For a discussion of the Regional Clean Hydrogen Hub tax credit in Act 108, see How "Clean" is Pennsylvania's New H2 Tax Credit? It's Up to the Feds

Although it includes $1.4 billion of “Local Resource Manufacturing” tax credits for petrochemical production, Act 108 of 2022 (formerly House Bill 1059) isn’t Pennsylvania’s biggest petrochemical subsidy. That distinction belongs to Act 85 of 2012, which created a $1.6 billion tax credit to attract Shell’s Beaver County ethane cracker.

Act 108 is remarkable, however, for more than doubling the original amount ($667 million) on Local Resource Manufacturing tax credits. Since the increase was negotiated behind closed doors and not publicly debated in the General Assembly, there’s been no official explanation for the increase, only celebration of it. The reason seems evident, though: with both gas prices and interest rates up significantly since 2020, new petrochemical projects are more expensive, and private investors won’t finance them without richer public subsidies.

In any case, with Act 108 the General Assembly has decided to spend more than a billion dollars of public money to help petrochemical manufacturers buy high-priced gas after repeatedly rejecting a severance tax on gas and the billions of revenue that it would bring, partly on the grounds that untaxed gas would fuel a “manufacturing renaissance.” We need the legislature to pass energy policies that most Pennsylvanians actually want – policies that bring economic development and jobs through a transition to renewable energy.

The “Local Resource Manufacturing” Tax Credits

Under Act 108, companies are eligible for tax credit of $0.47 for every thousand cubic feet of methane gas they buy for petrochemical manufacturing, provided they meet certain capital investment and workforce conditions. Act 66 of 2020, which created the Local Resource Manufacturing credits, capped their amount at $26,666,668 per year from 2024 to 2049 and made the credit available to up to four companies. Act 25 of 2021 reduced the number of eligible companies to two. Act 108 increases the annual amount of credits by $30 million per year, to $56,666,668. The total value of the credits is now $1.4 billion from 2024 to 2049.

The two companies that are supposed to benefit from the credit are Nacero, which is planning a Luzerne County plant to turn shale gas into gasoline, and KeyState Natural Gas Synthesis, which has proposed a Clinton County projects to make ammonia, urea, and hydrogen.

Both companies are touting their proposed products as environmentally-friendly (i.e., low or lower-carbon) alternatives to existing products. The extent to which that may be true isn’t clear. What is clear is that because eligibility for the tax credits isn’t conditioned on meeting any environmental or community protection standards, Act 108 won’t do anything to ensure that their products are clean or that their operations will benefit local communities. Carbon capture is encouraged, for instance, but not required. And community benefit agreements aren’t even mentioned.

Credit eligibility is conditioned on the payment of prevailing wages for construction jobs (though not permanent jobs). This part of Act 108 is good policy, since it will make ensure that the workers who build the plants are reasonably well compensated. It won’t help the people who live near the plants or help address climate change, though.

That Extra $30 Million Per Year

The section of Act 108 that enlarges the Local Resource Manufacturing tax credits was negotiated behind closed doors and pushed through both chambers of the General Assembly in a matter of hours, a speed possible only because the language was added to an existing bill (about tax withholding rules) so uncontroversial that it had sailed to the last stage of the legislative process without a single legislator opposing it.

On the one hand, this is just business as usual in Harrisburg: the Shell tax credit and Act 66 were passed in basically the same way. On the other hand, the lack of any public process leaves us to figure out the reason for the increase.

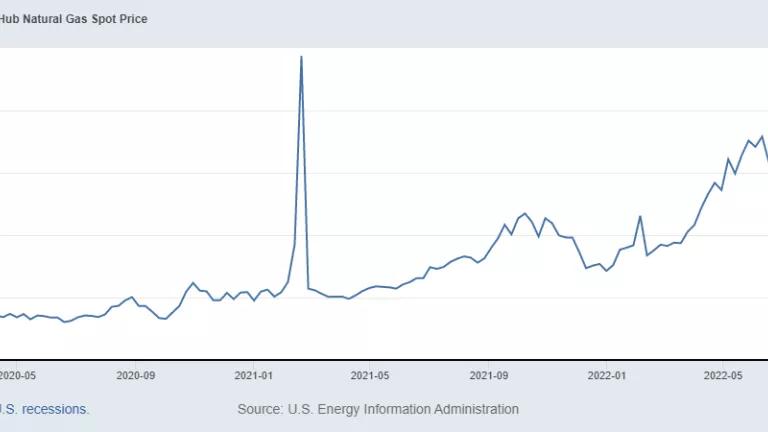

In this case it seems clear. First, as the American Fuel and Petrochemical Manufacturers Association have noted, “[s]piking natural gas prices—the highest in more than a decade—are…driving up the cost of feedstocks for petrochemicals and the cost of fuel for both refiners and petrochemical manufacturers.” On July 17, 2020, the Henry Hub benchmark price was $1.77 per Mcf; on October 21, 2022 it was $5.48. Prices are projected to come down – but only to a point.

Second, higher interest rates have raised the capital costs of new petrochemical projects. When Act 66 was passed, the effective Federal Funds rate was 0.9 percent; by the time Act 108 was enacted it was 3.08 percent.

Because of these factors, new petrochemical projects are more costly – and appear less likely to be profitable – than they were in 2020. That creates risk for investors. The apparent purpose of enlarging the Local Resource Manufacturing tax credits was to lower that risk and increase the likelihood that projects will be financed.

No Manufacturing Renaissance, No Severance Tax

Almost from the beginning of the shale gas boom, there were hopes that plentiful (and therefore inexpensive) gas would bring a manufacturing renaissance to Pennsylvania. “If the Marcellus is developed to the extent envisioned in this report,” a 2010 Penn State economic impacts analysis stated, “the abundance of reliable, low cost natural gas could attract gas intensive manufacturing industries to expand capacity in Pennsylvania.”

Never mind that energy prices were never the reason manufacturers left. In a state that lost more than 400,000 manufacturing jobs between 1990 and 2010 – many of them good-paying union jobs – the promise of a manufacturing renaissance held irresistible appeal.

No surprise, then the promise of manufacturing jobs featured prominently in arguments for why Pennsylvania shouldn’t replace its piddling impact fee with a meaningful severance tax on gas. “We stand on the verge of a manufacturing renaissance that will grow our economy and provide employment opportunities for generations of Pennsylvanians,” the Marcellus Shale Coalition testified in opposition to Governor Wolf’s “Restore Pennsylvania” proposal – but only if the General Assembly rejected a severance tax, which would “raise energy prices”

In fact, a severance tax would have almost no impact on energy prices. What has driven up prices is the fact that drillers are exporting record amounts of liquefied natural gas (LNG) to lucrative overseas markets while keeping production low in order to keep profits high. Since Pennsylvania has no severance tax, it’s getting no benefit from those high prices – only pain for consumers. And now higher subsidies for petrochemical manufacturing. So much for the renaissance.

Polls and surveys consistently show that Pennsylvanians want elected officials to create jobs through clean energy, especially renewables development. Will the next General Assembly listen?