According to the auto industry, setting strong fuel economy and carbon pollution standards will cost the U.S. auto industry hundreds of thousands of jobs. But their analysis is flawed in three fundamental ways. The first two ways -- inflated cost estimates and assertion that consumers won’t buy more fuel-efficient cars – are not surprising. However, their third, implicit argument, adding fuel efficiency technologies won’t increase the number of jobs required to build each car, is completely counter intuitive and wrong.

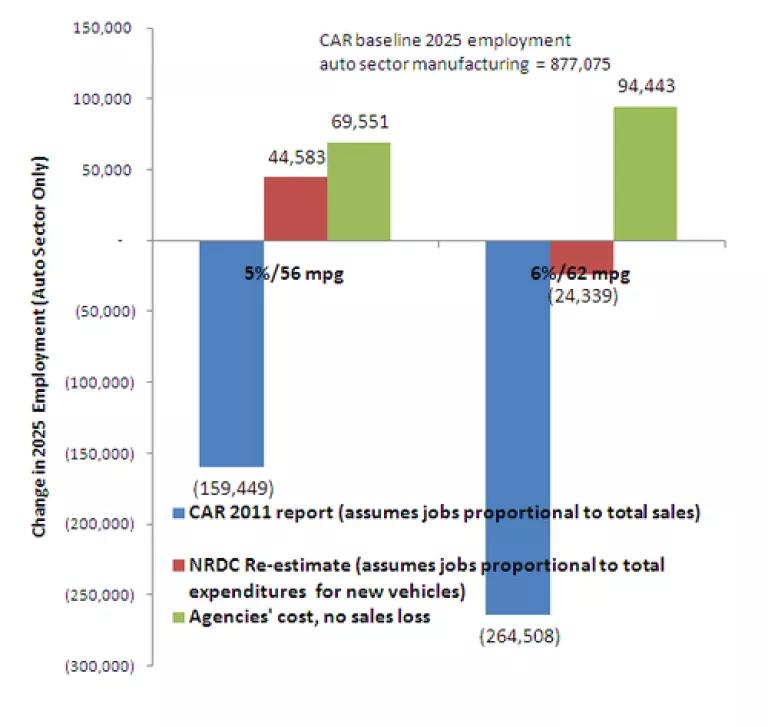

Both the UAW and the U.S. Energy Information Agency disagree with the auto industry on this fundamental point. Instead they both agree that greater fuel efficiency means more technology -- such as batteries, turbochargers and lower rolling resistance tires -- and more jobs per vehicle to design and build these components. By simply changing this one assumption in the auto industry’s job analysis (and ignoring for now their inflated cost and sales impact claims), their own model results in 10 times less job loss for 62 mpg and 45,000 jobs created for a 56.2 mpg standard. Using the regulators estimates for costs and assuming no loss in sales results in substantial job increases for both 56.2 mpg (70,000 jobs) and 62 mpg (94,000 jobs).

UAW and U.S. EIA Agree that More Fuel Efficiency Technologies Means More Jobs Per Vehicle

As reported in the Detroit News, the primary auto industry lobbying association, the Auto Alliance, sent a letter on May 11 to Secretary LaHood and Administrator Jackson claiming that a 62 mpg standard will lead to a “loss of almost a quarter of a million auto jobs.”

The basis of this assertion is an April 2011 forecast by a branch of the DOE, called the Energy Information Agency (EIA). But according to the U.S. EIA, the auto industry has misused its data:

Jonathan Cogan, a spokesman for the Energy Information Administration, said last week that the alliance's employment estimates "do not reflect either EIA's views or the results of its modeling."

Use of more fuel-efficient technology is likely to increase the number of employees needed to manufacture a vehicle, the agency said.

Cogan wrote in an e-mail to Automotive News that the alliance's "implicit assumption that employment per vehicle does not increase as vehicles incorporate additional technology to become more fuel efficient does not seem reasonable." [Automotive News, June 27, 2011]

UAW, in a March testimony before the Congress, recognized the job creation benefits of fuel-efficiency components:

The simple equation for understanding how this job creation occurs is that the new technology required to meet tailpipe emissions standards represents additional content on each vehicle, and bringing that additional content to market requires more engineers, more managers, and more construction and production workers. [Testimony of Barbara Somson, UAW, before the Senate, March 17, 2011]

Re-estimating the Auto Industry Claims

The auto industry’s latest claim relies on a study by the Center for Automotive Research (CAR). According to CAR, the costs of meeting a 62 mpg standard by 2025 will be a $9,790 increase in per vehicle price and 260,000 lost jobs in 2025. For 56.2 mpg, the CAR estimates a cost of $6,714 and a job loss of 159,000.

Perplexingly, the CAR analysis assumes a fixed number of workers per vehicle, regardless of content:

CAR uses the long-term 0.4 percent productivity growth rate (1960-2008) to estimate a ratio of 12.26 vehicles produced in the United States per worker, in 2025. This ratio is used to forecast automotive manufacturing employment for each of the U.S. production scenarios shown in Table 13. [CAR study page 45]

What happens if one assumes that jobs increase in proportion to the increased cost of the fuel efficiency technologies? By changing this one simple assumption (and ignoring for now their inflated cost estimates and CAR's estimate of vehicle sales loss), the results of the re-estimated CAR model are that a 62 mpg scenario would result in a 2.8 percent job loss, not a 30 percent job loss predicted by CAR, or a ten times lower impact. For 56.2 mpg, the re-estimated CAR model yields a job increase of 45,000 instead of a job loss of 159,000.

Conclusion: Auto Industry Cost Claims are Wrong

If the cost assessment is corrected, the job growth for 62 mpg would almost certainly be positive using the CAR model. Using the regulators estimates for costs and assuming no loss in sales results in substantial job increases for both 56.2 mpg (70,000 jobs) and 62 mpg (94,000 jobs).

According to the CAR study, if the technologies pay for themselves in five years or less, there will be no impact sales or an increase in sales. The regulators estimate for payback time is 3 years for 56.2 mpg and 3.8 years for 62 mpg. Therefore "no sales impact:" is a conservative assumption.

The more technology per vehicle the more jobs per vehicle. The equation is simple. The auto industry conveniently ignores this basic fact and is distorting the job impacts of stronger standards.

Who’s right in the job’s debate? One thing is for certain: by ignoring that someone has to design and build fuel efficiency technologies, the auto industry job loss estimates are surely wrong.