NRDC Analysis: IRA Will Spur Clean Energy Transition

New NRDC analysis, released today, finds that the IRA's clean electricity tax credit package will reduce climate-warming emissions all while reducing Americans’ electricity bills, creating hundreds of thousands of clean energy jobs, and scaling home-grown clean energy solutions.

On August 16, 2022, the United States witnessed the passage of the strongest climate investment package in U.S. history. The Inflation Reduction Act of 2022 (IRA) rises to the climate imperative by directing $369 billion towards advancing clean energy solutions and promoting community-scale environmental justice. New NRDC analysis, released today, finds that this funding will reduce climate-warming emissions all while reducing Americans’ electricity bills, creating hundreds of thousands of clean energy jobs, and scaling home-grown clean energy solutions. The full report, “Clean Electricity Tax Credits in the Inflation Reduction Act Will Reduce Emissions, Grow Jobs, and Lower Bills”, can be found here.

The landmark IRA legislation extends and expands tax credits for clean electricity technologies; these will help scale solar, wind, storage, and other zero- to low-carbon resources by lowering the cost of developing and maintaining projects. This report assesses the potential energy, climate, and economic impacts of the law’s power sector incentives by comparing system-level projections of a modeled tax package with a business-as-usual case without these policies.

If implemented in full, the analysis finds that IRA’s $145 billion investment in clean electricity tax credits will:

- Slash emissions from the US electricity grid. Under the tax credit case, carbon emissions drop by an additional 275 million tons in 2030 relative to a case without these tax credits. This represents a 66 percent reduction in power sector carbon pollution from 2005 levels. Preliminary economy-wide analyses suggest that, under IRA, the US will see a 40 percent reduction in greenhouse (GHG) emissions from 2005 levels by the end of this decade, launching the country within reach of President Biden’s 2030 goals of 80 percent clean electricity and 50-52 percent economy-wide GHG reductions relative to 2005.

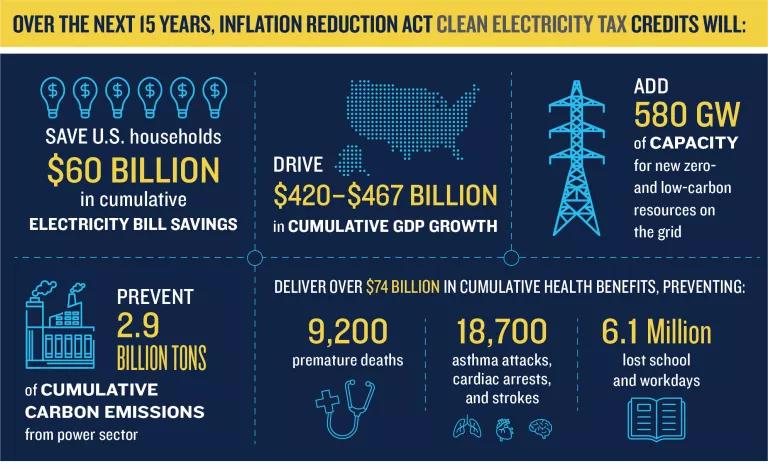

- Scale clean energy resources at an unprecedented rate. Under the tax credit case, zero- and low-carbon capacity on the grid (mainly renewables and storage) grows 280 GW by 2030 and 580 GW by 2035, relative to today’s levels. This represents the fastest and most sustained build-out of renewables and other clean electricity resources in U.S. history. Though not modeled in the policy case, the eligibility requirements for these tax credits ensure that these projects will be tied to American jobs, boost domestic manufacturing, and incentivize investments in low-income and “energy” (fossil industry-dependent) communities.

- Reduce electricity bills for Americans and businesses. The average residential electricity bill is 3.4 percent lower by 2030 and 4.6 percent lower by 2035 under the tax case compared to business-as-usual. In an era of rising and volatile fuel costs, these policies are expected to save each American household between $37 and $52 annually (2021$) by the next decade, totaling to $60 billion in electricity bill savings for U.S. households over the next 15 years.

- Ramp up American job growth. Power sector investments supported by the IRA tax credits are expected to create at least 153,000 to 169,000 high-quality clean energy jobs in the U.S. economy in 2030. By 2035, this job growth doubles to at least 341,000 to 382,000 jobs annually.

- Save lives and lower medical costs from health-harming air pollution. By shifting the system away from the dirtiest forms of power generation, these tax credits will slash emissions of nitrogen oxides (NOx) and sulfur dioxides (SO2). These air pollutants contribute to soot and smog, which threaten public health and disproportionately impact low-income communities and communities of color. By reducing these pollutants, these tax credits help avoid premature deaths, ER visits, hospital admissions, lost work and school days, and childhood asthma attacks. This amounts to $9 billion in public health benefits annually by 2030 and a cumulative public health benefit of almost $75 billion over the next 15 years, as compared with a case without the tax credits.

This analysis focuses on IRA’s power sector-related provisions, meaning it offers a lower-bound assessment of IRA’s economy-wide impact. The full suite of investments outlined in the bill will support clean energy technologies and domestic manufacturing across the industrial, transportation, and buildings sectors. In tandem with local, state, and federal regulatory actions, this bill will drive the clean energy transition at a speed and scale even greater than captured in this report.

While this congressional success will bring the US closer than ever before to achieving its climate goals, these policies must be implemented swiftly and properly for their climate, economic, and health benefits to materialize. More will be needed to meet the President’s goal of an 80 percent clean grid by 2030: IRA implementation must compound upon state clean energy standards, utility resource planning decisions, and updated federal regulations (including revised clean air rules and carbon pollution standards). IRA has started the flywheel, and a just and healthy climate future is within reach.

This analysis was conducted using energy system modeling from ICF’s Integrated Planning Model (IPM®), with all assumptions and policy scenarios developed by NRDC. The analysis compared two cases: a business-as-usual scenario built on existing state and federal policy as of the spring of 2022, and a clean electricity tax package scenario that included the bulk of IRA’s clean electricity tax provisions, including production tax credits (PTC) for wind, existing nuclear, and other new zero-emission technologies and investment tax credits (ITC) for solar and battery storage. Further details on NRDC’s methodology can be found in the technical appendix of the report.