We've made tremendous strides up the high road to a clean energy economy over the past decade, thanks not just to new car performance standards and the Clean Power Plan but also to historic investments made in the much-maligned American Reinvestment and Recovery (Recovery Act). The building momentum is palpable and inspiring.

And much more investment is needed. Credible estimates claim that trillions of dollars will need to drive us forward to this brighter future. And this is where environmental finance can fill the gap. What is environmental finance? As guru Michael Curley sums up, "The goal of environmental finance is to bring the greatest environmental good to the largest number of people at the lowest possible cost." (for this and much other wisdom see his textbook on finance policy). To do this job, finance experts have a toolbox. The Recovery Act used a couple of tools, most notably grant-making and tax incentives. Fortunately, there's also a multi-trillion dollar global bond marketplace.

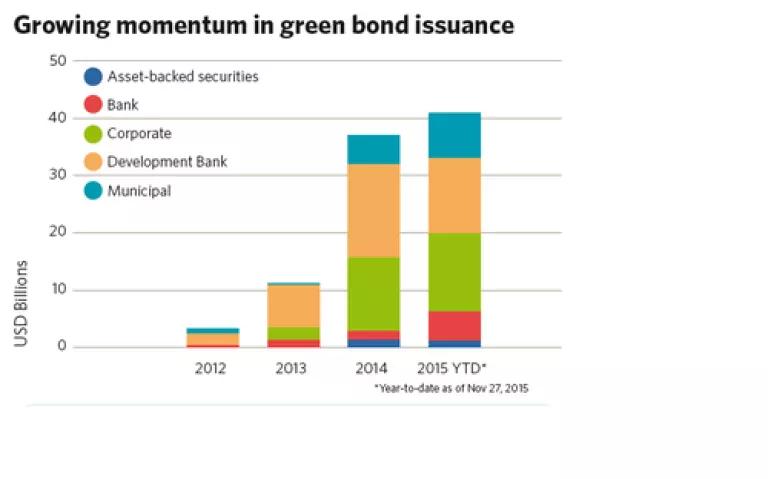

In order to help attract investors in this market, NRDC is proud to be part of the Green City Bond Campaign (organized by the Climate Bonds Initiative) to help with the certification and issuance of bonds to finance new infrastructure, including clean transportation projects. Green city bonds are similar to municipal bonds, except that they are labeled "green," their proceeds go to green investments and issuers "track and report on the use of proceeds to ensure green compliance." (see the nifty primer on green city bonds here). This is an exciting marketplace for financing sustainability, as you can see from this graph drawn from the latest Climate Bonds Initiative (for more info go to the two-page update itself):

Even better news is that 2016 started off with a bang, as New York City's Metropolitan Transit Authority (MTA, the nation's largest public transportation agency) issued their first-ever green bond. As the Climate Bonds Initiative noted in its press release quoting my colleague Doug Sims last week, this is also the first U.S. muni bond certified as Low Carbon Transport based on new criteria and the largest certified green bond so far at $500 million.

Proceeds from bond sales go to capital investments in electrified rail, which provides millions of rides to New Yorkers every day. This is an important part of New York's clean transportation future, with subway ridership trending upward about 11 percent from 2009-2014 alone to more than an eye-popping 1.7 billion rides a year. Issuing this historic green bond to support this growth serves multiple purposes as described in the Climate Bonds Initiative's primer - it diversifies the investor base for rail, helps inform and involve residents in the future of rail in New York, and opens up new a collaboration between New York City agencies which might lead to other innovative initiatives.

Now that MTA has blazed the trail for green bonds, other transit agencies should seriously consider using this tool for leveraging public investments. There are trillions of dollars at play in the bond marketplace, and investors, cities and the environment deserve more clean transportation investment opportunities.