Smart RGGI Investments Can Lower Electricity Bills in PA

Investments in energy efficiency and renewable energy under the Regional Greenhouse Gas Initiative (RGGI) can help lower electricity bills for Pennsylvanians, as well as improve public health, our climate, and Pennsylvania’s economy.

What a residential electricity bill looks like in Pennsylvania, if you're a PPL customer

This blog is about how investments in energy efficiency and renewable energy under the Regional Greenhouse Gas Initiative (RGGI) can help lower electricity bills for Pennsylvanians, as well as improve public health, our climate, and Pennsylvania’s economy.

Electricity pricing in Pennsylvania is hard to understand, and fossil fuel interests exploit that difficulty to misrepresent the cost of clean energy policies. At the same time, it’s absolutely true that high “energy burdens”—the percentage of household income spent on energy—are a serious problem for millions of low-income people in Pennsylvania, especially Black and Latinx Pennsylvanians.

So this blog aims to clarify how electricity costs are determined in Pennsylvania, and how the Commonwealth’s participation in RGGI is likely to affect those costs.

What We Pay for, When We Pay for Electricity

Electricity bills in Pennsylvania include two kinds of costs: on the one hand, generation and transmission costs, which are determined by markets designed and run by the PJM Interconnection, the regional transmission organization that operates Pennsylvania's high-voltage electrical grid, and on the other, distribution system costs, which are determined in proceedings before the Pennsylvania Public Utility Commission (PUC).

Before Pennsylvania enacted the Electricity Generation Customer Choice and Competition Act of 1996, the PUC regulated both generation as well as distribution. But as I discussed in an earlier blog, the "Competition Act" forced electric utilities to spin off their power plants to competitive generators and become "electric distribution companies" (EDCs). The theory was that if power plants had to compete against each other in PJM's markets, they would produce power more efficiently and customers would pay less for it.

So rather than generating power themselves, Pennsylvania’s EDCs (PECO, PPL, MetEd, etc.) buy electric power, capacity, and "ancillary services" at wholesale on PJM's markets and pass the costs along at retail to Pennsylvania households and businesses. At least they do for "default service" customers. If you "shop" for your electricity on PA Power Switch, you're buying generation from a private company classified by the Competition Act as an "electric generation supplier" (EGS). EDCs and EGS also pay PJM for transmission service and pass these charges along to their customers.

As for distribution charges—these are what you pay your EDC to maintain and operate the system of poles, wires, and substations that "distribute" electric power to homes and businesses, as well as to administer energy efficiency and conservation programs under Act 129 and "universal service" programs that help low-income customers afford their bills. Distribution charges are mostly determined by the types of investments that EDCs make in their systems and are collected from customers in two forms: "volumetric rates," whereby you pay a certain number of cents for each kilowatt-hour of electricity used, and "fixed charges," which all customers within a particular class (e.g., residential customers) pay equally regardless of usage. These rates and charges are established at the PUC through "base rate cases" (PECO and Duquesne Light Company both recently filed one) and other "tariff" proceedings, such as Distribution System Infrastructure Charge (DSIC) proceedings.

Rates, Charges, Bills, Prices

Part of what makes electricity costs hard to understand is the nomenclature. The term "rates" can refer to both wholesale rates (what EDCs pay when they buy electricity from PJM) and retail rates (what households and businesses pay on their bills). "Charges" include both fixed distribution charges and volumetric charges, and there are two types of volumetric charges (one for generation and transmission, one for distribution) determined by different rates. Your bill—the thing you actually pay when you send a check to your EDC—is the sum of all these charges. Your EDC keeps some of your payment and sends some to PJM (and to your EGS, if you have one).

"Price" can be a confusing term regarding electricity costs because different people use it to mean different things. Not surprisingly, RGGI opponents almost always use "price" when they discuss the program, often misleadingly.

How RGGI Affects Electricity Costs

RGGI affects electricity costs in two ways. First, RGGI's requirement that power plants buy "allowances" for their carbon dioxide pollution typically leads to small increases in wholesale electricity rates. That's because power plants have to include the cost of the allowances as an operating cost in their bids on PJM's markets. Second (and this is the part RGGI opponents leave out) RGGI states' investments of allowance proceeds into clean energy, especially energy efficiency (EE), lowers customers' bills, which are what people really care about. Efficiency saves money because as noted above, electricity pricing is largely volumetric. So the less electricity you use, the less you pay, and lower consumption can result in a lower bill even if your kilowatt-hour rate goes up.

The net effect of this dynamic is that during RGGI's first decade, the program lowered customers' bills even though wholesale rates went up. Or, as the Analysis Group put it in its most recent independent economic evaluation of RGGI (covering 2015-17):

[T]he inclusion of the cost of CO2 allowances in wholesale prices tends to increase wholesale electricity prices.... But these near-term impacts are more than offset ... because the states invest a substantial amount of the RGGI auction proceeds on EE programs that reduce overall electricity consumption and on RE projects that reduce the use of higher-priced power plants. Consumers gain because their overall electricity bills go down. Since RGGI’s commencement in 2009, energy and dollar savings resulting from all states’ investments in EE and RE has more than offset the wholesale market price increases associated with inclusion of allowance costs in market bids.

And of course, this is only one part of the value of RGGI investments. As I discussed here, the Analysis Group’s analyses have consistently shown that the investments create net economic value and jobs ($1.4 billion in value and 14,500 job-years during the 2015-17 period, according to the latest report).

The DEP's Projections Regarding Rates and Bills

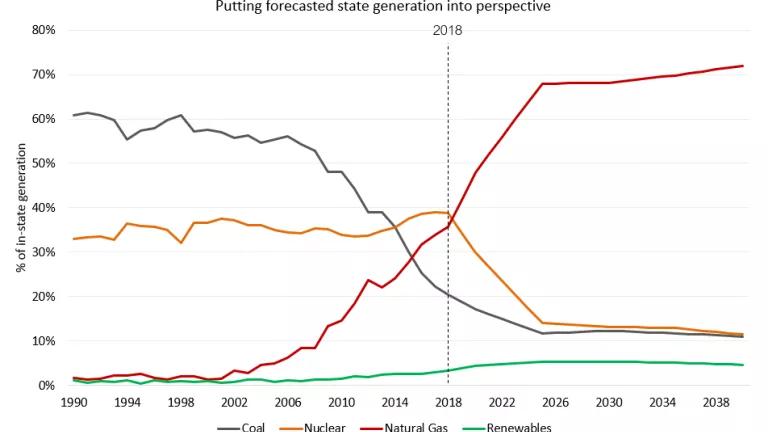

At several advisory body meetings next week the DEP will present power sector modeling results that highlight the critical need for RGGI investments into clean energy, especially weatherization assistance and low-income efficiency.

Slide 16 from the DEP's presentation of its latest power sector modeling, available at https://www.dep.pa.gov/Citizens/climate/Pages/RGGI.aspx, with illustration by Jessica Russo (NRDC).

The projections in this DEP slide are not surprising. What bears emphasis is in the phrase that follows the asterisk: "Does not include anticipated electricity price decreases resulting from energy sector investments." Another way to say this would be, this modeling is not actually of RGGI—because driving investment in efficiency and renewables is an integral part of the program and as much as capping carbon pollution. NRDC would not support Pennsylvania's participation in RGGI's auctions and trading markets without massive corresponding investments by the program in energy efficiency to drive down Pennsylvanians' bills—especially through weatherization and other low-income efficiency programs.

We Need Affordable Energy for All Pennsylvanians and Action on Climate

Fossil fuel advocates often misrepresent RGGI's historical and projected impacts on electricity costs, using energy affordability as a rhetorical device even as they oppose economic and safety net policies—Pennsylvania's now-eliminated General Assistance program, for example, or a higher state minimum wage—that would help realize energy affordability an outcome.

This is a problem because energy affordability is a critical problem for millions of Pennsylvanians. According to the most recent (April, 2021) Home Energy Affordability Gap data published by Fisher, Sheehan, and Colton, in 2020 the 284,000 Pennsylvania households with incomes of below 50 percent of the Federal Poverty Level (FPL) paid 29 percent of their annual income for home energy bills. Another 346,000 households with incomes between 50 percent and 100 percent of the FPL faced a home energy burden of 16 percent. An energy burden of more than 6 percent is generally considered unaffordable.

Participating in RGGI won’t solve this problem—but it can help ameliorate it if, as other RGGI states do, Pennsylvania invests significant allowance proceeds from the program into weatherization and other low-income energy efficiency programs and (if the General Assembly allows RGGI proceeds to be spent in ways that go beyond air pollution reductions) cash assistance for low-income Pennsylvanians.