Less Carbon, More Money

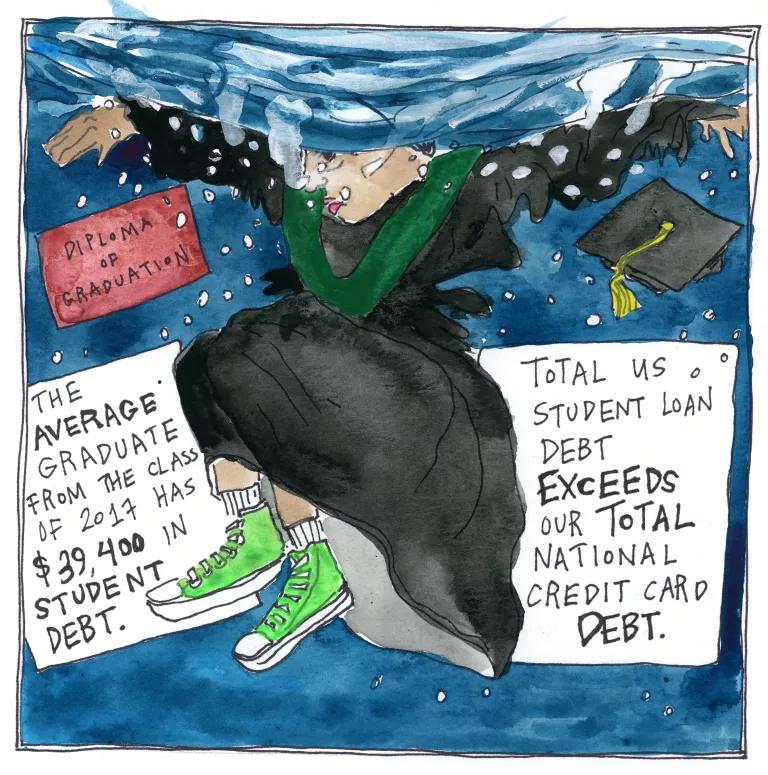

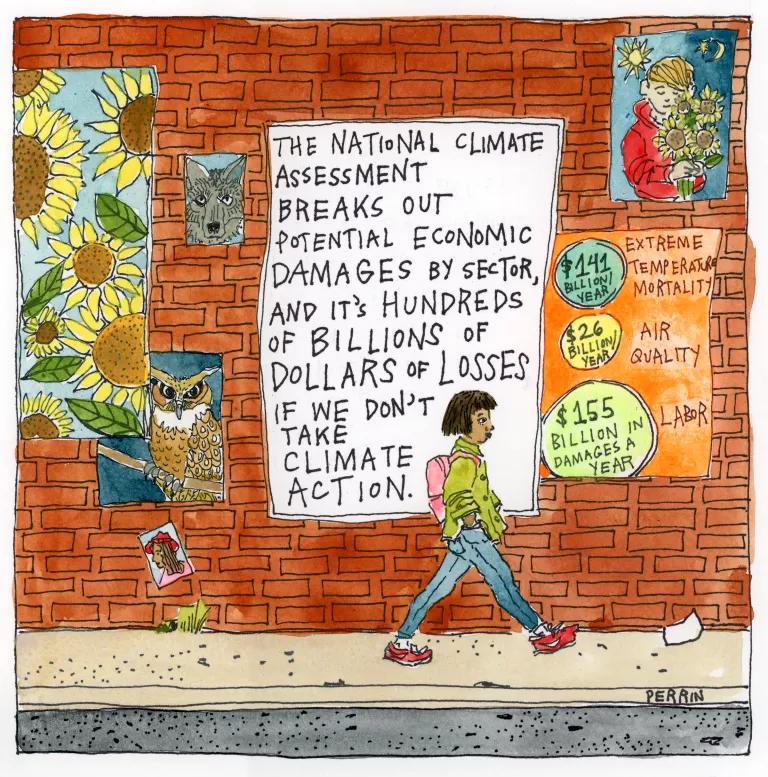

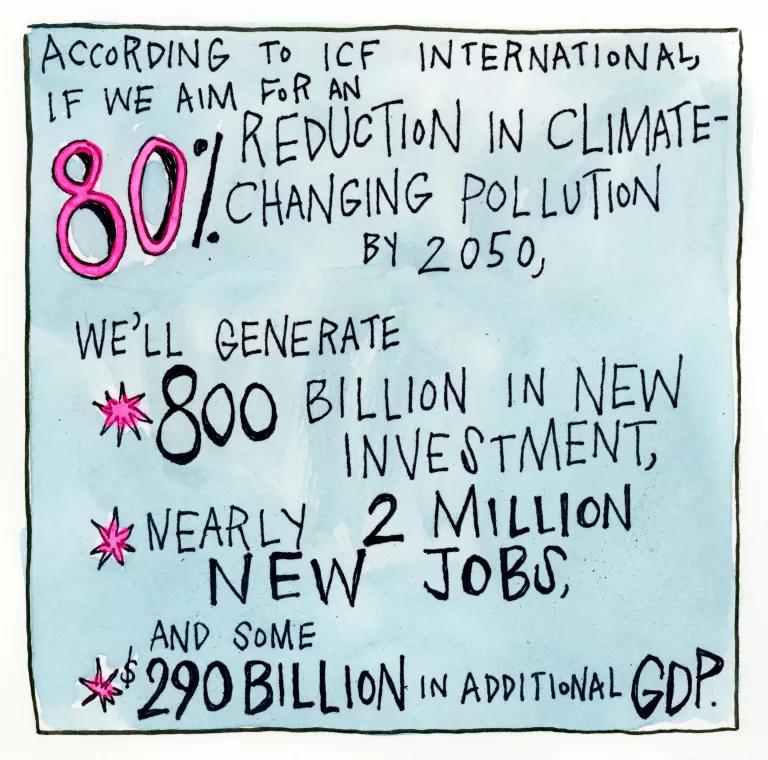

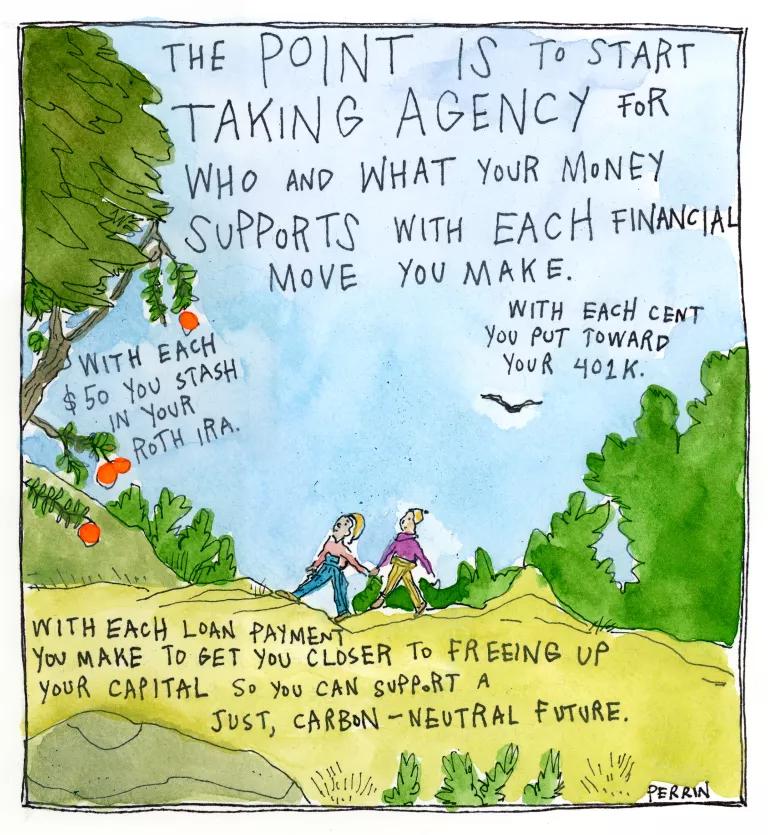

A recent climate assessment raised red flags about a shrinking economy. But maybe it doesn’t have to play out that way for millennials—we can start demanding with our dollars for a green, just economy.

This NRDC.org story is available for online republication by news media outlets or nonprofits under these conditions: The writer(s) must be credited with a byline; you must note prominently that the story was originally published by NRDC.org and link to the original; the story cannot be edited (beyond simple things such as grammar); you can’t resell the story in any form or grant republishing rights to other outlets; you can’t republish our material wholesale or automatically—you need to select stories individually; you can’t republish the photos or graphics on our site without specific permission; you should drop us a note to let us know when you’ve used one of our stories.

Will COP26 Move Us Closer to Solving the Climate Crisis?

President Biden Has Promised to Fight Environmental Racism

Electric vs. Gas Cars: Is It Cheaper to Drive an EV?