Climate Law a Game-Changer for Clean Energy in Rural America

In rural communities across America, the Inflation Reduction Act will be a game-changer in accelerating the transition away from fossil fuels to a clean energy economy that will lower utility bills for families, support good-paying clean energy jobs, and tackle the climate crisis. It is the strongest climate action in American history, deploying $369 billion in strategic climate and clean energy investments over 10 years.

This law provides $14 billion for rural clean energy projects via additional grants and loans in its Rural Development title. In addition, this law for the first time unlocks billions of dollars’ worth of clean energy tax credits, which were previously not accessible to the nonprofit, community-owned electric cooperatives and municipal utilities that have powered rural America for decades. The law levels the playing field for rural America by giving tax-exempt entities, such as municipal utilities and electric cooperatives, cities, counties, school districts, and tribal governments better access to federal tax credits that for-profit corporate utilities have long enjoyed.

The transition to a rural clean energy economy is already happening. In fact, it’s well underway and has earned the support of a majority of rural Americans. It turns out there’s nothing partisan about economic growth. These clean energy jobs are being created in red and blue states alike. Among the top five states for wind power generation last year, four—Texas, Oklahoma, Iowa and Kansas—have entirely Republican Senate delegations.

Electrification in Rural America

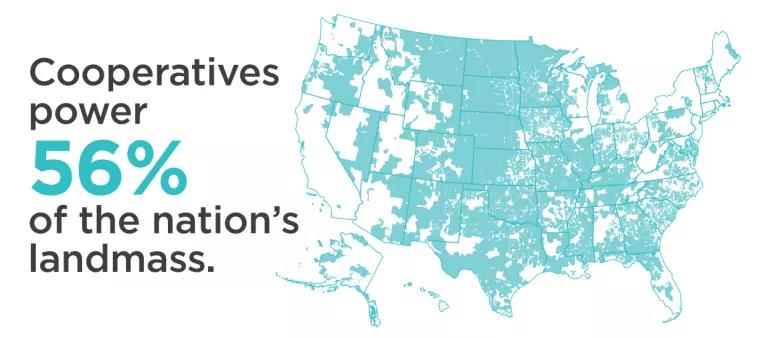

Rural America is home to more than 46 million people. Of them, 42 million live in more sparsely populated areas spanning 56 percent of the nation’s landmass. Historically, these areas were difficult to electrify as for-profit electric utilities neglected them because serving them adequately would hurt the bottom line. This didn’t change until President Roosevelt’s New Deal and the Rural Electrification Act of 1936 supported the creation of hundreds of electric cooperatives that electrified rural America.

An electric cooperative (co-op) is a not-for-profit entity owned and guided by its members—its own customers—unlike a traditional for-profit electric utility corporation owned by investors. Today, co-ops power 56 percent of the nation’s landmass. They serve over 21 million businesses, homes, schools and farms—42 million people—across more than 2,500 counties, according to the National Rural Electric Cooperative Association (NRECA), the national trade association representing nearly 900 local electric cooperatives.

Transitioning away from fossil fuels, towards clean energy

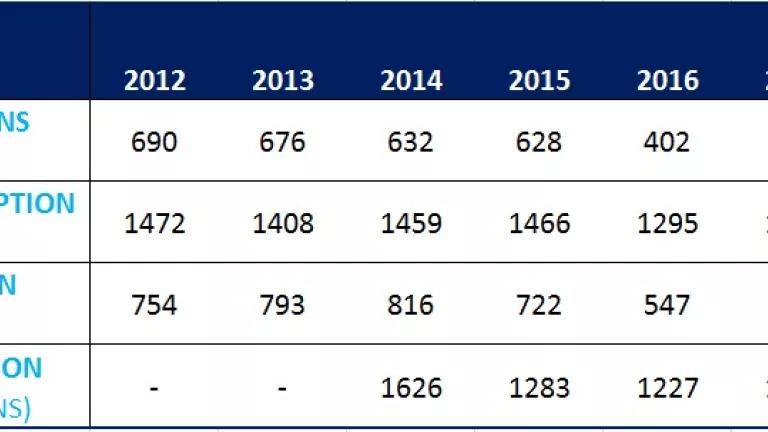

Rural America is experiencing a major shift towards clean energy; co-ops have more than tripled their renewable capacity between 2010 to 2021. And yet, co-ops are still more reliant on uneconomic coal than the rest of the country. Coal was responsible for 28 percent of the electricity served by co-ops in 2020, compared to the 19 percent national average.

“Coal debt” is one major factor hampering the clean energy transition for co-ops like Tri-State, which is locked into paying more for coal power than what it could be paying for renewable energy. Another factor has been the inability of co-ops to take advantage of federal clean energy tax credits, which their for-profit corporate utility counterparts have long enjoyed.

Investing in communities that need it most

“Rural communities have witnessed disinvestment as people have left for cities and communities that are dependent on manufacturing or fossil energy have seen those industries pull out without leaving a lifeline for those who remain.”

Indeed, 92 percent of all persistent poverty counties in America are served by co-ops. By providing billions of dollars in grants, loans, and direct pay tax credits to rural communities and the co-ops that serve them, the new climate law will ease their transition to a clean energy economy.

The promise of a clean energy economy is real and it’s here. Every day, 3 million Americans across all 435 congressional districts work building our clean energy economy, according to the latest 2022 Clean Jobs America report by E2 (Environmental Entrepreneurs). The report shows that clean energy is a critical job creator in every state and district, employing 1 in every 50 American workers. More Americans today work in clean energy than as lawyers, police officers, farmers, firefighters, kindergarten teachers, and mail carriers combined.

Hailed by labor leaders and workers alike, the Inflation Reduction Act is a historic investment that will create more than 9 million good jobs over the next decade, according to analysis by University of Massachusetts Amherst commissioned by the BlueGreen Alliance.

How does the Inflation Reduction Act advance clean energy in Rural America?

Transitioning rural electric cooperatives to clean energy

$9.7 billion

Provides $9.7 billion in grants and loans for co-ops to purchase or build new clean energy systems. A wide range of projects are eligible, including renewables, energy storage, nuclear, carbon capture, and generation and transmission efficiency improvements. Co-ops are eligible to receive an award for up to 25% of their project costs, with a maximum of $970 million going to any one co-op.

While it is important for co-ops to have flexibility in developing solutions that meet their unique needs, it is critical that this funding is deployed to “achieve the greatest reduction in carbon dioxide, methane, and nitrous oxide emissions associated with rural electric systems,” as the law states. Oversight and advocacy during the project proposal and evaluation stages will be needed to ensure this emission reduction objective.

New eligibility for direct-pay tax credits

Historically, taxpaying entities like for-profit corporate utilities were most able to take advantage of federal clean energy tax credits. Not-for-profit entities that don’t pay federal income taxes, such as co-ops and municipal utilities; as well as cities, counties, school districts, Indian tribal governments and 501(c)(3) organizations, could not directly benefit from these tax credits and therefore did not have a strong incentive to shift their portfolios towards renewables. Over time, this has led to a higher degree of private ownership of clean energy projects.

For the first time ever, the Inflation Reduction Act helps level the playing field for often underserved rural communities stuck paying the price for aging, outdated fossil fuel infrastructure. The law establishes “Direct Pay” for municipal utilities, rural coops, cities, counties, school districts, tribal governments, and 501(c)(3) organizations. This means instead of a tax credit, the law gives these entities a direct payment supporting their build-out and ownership of clean energy projects thereby lowering consumer costs.

Rural Energy for America program

$1.965 billion

Expands USDA’s Rural Energy for America Program (REAP) to provide an additional nearly $2 billion in grants and loans for more than 41,500 farms and small businesses to invest in renewable energy and energy efficiency projects and covering up to 50% of the project cost. It also provides a $303 million carve-out for underutilized renewable energy technologies.

Here is an example of the kind of clean energy projects that REAP makes possible:

Additional funding for electric loans for renewable energy

$1 billion

The climate law provides an additional $1 billion to cover the cost of loans under Section 317 of the Rural Electrification Act of 1936, for electric generation from renewable energy resources for resale to rural and non-rural residents. This includes solar, wind, hydropower, biomass, or geothermal, as well as energy storage projects. The borrower would be eligible for loan forgiveness for up to 50 percent of the loan.

Summary

U.S. Department of Agriculture Secretary Thomas Vilsack perhaps said it best:

“The Inflation Reduction Act will provide significant support for farmers, ranchers, and forest landowners as they care for our precious land, adapt and mitigate to climate change and ensure America remains a food secure nation. With historic investments in a clean energy economy, the Inflation Reduction Act will create good-paying jobs and more economic opportunity in rural communities across the country. Rural Americans will see lower utility bills and appreciate the fiscally responsible way the law lowers deficits.”