Fossil industry mouthpiece Energy Ventures Analysis (EVA) has a long track record of shoddy analysis performed in support of big polluters' agendas, and it has kept with its pattern of substandard assessment of the Clean Power Plan with the National Mining Association (NMA) release yesterday. About a year ago, EVA conducted an analysis on behalf of NMA on the proposed Clean Power Plan, suggesting that the nation's first-ever carbon pollution standards for power plants would raise electricity bills and lead to economic destruction.

Today, NMA and EVA claim the Clean Power Plan will increase "wholesale electricity prices" by $214 billion by 2030 with increases in nearly all states, and require $64 billion of spending in the electricity sector. Any credible analysis should provide readers with its methodology and the full set of assumptions used. Instead, EVA provides the reader with an appendix that, after providing the most basic details of how the Clean Power Plan works, only goes on to describe that EVA did not factor in all of litigation uncertainty facing the rule. (Un)helpful. Since the most recent materials lack the necessary background information on the modeling and analytical methodology for us to fully analyze, for now we will review some highlights.

Here are EVA's summary bullet points (on page 2):

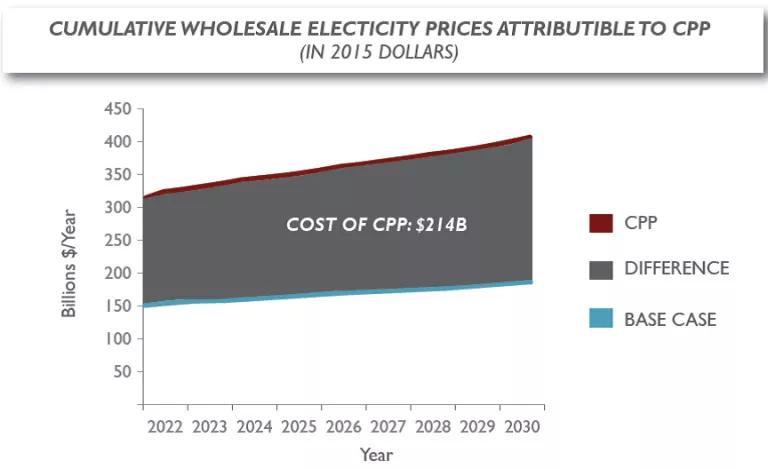

Going down to page 4, EVA shows this graph depicting "cumulative wholesale electicity [sic] prices":

Ignoring the fact that two of the five full words in the title are misspelled, let's look at EVA's explanation for this chart:

"This analysis found that the impacts of the rule on electricity costs will be significant, with consumers paying an additional $214 billion for electricity between 2022 and 2030 compared to the same period without the CPP. The CPP cost premium begins in 2022 at $15 billion"

Now the question: how does the graph even remotely reflect what EVA has described?

(1) The "cost premium" certainly does not start at $15 billion according to this graph. In 2022, the base case "cost" (an undefined one, but presumably based on wholesale power prices) is $150 billion. The CPP case "cost" (see note above) is over $300 billion. That means over $150 billion in the first year!

(2) Just roughly, let's say this graph shows an additional $150 billion between the CPP line and the base case line in each of these years. The shaded area represents $1.35 trillion between 2022 and 2030.

(3) It's hard to even see how this graph (however flawed) can be justified as showing costs. When we pay for electricity, we pay our bills, not our prices! Bills are based on the price and the quantity, and we've seen that clean energy services and resources like energy efficiency and renewables can decrease our bills by cutting energy waste and fuel costs.

If this isn't enough to give you a sense of the quality of this study, we'll continue to the next two bullet points.

Double digit wholesale electricity price increases in 46 states. $64 billion to replace lost power capacity serving 24 million homes. $64 billion is purportedly the amount the electricity sector would need to spend in order to make the generation mix changes to bring itself into compliance with the Clean Power Plan limits. But EVA provides no further details on how it gets to those results. What is the resulting generation mix? How much new capacity was built, and how much was retired? Did EVA take into account the rapidly declining costs of renewable energy? It's phantom math, at least until EVA can provide more details. Even then, it's hard to see how investments in cleaner energy would give rise to increases in wholesale prices as dramatic as EVA claims they will be. In fact, energy efficiency and renewable energy technologies are capital-intensive investments that then require little or no operating costs (such as fuel) - which is why study after study, from Ohio to Texas to California, has shown that these clean energy investments result in lower wholesale prices.

And, customers pay electricity bills - not retail rates, and certainly not wholesale prices. By making smart investments in energy efficiency, we can lower pollution simply by cutting energy waste, saving customers money in the process!

Lastly, EVA makes no mention of how it is accounting for allowance costs - a line item that NERA recently used to artificially inflate costs. In reality, although allowances (which represent a permit to emit 1 ton of CO2) do raise the wholesale price of electricity, that value ultimately belongs to the state. States can choose to give allowances away freely to generator, resulting in windfall profits for the industry, or states can instead require that polluters pay for the allowances - note that this does not have any impact on wholesale prices - and reinvest the revenues for customer benefit.

In the Regional Greenhouse Gas Initiative (RGGI), over 95% of the revenues from the program have been reinvested in energy efficiency and other customer benefits. As a result, a comprehensive analysis has demonstrated that customers have saved $1.5 billion on their utility bills, and the program has brought in $2.9 billion in additional economic benefit to the region! EVA's conclusions fly in the face of three well-documented relationships in the electricity sectorÂÂÂÂÂÂÂÂ:

(1) All else equal, investments in energy efficiency and renewable energy result in lower wholesale prices

(2) To the extent that wholesale prices do rise as a result of the program (due to redispatching from coal to gas, or due to allowance costs, for example), investments in energy efficiency can still result in bill savings for customers

(3) Auction revenues in a mass-based program can be reinvested for customer benefits, driving bill savings for customers and economic growth

Unfortunately, EVA does not provide us with even the first level of details regarding how they reach these conclusions. With all of these glaring errors, we would guess that EVA is likely drawing heavily upon the analysis they put together on the Clean Power Plan proposal. We cover that analysis in a separate post. For now, it's safe to say that the latest NMA/EVA work is a masterpiece of nonsense.

Thanks to my colleagues, Kevin Steinberger and Amanda Levin for their contributions to this post.