The Independent Petroleum Association of America recently commissioned and funded a study, covered in the New York Times and elsewhere, which claimed that university endowments would suffer without fossil fuels in their portfolios. The Wall Street Journal ran an op-ed calling fossil fuel divestment a "Feel-Good Folly."

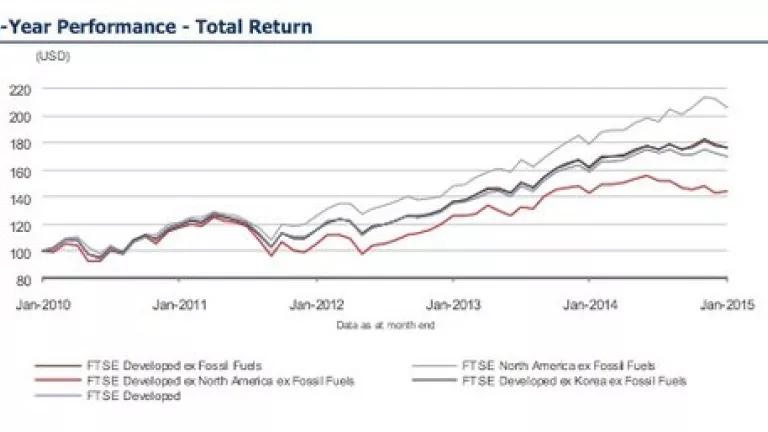

Let's look at the facts. The global indexing firm FTSE has developed several fossil fuel free indices, and has tracked performance over the past five years. Over this time period, FTSE's North American fossil fuel free index has consistently outperformed the conventional benchmark index.

You can see the gray line at the top, representing the North American ex Fossil Fuels index, in the chart above. (This data is from FTSE's publicly available monthly fact sheets--the opinions in this blog are mine.)

This five-year snapshot is not necessarily an indicator of future performance, but it is five years of real data demonstrating that a fossil-fuel strategy can make perfect financial sense. The fossil fuel free index also showed less volatility than the conventional benchmark, another factor that puts investors at ease.

The only folly is a failure to see where continued investment in fossil fuels is taking us--into an uncertain future of weather extremes, which we're already getting a taste of now. Storms, droughts, and flooding are expected to become more frequent and severe as the climate warms; sea levels are rising, swamping low-lying lands. The Pentagon sees climate change as a national security threat.

Scientists have calculated that in order to avoid the worst impacts of climate change, as much as two-thirds of known fossil fuel reserves need to stay in the ground. We need to invest in cleaner sources of energy, free from carbon pollution--not pour more resources into drilling our way toward climate disaster.

If universities and other institutions are still afraid to divest, despite the facts, it suggests to me that the worry is really about breaking faith with the oil and gas industry and its very deep pockets. If fossil fuel interests are really so deeply entwined in our educational--not to mention political and financial institutions--then the movement to divest becomes even more important. We must start to disentangle ourselves from this polluting industry that has such a hold on our lives--and our futures.

Thousands are rallying around the world for Global Divestment Day today, calling on universities and other institutions to break their financial ties to the fossil fuel industry. It's not only a financially sound decision, but a morally sound one, too. Universities in particular are the institutions we trust to shape our future--not sacrifice it.