Key IRA Program Can Help Drive Transformation in Steelmaking

As OCED prepares to invite applications for funding, NRDC and our partners have urged the office to focus on “first few,” high-impact demonstration projects in critical industrial sectors like cement, steel, and chemicals.

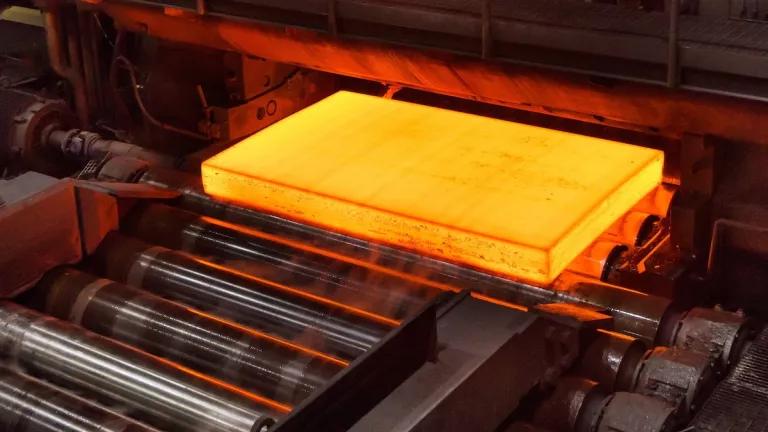

Steel being produced at the HYBRIT fossil-free steel pilot plant in Lulea, Sweden

Jan Lindblad Jr./SSAB

This blog is the third of a series of analyses being developed by a coalition of NGOs engaged in decarbonization of the U.S. industrial sector. It was written jointly with our partners at the Rocky Mountain Institute (RMI), and focuses on investment priorities for $5.8 billion in funding for industrial decarbonization in the Advanced Industrial Facilities Deployment Program, passed by Congress as part of the Inflation Reduction Act. We and our coalition partners will continue to update our blogs to references one another’s work. The first and second blogs in the series can be found here and here.

Implemented well, the Inflation Reduction Act (IRA) has the potential to be a game changer for the U.S. industrial sector. If the United States meaningfully capitalizes on the incentives made available in the IRA, it stands to become a global leader on decarbonizing some of the most polluting and tricky industrial applications like steel manufacturing, creating a major economic engine and dramatically bending the curve of U.S. industrial greenhouse gas (GHG) emissions to bring it much closer to alignment with climate goals.

A centerpiece of this opportunity is the $5.8 billion Advanced Industrial Facilities Deployment Program (AIFDP) now housed within the Department of Energy’s Office of Clean Energy Demonstrations (OCED). As OCED prepares to invite applications for funding, NRDC and our partners have urged the office to focus on “first few,” high-impact demonstration projects that can de-risk transformative technologies in critical industrial sectors like cement, steel, and chemicals; reflect this explicitly in the agency’s Funding Opportunity Announcement (FOA); and maximize the criteria outlined in our coalition letter as key project selection factors, alongside cost. Notably, our groups are invested in seeing this funding create a domino effect in terms of the potential for funded technologies to be adopted throughout these critical industries.

Here we focus on one such technology in the ore-based primary steelmaking sector: an electric arc furnace powered by zero-carbon electricity, paired with the use of direct reduced iron via a process that runs on 100% green hydrogen (H2-DRI). We then provide a back-of-the-envelope analysis to illustrate the potential benefits of focusing investments under the AIFDP program on transformative technologies, comparing cost and emissions reductions from such a steel plant (coupled with the potential for the technology to cascade through the industry) vs. deployment of industrial heat pumps across a large number of paper and pulp facilities.

The unique needs of many industrial processes—in this case, the need for a chemical reaction to reduce iron ore into steel—means direct electrification may not be able to carry us all the way to our decarbonization goals. A carbon-free, high-energy source like green hydrogen is also necessary.

Green hydrogen, produced by splitting water in electrolyzers in a process powered by renewable electricity, can replace coal and gas as a feedstock for this chemical reaction in steel manufacturing. The process represents a major technological breakthrough; replacing fossil fuels in the direct reduction of iron with hydrogen produced with renewable energy enables the manufacturing of nearly emissions-free steel. The use of hydrogen in steelmaking has been successfully piloted, and most major European steel players have received government support to build or test the technology.

With IRA subsidies, the United States is now poised to follow suit and can lead the global transition to green steel, as we discussed here. This includes the largest hydrogen subsidies in the world, which, if implemented well, may provide a sea change in the hydrogen market. Together, this would have major benefits, especially considering recent alarming findings that the steel sector is the most off-track in terms of alignments with global climate goals, with a significant increase in projected GHG emissions absent a major intervention.

While there are several stages in the steel value chain where GHG emissions can be addressed, the ironmaking process is responsible for roughly 70% of the emissions footprint, making it the most advantageous point in the steelmaking process to target emission reductions.

Let’s start by considering the emissions reduction potential of reconfiguring an integrated steel mill (which uses an integrated blast furnace (BF) / basic oxygen furnace (BOF)) with a H2-DRI and electric arc furnace (EAF) design. Using RMI’s data on recent project costs, the capital investment required to convert a single average-sized steel plant (with a capacity of 2 million tons of crude steel per year) to H2-DRI and EAF is estimated to be approximately $1.5 billion. Assuming an emission intensity of 2.4 tons of carbon dioxide (CO2) per ton of crude steel from a conventional BF-BOF operating with a 90% facility utilization rate, suggests that the use of AIFDP funding to convert a single average-sized steel plant has the potential to cut emissions by 4.1 million metric tons of CO2 per year. As up to six existing BF-BOF facilities in the United States approach major capital investment decisions in the next ten years, the commercialization of H2-DRI can greatly magnify the climate impact of an initial, breakthrough investment by providing a low-carbon capital re-investment alternative that is free from fossil fuels.

Now, let’s compare this to widespread deployment of industrial heat pumps in the paper and pulp industry, which has high process heating demands. Drawing upon the assumptions that underlie an ACEEE report on industrial heat pumps, the installation of industrial heat pumps in multi-effect evaporators in 166 facilities has the technical potential to avoid 2.0 million metric tons of CO2-equivalent per year, with an associated capital investment of $1.4 billion.

In this illustrative example, a comparable amount of investment from AIFDP would have twice the emissions benefit if directed toward reconfiguring a single integrated steel mill instead of broadly deploying industrial heat pumps in the paper and pulp industry. The climate benefits of the former are even more pronounced when you consider the strong potential for industry “cascade” effects that could result from using AIFDP funds to demonstrate and thereby de-risk transformative technologies.

Additionally, OCED must factor in four additional considerations:

First, cultivating a domestic green steel industry could be a boon for the U.S. economy and a source of high-quality jobs. But it also offers an opportunity for the United States to lead a cascading effect beyond its borders, bolstering emerging global efforts to decarbonize the steel sector and, along with other major economies such as Britain, India, China, and the European Union, and others, meet their recently announced goal of ensuring that “near-zero emission steel production” is established and growing in every region by 2030. This is especially consequential when considering that the global steel sector needs urgent course correction, as mentioned above.

Second, OCED must keep in sharp focus the unique role of the AIFDP, as compared to other federal incentives. Widespread deployment of industrial heat pumps in sectors like chemicals manufacturing and the pulp and paper industry offers a clear and present decarbonization lever that the United States must pull. However, federal incentives available elsewhere in the federal government – such as via the 48C manufacturing tax credit, which the IRA expanded to include industrial emissions reductions – can help spur uptake of industrial heat pumps and other similar technologies across industrial facilities of all sizes. By contrast, the AIFDP uniquely offers federal funding for upfront capital investments in first-at-scale industrial technology that has the potential for deep GHG emissions and pollution reductions and sector-wide adoption.

Third, the federal government cannot properly address industrial decarbonization by focusing only on incentive programs to help with the upfront capital costs and transformation of industrial plants themselves; it’s essential to also consider the ongoing economics and build market demand for their outputs. This market pull is part of what will determine whether these projects are one-offs, or whether OCED’s investment catalyzes the kind of cascading market transformation that’s needed. In September, the White House Buy Clean Task Force announced that federal agencies will prioritize low carbon procurement across four major materials categories—steel, concrete, asphalt, and flat glass—covering 98% of materials purchased by the federal government. It’s a clear demonstration that the Biden administration is serious about putting these policies to work and at a major scale. Major U.S. corporate purchasers of steel like Ford Motor Company have also committed in advance to purchase at least 10% of their annual steel by 2030 from zero- or near-zero emission suppliers. This pipeline of demand for zero- or very-low-carbon steel from both the public and private sector would significantly enhance the leverage of projects funded under the AIFDP.

Finally, the AIFDP and hydrogen hubs program (also administered by OCED) can be mutually reinforcing. First-of-a-kind green steel plants bear high capital costs, such that hydrogen hub funds alone are unlikely to be sufficient to fund a meaningful fleet of plants. AIFDP funds would bolster hydrogen hub funds to support a larger fleet of first-of-a-kind plants and significantly accelerate commercialization. A positive feedback loop can also be unlocked: given their large green hydrogen demand, green steel plants would help drive important economies of scale and de-risking in hydrogen hubs. And, in turn, the hydrogen hubs program would enable the demonstration of the full green steel value chain—from feedstock production through offtake contracts—as opposed to a sole focus on the individual plant.