Even before the Obama administration's proposed carbon pollution and fuel economy standards of 56.2 mpg by 2025 was announced, the auto industry has sought to scare policymakers from setting strong standards , claiming drivers would reject more fuel efficient model lineups. “We can build these vehicles,” Alliance of Automobile Manufacturer vice president Gloria Bergquist told The New York Times this weekend. “The question is, will consumers buy them?”

But Ms. Bergquist doesn’t have to look very hard to answer her own rhetorical question. In fact, the used car market tells a very different story: the consumers are demanding fuel-efficient vehicles and are willing to pay more for higher fuel economy. Prices for used fuel-efficient cars are skyrocketing because automakers are building enough hybrids and other fuel sippers. So ironically enough, Ms. Bergquist should be asking the rhetorical question “why aren’t automakers building enough of them?”

Used Vehicle Market Demonstrates Consumers Willing to Pay More

A look at the used vehicle market casts more light on the false assertion that consumers are unwilling to buy more fuel efficient cars. Since the supply of used cars are relatively fixed, changes in consumer preferences and other market factors tend to play themselves out quicker and more directly than in the new car market. The laws of economics tells us if demand increases and supply is fixed, prices must go up. And that's exactly what is happening in the used car market for fuel efficient cars.

The national average gas price has risen about 20 percent in the last six months to $3.60, and the response of the used vehicle market has been unambiguous: consumers are willing to pay hundreds and often thousands of dollars more for the same used fuel-efficient models than they were a year ago, when gas hovered near the $2.75 mark.

Kelley Blue Book: Used Hybrids are Hot

Used cars as a whole have been hot of late according to Kelley Blue Book, which estimates that the average used vehicle price has increased by 5.4 percent through the first six months of this year. But vehicles at the more fuel-efficient end of the spectrum, hybrids, compact and subcompacts, have done particularly well.

The latest Kelley Blue Book numbers for the first six months of this year show the average price of a used hybrid has risen about $3,000 since January, a 20.4 percent boost in just six months. (For comparison, the average price increase for all pre-owned vehicle models was just $950.) Compact and subcompact vehicles have also done very well recently, appreciating in value by 21.4 and 22.0 percent respectively over the same period.

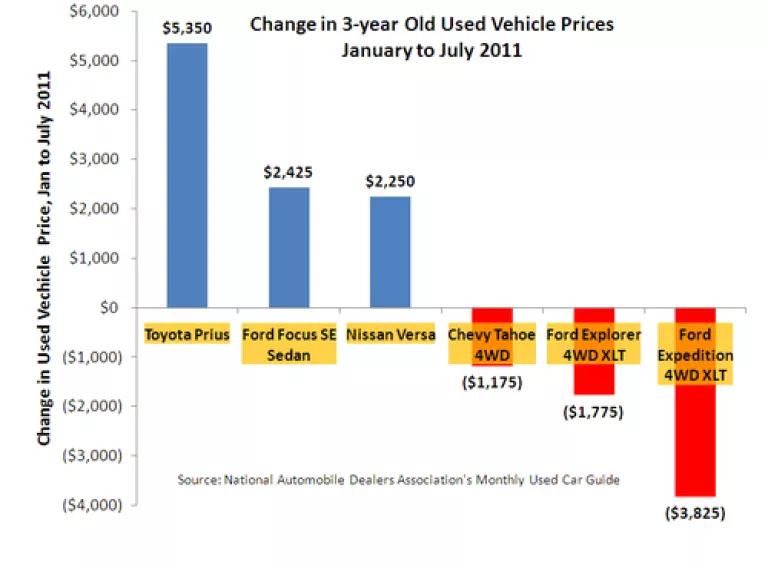

Used Toyota Prius Price up $5,350 this year, Expedition Price down $3,825

The used Toyota Prius has come to be one of the hottest new or used cars available. According to the National Auto Dealers Association monthly used car guide, the value of a 3-year old used Prius (model year 2008) has gone up by $5,350 this year (a 31.9 percent increase). A 3-year old used Focus will cost you $2,425 more (a 20.6 percent increase) and a used Chevy Cobalt has gone up by $1,425 (a 13.8 percent increase).

On the other hand if you are willing to pay $100 to fill up your tank, then you are in luck because you can buy a 3-year old Ford Expedition 4WD XLT for cheap. It will cost you $3,825 less (a 14.1% drop) than in January. A Ford Explorer 4WD XLT cost $1,775 less (an 8.4 percent drop), and a Chevy Tahoe 4WD cost $1,175 less (a 3.7 percent drop).

Manheim Used Vehicle Analysis Confirms Demand for Fuel Efficiency

“On a mileage-adjusted basis, compact car prices in May were up more than 20% from their year-ago level,” says Tom Webb, chief economist for Manheim Consulting in his analysis of the May used vehicle market. “This reflects inventory shortages in the new vehicle market, the impact of higher pump prices, a shift in consumer preferences beyond what gas prices would suggest, and better product offerings in this segment.”

The reaction of the pre-owned market to higher fuel prices has been more pronounced than with new cars in part because such a large portion of new vehicle sales can be attributed to private business purchases of light-duty trucks. In the used market, the opposite is true. The latest June Manheim used vehicle analysis found that prices for CUVs and SUVs have fallen 7.1 percent and pickups by 1.3 percent respectively.

Auto Actions on Fuel Efficient Cars Speaking Louder than their Lobbyist Words

So the data is clear: consumers want fuel efficiency. Automakers executives and engineers know this. Just this week, there have been stories about GM, Chrysler and Hyundai moving forward with highly fuel efficient products, including the 40+ mpg Chevy Sonic, a 50 mpg diesel Chevy Cruze, and 40 mpg Chrysler. GM has already broken from the pack and says they can meet 56.2 mpg. Hyundai has a while ago voluntarily committed to 50 mpg.

So what’s going on with Ms. Bergquist’s rhetorical question? The answer is simple to anybody that has followed the history of automobile regulations. The auto industry lobbyists has the unenviable of fighting new pollution, safety or fuel economy standards with a “just say no” voice. While at the same time, the executives and engineers are planning to meet the standards, often at lower cost than the regulators predict. Let’s hope the President is looking past the auto lobbyists’ tired rhetoric.