Violence in Libya, Oil Up, Stocks Down, Gasoline Up. Driving on Electricity? Still a Predictably Good Deal.

As traders watched images of violence in the streets of Tripoli, oil futures surged 14% last week, the largest increase in two years. This week, the stockmarket slid in response to Ben Bernanke’s caution that rising oil prices could undermine the economic recovery, and gasoline prices jumped almost 20 cents/gallon, the second largest one-week increase in over 20 years. Libya has the largest proven oil reserves in Africa. Almost ninety-eight percent of Libya’s economy is based on the fossil fuel industry. When oil prices surge, regimes like those in Libya profit, the stockmarket falls, Americans pay more for gasoline, and the price of electricity, it turns out, remains largely unmoved. Powering vehicles on that electricity will reduce America’s vulnerability to geopolitics and speculative oil markets, decrease carbon dioxide pollution, and save drivers money at the pump.

Electricity is made from a variety of sources, most of which are domestic. While we need to continue to clean up the electricity grid to reduce pollution and maximize the environmental benefits of plug-in electric vehilces, less than 2% of our electricity comes from oil today. In contrast, our gasoline is almost entirely derived from oil, most of which we import. America’s transportation sector uses 14 million barrels of liquid fuels every day. The unrest in Libya and other oil-exporting nations underscores the need to reduce our oil dependence by improving the efficiency of our vehicle fleet. If you want to help America in this effort by driving on electricity, you will practically eliminate your own oil dependence.

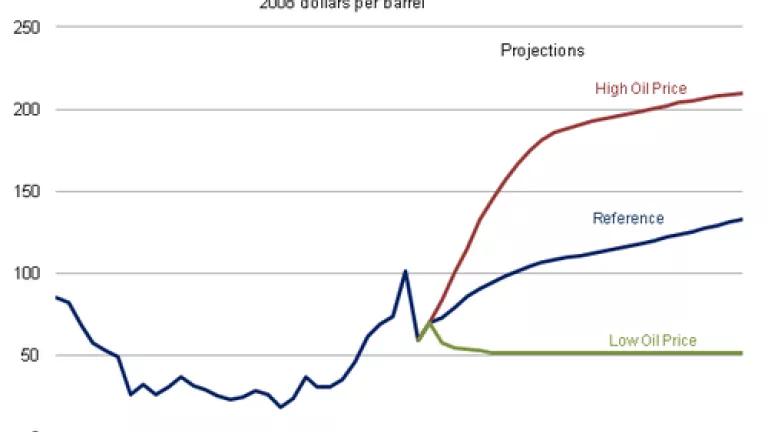

The good people at the Energy Information Administration are tasked with collecting data on all things energy. As the conflict in Libya continues, it is worth taking a moment to contrast the difference in electricity and oil price data and forecasts. The historical variability in the price of oil (in dollars per barrel) is significant, and the price spikes more severe. Note also that by 2035, the “High Oil Price” is more than four times the “Low Oil Price” scenario, with an absolute range of uncertainty of over $150 a barrel.

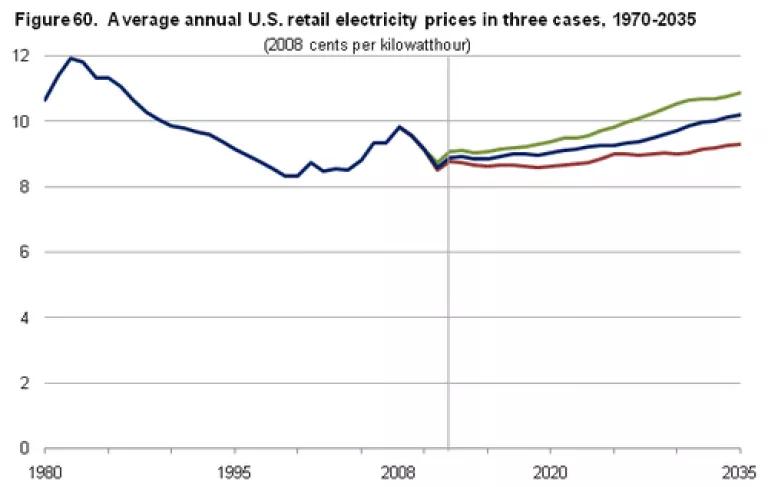

In contrast to oil, the price of which is volatile and extremely difficult to predict, the price of electricity is less dependent on any single energy source, and is carefully regulated by state public utilities commissions. This diversity of supply coupled with regulatory oversight translates into relatively stable prices. By 2035, the cost of driving on electricity in the high and low case forecasts is roughly the difference between driving on $1.15/gallon and $0.98/gallon gasoline.

Most likely, the cost of electricity for general use will be close to the blue line, which is equivalent to about $1.07/gallon gasoline. The fuel costs for plug-in electric vehicles could be even lower in some regions, as utilities are offering customers the chance to charge their cars on cheaper, off-peak electricity. Prices will vary across the country, but on average, driving on electrity for the next twenty or so years is likely to cost somewhere around a-buck-a-gallon. Compared to volatile, unregulated oil prices, that’s a pretty safe bet. In addition to reducing carbon dioxide pollution and predictably saving money at the pump, taking that bet will help lessen our dependence on oil from regimes like that of Muammar Qadhafi.