You couldn’t open the newspaper in 2009 or 2010 without seeing an ad for the federal tax credit for windows, doors, and other energy efficiency improvements. While certainly popular, was this incentive the most effective use of taxpayer dollars? Or could greater energy savings be achieved, which reduce consumers' utility bills and harmful pollution, while increasing energy security, all at a lower cost to the Treasury?

A new GAO report released today looks at the use of this credit (officially known as Section 25C or the “nonbusiness energy property credit”) and contemplates how to modify the credit to reduce its cost and increase its effectiveness. While the report does not make any conclusive recommendations, it is clear from the information presented (and in particular the credit’s $5 billion price tag) that it’s time to rethink this incentive.

For those not familiar with 25C, the credit provided homeowners with a tax credit for various types of residential energy efficiency improvements, including insulation, windows, doors, water heaters, and HVAC equipment. When it was enacted in 2005, the credit was limited to $500 per taxpayer with individual caps for certain types of measures. As part of the Recovery Act, the overall limit of the credit was raised to $1500 and the individual caps were eliminated.

Concerned about the cost and structure of the tax credit, in 2009, Senators Bingaman, Snowe, Feinstein, Kerry and Baucus requested GAO to study the effectiveness of 25C and recommend ways to improve it. Today’s report is the long awaited response to that request. One of the key questions asked by the Senators was whether 25C would be more effective as a performance-based credit, where the amount of the incentive was based on energy savings. Currently the credit uses a cost-based structure, where the amount of the credit is based on the total amount spent on efficiency measures.

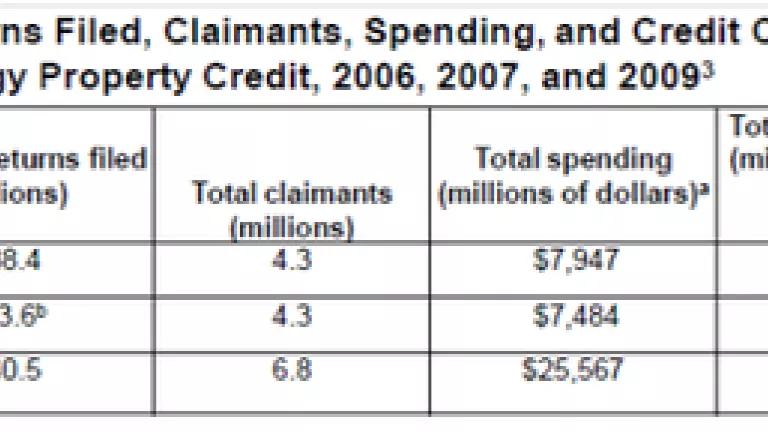

While the report unfortunately does not make any significant conclusions, it finds (not surprisingly) that the amount spent by the government for 25C increased dramatically in 2009 in conjunction with the increased incentive amount. As shown in the table below, while the total credit claimed was approximately $1 billion in each 2006 and 2007, this amount rose to over $5 billion in 2009. This is significantly higher than the $2 billion score for both 2009 and 2010 estimated when the Recovery Act was enacted.Furthermore, the actual cost for 2009 would likely have been even higher if it weren’t for the efforts of Senator Snowe to increase some of the credit’s efficiency criteria, in particular for windows (when extended in the Recovery Act, over 90 percent of windows on the market qualified under the credit’s previous efficiency criteria).

Source: http://www.gao.gov/assets/590/589833.pdf

However, the Federal government did not get as much bang for the buck when the amount of the credit was increased. While in 2006 and 2007, there was $8 reported in private sector spending for roughly every $1 in government spending, in 2009, this ratio fell to $4.8 in private spending for every $1 in government spending. Additionally, due to the structure of the form in 2006 and 2007, it is likely that private sector spending was under reported in these years, which would make this difference even larger.

The report unfortunately does not look at the energy saved per federal dollar spent, whether the measures purchased provided consumers with the most cost-effective energy savings, or how many of these consumers were essentially “free riders” – claiming an incentive for a purchase they would have made anyways. The numbers do show that at the higher amount, the efficiency improvements were more expensive per dollar to the federal treasury, which indicates that government spending could be leveraged more strategically and effectively.

The report does not make conclusions about whether a performance based incentive would be better but finds that “a performance-based credit is more likely to effectively reduce energy use and CO2 emissions, because it rewards energy savings from the investment rather than the cost-based credit’s rewarding spending regardless of whether the spending results in energy savings.” It cautions that a performance based credit could entail additional costs in terms of verification and compliance, but the credit proposed by Senators Snowe and Bingaman in the Cut Energy Bills at Home Act (S.1914) takes significant steps to avoid these challenges and costs.

With a price tag of over $5 billion, it is clear the 25C incentive levels from the Recovery Act are history. It’s time to look at this incentive closely to see how to motivate the biggest energy savings at the lowest cost. The performance based credit proposed in S.1914 is a significant step in the right direction.