The Treasury Department has released revised “coal guidelines” on how they will vote on coal projects brought to them by the development banks. A number of controversial coal projects have been approved by these banks in recent history, including some of the world’s largest coal plants. These guidelines respond to the call by President Obama in the U.S. Climate Action Plan to stop using U.S. funding for overseas coal projects. These guidelines mean that the U.S. will have to vote no on using U.S. funding for coal projects that lead to more climate change. With clean energy booming around the world these banks should be focused on how to build more wind, solar, and energy efficiency – not more coal projects.

In June President Obama directed the U.S. government to stop using public financing for new coal plants overseas that don’t capture their carbon. And he committed to work with other countries to implement similar provisions. Soon after this announcement the World Bank Group committed to funding coal projects only in “rare circumstances” and the Nordic countries agreed to join the U.S. in ending overseas coal financing. These guidelines – Guidance for U.S. Positions on MDBs Engaging with Developing Countries on Coal-Fired Power Generation – are a next step in implementing this commitment to stop using scarce U.S. funding to support coal projects that are driving climate change.

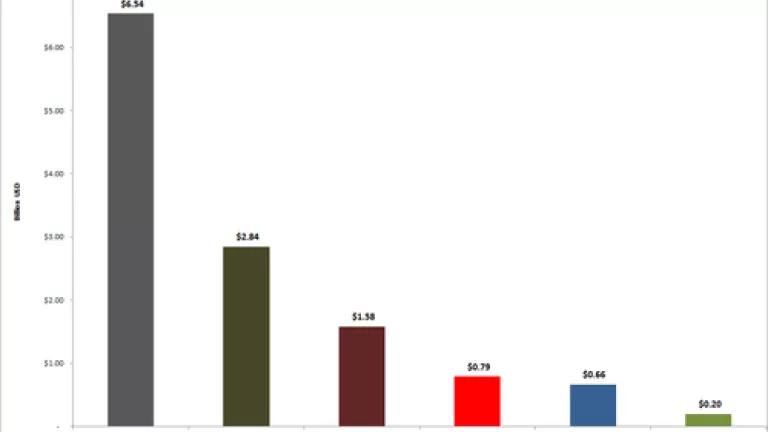

The Treasury Department represents the U.S. at the World Bank Group (WBG), Asian Development Bank (ADB), African Development Bank (AfDB), and European Bank for Reconstruction and Development (EBRD). So these revised guidelines would shape how the U.S. – the largest shareholder at these institutions – would vote on any coal project proposed by these development banks. Over the past 5 years these banks have invested almost $13 billion in coal projects that are driving climate change (see figure) so this is an important signal.

I’ll add more details tomorrow as I sort through the specifics, but here are quick reactions. The guidelines:

- Require that the banks make clean energy investments a priority. Hopefully these banks will double-down on clean energy investments and stop proposing damaging coal projects.

- End funding for coal power plants in middle-income countries unless they capture the carbon and completely offset the incremental carbon pollution over the life of the plant. Most of the historic funding from these development banks has occurred in middle-income countries like South Africa and India.

- Require that projects will only be allowed in lower-income countries in rare circumstances where alternative sources of energy aren’t available. They’ll require that the coal plant use the best available technology. And analysis of the project viability will have to take into account the damaging health and climate pollution from unconstrained coal plants. With clean energy booming and air pollution causing cancer and climate change it is hard to imagine projects that can meet this test. There are a couple of projects including the Kosovo that will test this principle.

- Cover all types of financial support that the banks provide. This includes a common practice to use intermediaries as the World Bank Group is currently doing for a coal project in Indonesia.

- Don’t require, unfortunately, that these banks stop funding coal mine projects. Since these coal mines provide coal which is driving climate change and is often used in coal power plants it is unfortunate that these revised guidelines don’t cover these destructive investments. Since 2007, these banks have invested over $3 billion of coal mining projects, according to data compiled by Oil Change International*

Overall, this should send a clear signal that the time of using U.S. funding for overseas coal projects is at an end. By focusing these banks away from damaging coal projects it will free them to focus all their time and resources on deploying more renewable energy and energy efficiency. Sadly this hasn’t been their storied history so hopefully this will mark the moment where they double-down on clean energy investments.

------------

* NRDC has classified projects in the Oil Change International Shift the Subsidies database according to project type (e.g., coal power plant, coal mine, etc). NRDC will shortly be publishing a new issue brief on the overall financing of all international financial institutions over this period.