This weekend President Obama reaffirmed his decision to evaluate the permit for the Keystone XL tar sands pipeline “based on whether or not it is going to significantly contribute to carbon in our atmosphere.” Keystone XL clearly fails the President’s climate test. There is little question that tar sands is more carbon intensive than conventional crude. Both the State Department and the Environmental Protection Agency have concluded that from the tar sands mine to the gas tank, tar sands emissions are 81 percent greater than conventional oil. Keystone XL, as the largest of the proposed tar sands pipelines and farthest along in its permitting process, is the linchpin for the tar sands industry’s reckless expansion plans. An accounting of Keystone XL’s climate impact by NRDC shows that approving the tar sands pipeline would add 1.2 billion metric tons of carbon pollution to the atmosphere over the 50-year lifespan of the project. That makes the pipeline’s climate impact comparable to some of the most significant and ambitious emissions reduction programs underway in the United States, such as the fuel efficiency standards for heavy-duty trucks or the Regional Greenhouse Gas Initiative (RGGI). The President is right to consider Keystone XL on its climate impact – and in so doing, he has set a bar for approval which Keystone XL does not pass.

Whether Keystone XL will significantly increase carbon emissions comes down to two questions. First, are tar sands more carbon intensive that the conventional crude they would replace? Second, would approving Keystone XL enable a significant increase in tar sands production? A close consideration of both of these questions clearly demonstrates that approving Keystone XL would significantly increase the problem of climate pollution.

Tar sands are significantly more carbon intensive than conventional crude

Tar sands crude is significantly more carbon intensive than the conventional crudes refined in the U.S. This point is not controversial. Producing and refining tar sands requires significantly more energy than conventional crude. From well to gas tank, emissions from tar sands derived fuels are 81% greater than for fuels derived from conventional crude. Simply evaluating the higher emissions from transportation fuels, State concluded that by replacing conventional crude with tar sands, Keystone XL would increase annual emissions by 18.7 million metric tons CO2e per year.

However, refining tar sands doesn’t just produce transportation fuels. Tar sands refining results in significant quantities of petroleum coke – a solid, coal like by-product. Refineries wanting to get rid of it sell it to power plants as a cheap, more carbon intensive alternative to coal. State and the Department of Energy (DOE) have concluded that the increased petroleum coke production associated with Keystone XL’s tar sands refining would increase the project’s emissions relative to conventional crude by an additional 30%, or to 24.3 million metric tons CO2e per year.

These figures underestimate the relative climate impacts of tar sands production. Current estimates ignore the land use impacts of tar sands extraction, such as methane emission from peatlands and reduced sequestration capacity of the Boreal forest. Moreover, as increasing shares of tar sands crude come from more carbon intensive in situ drilling, tar sands comparative emissions are likely to increase. As my colleague Danielle Droitsch details, when faced with a choice between supporting tar sands expansion and fulfilling its international climate commitments, the Canadian government has thrown its support behind expansion by weakening the country's existing envrionmental protections.

Of course, in a recent letter, TransCanada claimed that tar sands emissions are similar to Venezuela heavy crude. There are three problems with this argument:

- It’s not true. Tar sands crude is more carbon intensive than Venezuela or Mexican heavy crudes. According to State, “incremental emissions would be 13.8 MMTCO2e and 19.5 MMTCO2e annually if oil sands crudes offset Mexican Maya and Venezuelan Bachaquero crude oil, respectively.”

- Had it been true, tar sands from Keystone XL isn’t going to displace Venezuelan and Mexican heavy crudes in Gulf Coast refineries because refineries processing these crudes are owned by Citgo and PeMex – the state owned oil companies of Venezuela and Mexico.

- Contrary to TransCanada’s assertions, the absence of tar sands crude from Keystone XL hasn’t resulted in an increasing flood of imports from Venezuela and Mexico – imports from both countries are in decline. Decline Venezuelan imports and the absence of Keystone XL hasn’t stopped Texas Gulf Coast refineries from operating at higher rates than they have in years.

Keystone XL is a linchpin for tar sands expansion

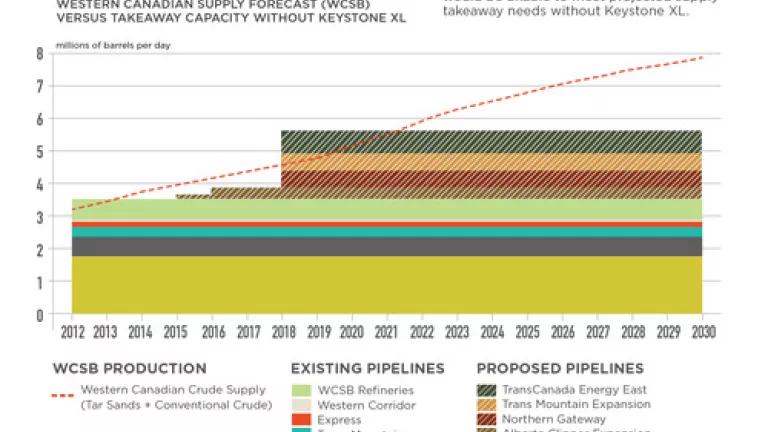

Experts in industry, the investment community and the Canadian government have all indicated that Keystone XL is critical for tar sands expansion. Their reasoning is clear and straightforward. The tar sands industry faces both short and long term transportation constraints. Based on current industry expansion plans, tar sands production is expected to exceed existing pipeline capacity sometime before 2015. Meanwhile, over the long term, the tar sands industry needs more than 4 million barrels a day of cheap new transportation capacity before 2030. In the unlikely event that every other proposed pipeline moved forward, the tar sands industry would still need millions of barrels of transportation capacity to fuel its reckless expansion plans.

Moreover, as detailed in NRDC’s analysis, there are significant obstacles to these proposed tar sands pipeline projects. Northern Gateway, a pipeline through Canada’s West Coast, has elicited so much opposition, including its formal rejection by the province of British Columbia, that even industry commentators find its prospects unlikely. Kinder Morgan’s TransMountain expansion would require the dredging of Vancouver harbor to accommodate super tar sands tankers. TransCanada’s nascent Energy East proposal would require the construction of new pipeline through Quebec, a province noted for its opposition to tar sands pipelines. And the Alberta Clipper Expansion requires the same permitting process through the U.S. as Keystone XL and would be implicated by the same policy concerning high carbon infrastructure.

Meanwhile, while rail provides a potential transportation option for light crude, moving heavy tar sands is significantly more expensive, which is why tar sands crude has been largely absent in the current crude-by-rail boom. As Goldman Sachs recently observed, there are substantial logistical hurdles which increase the cost of moving heavy tar sands crude by rail:

- “The first hurdle is that bitumen/heavy crude oil rail cars have to be specially made, so that their viscous cargo can be heated by steam in order to flow the crude out of car.

- Secondly, heating a rail car so that the heavy crude oil can be unloaded takes more time than simply tapping a rail car filled with light oil, which means fewer heavy barrels per day can be transported than light.

- Third, bitumen and WCS are denser than light crude, and since rail cars have maximum weight restrictions, fewer barrels of heavy crude can be carried in each car compared to light. Therefore, of the 150,000 b/d of crude transported by rail in 2013, we estimate that no more than 40% is likely to be heavy (and this number could prove closer to 20%).”

On this point, Goldman Sachs is right. Tar sands producers are seeing rapidly rising production costs. In 2013, breakeven costs for new tar sands projects range from between about $80 (for in situ) to $100 per barrel (for standalone mines). These costs assume very low pipeline transportation costs – less than $5 a barrel. Moving tar sands by rail costs about $30 a barrel and would add about $25 a barrel to the already high breakeven costs necessary to justify expansion projects. As Goldman Sachs concluded in its June report, “given the long distances and higher costs of rail, we believe pipeline capacity growth is critical in Canada and the key to sustainably removing congestion in the system."

By affecting tar sands crude prices and market expectations, Keystone XL would greatly enable the tar sands industry’s reckless expansion plans. The pipeline would link tar sands crude to international oil markets, giving the tar sands industry access to higher oil prices and making new tar sands projects more profitable.

Keystone XL simply does not pass the President’s climate test and is inconsistent with a policy intended to address the problem of climate change. In what KC Golden of Climate Solutions has termed “the Keystone Principle”, in order to start making things better, we much first stop making things worse. And that means rejecting Keystone XL.

“If the president and if the secretary of state approach this in a good-faith manner, there can be no doubt about the outcome. We said from the beginning that we think that if we can ever get this project viewed on its merits, that it will be seen for the disaster that it is.” Bill McKibben, National Press Club, July 23, 2013

Let President Obama know how you feel at www.stoptar.org.