finance in SFOPs is the cornerstone of U.S. investments in helping to tackle the climate crisis.

Woefully short of the needed investment

The FY22 directly appropriated amount of international climate finance is $1 billion, significantly lower than President Biden’s request of $2.5 billion and what the House and Senate Democrats in Congress had proposed ($2.8 billion for the House and $3.1 billion for the Senate). While it would be an increase of $387 million from the previous year, it is essentially the same amount that Congress allocated at the end of 2015 (which was $1.05 billion in fiscal year 2016 including the Green Climate Fund contribution). Since that time, climate action has become more urgent, more members of Congress have stressed the importance of climate action, addressing climate change has become the administration’s top tier priority, and the needed investment around the world has risen dramatically.

Over 85 faith-based, development, environmental, and business groups urged congressional appropriators to provide at least $3.3 billion in direct U.S. support for international programs addressing the climate crisis. This FY22 investment falls significantly under that urgent request with all accounts alarmingly below the needed amounts (see figures for full comparison):

- Renewable energy bilateral assistance: $260 million (compared to: $354 million proposed by the diverse groups and in the President’s request)

- Sustainable landscapes bilateral assistance: $185 million (compared to: $232 million proposed by the diverse groups and in the President’s request)

- Adaptation bilateral assistance: $270 million (compared to: $300 million proposed by the diverse groups and $222 million in the President’s request)

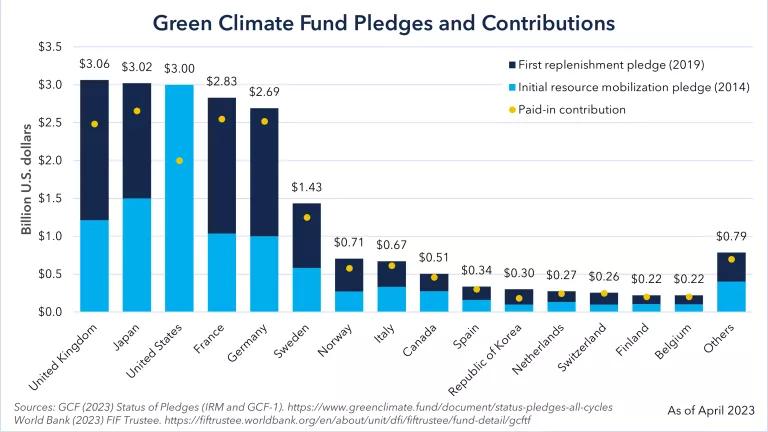

- Green Climate Fund: $0 directly allocated, but may be funded through other existing funding at the State Department and Treasury Department (compared to: $2 billion proposed by the diverse groups and $1.25 billion in the President’s request)

- Adaptation Fund: $0 directly allocated (compared to: $100 million proposed by the diverse groups and $100 million in the President’s request for “multilateral adaptation funds”)

- Least Developed Country Fund: $0 directly allocated (compared to: $51 million proposed by the diverse groups)

- UN Framework Convention on Climate Change and the Intergovernmental Panel on Climate Change: $15 million (compared to: $21 million proposed by the diverse groups and in the President’s request)

- Montreal Protocol: $52 million (compared to: $64 million proposed by the diverse groups and in the President’s request)

Overall U.S. Climate Finance: Final FY22 vs Minimum Need

U.S. Bilateral Climate Finance

Source: Joe Thwaites, WRI

International Climate Investments are in America’s Interest

These investments serve a variety of critical needs to address the climate crisis. First, they help spur the kind of global action necessary to reduce emissions to keep 1.5°C within reach. We can’t drive the necessary climate action the world needs without bold domestic action by the U.S., but we also can’t solve the crisis if the U.S. doesn’t invest in helping developing countries speed up their emissions reduction strategies. Investments in renewable energy and sustainable landscapes (e.g., deforestation reduction) enable developing countries to unleash greater emissions reductions than they can do on their own. Every dollar the U.S. invests help spur significantly larger investments by other governments and the private sector.

Second, the poorest countries in the world have contributed very little to climate change, yet they are already facing the dire impacts from climate change. Investments in adaptation help reduce the impact of severe weather and climate-fueled disasters on critical infrastructure, agricultural productivity, and public health in these countries. Just the top 10 climate events in 2021 cost the world $170 billion—these are just the insured losses as the full tally is much higher. And global disaster response efforts demonstrate that investing $1 today helps avoid around $7 in spending needed after a disaster hits.

Third, they help create opportunities for American companies and entrepreneurs. The global clean energy market in emerging economies is estimated at $23 trillion by 2030, creating a massive and relatively untapped opportunity for American companies. Renewable energy investments help create the conditions for companies to tap into this growing demand for renewable energy. Smart U.S. investments can help unleash the trillions in private sector finance that is ready to tackle the climate crisis.

Lastly, they provide a key cornerstone of America’s ability to rally the world to address this challenge. America’s actions are more important than its words—and money drives real action. Other countries contribute significantly more to international climate efforts. The European Union nations have a combined economy smaller than the United States, yet already contribute more than $24.5 billion per year in public climate finance. If the U.S. wants to be able to help lead global climate action, then it needs to invest like its peers.

The U.S. Needs to Do Much Better

The Biden Administration must prioritize international climate funding as it looks to implement this budget and hopefully find more resources through related programs. After all, climate change can’t be “an essential element of United States foreign policy and national security”—as Biden committed—if America’s investments don’t align with that priority. The administration needs to look in every corner of the U.S. budget to find more investments this year.

President Biden and Congress must also do significantly better next year. President Biden committed to mobilize $11.4 billion of direct U.S. public investments by 2024, so what the President and Congress approve for fiscal year 2023 (October 1, 2022 through September 30, 2023) will be decisive in showing that the U.S. is serious. It is no longer the time for half-steps, it is time to be bold.

It isn’t too late to do better, but the clock is ticking.