The future is looking darker for the coal industry.

Publicly-traded giants such as Alpha Natural Resources, Arch and Peabody have seen their stock prices hit historic or near-historic lows. Peabody was recently dropped from the S&P 500 index.

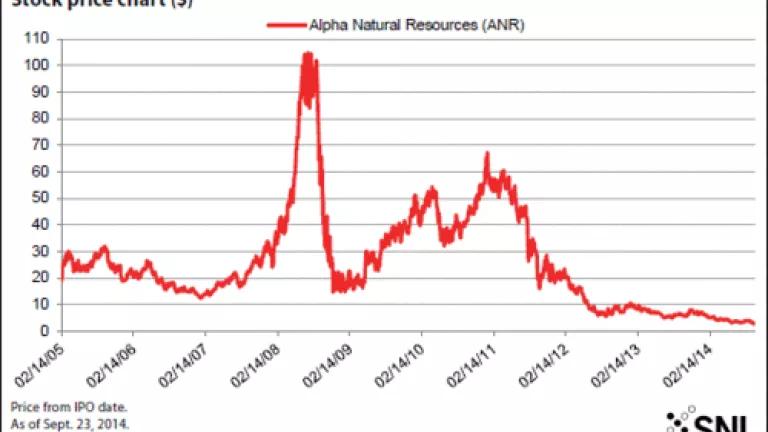

On Tuesday, Arch Coal Inc. traded at $2.32, down 83.7% from the Initial Public Offering (IPO) in 1997. On the same day, Alpha shares sunk to $2.88, down about 85.79% since their 2005 IPO.

One industry analyst summed it up early this week “The reality is that investors hate coal at the moment.” (BB&T Capital Markets Mark Levin Sept. 23 report). Mayur Sontakke In Yahoo Finance’s “Market Realist” segment on Tuesday took a broader view: “The domestic thermal coal demand could slowly become extinct.”

Or, to put it more colorfully, SNL reported that:

In a wide-ranging, powerful keynote address at an industry conference Sept. 22, Murray Energy Corp. President and CEO Robert Murray said anyone who believes the domestic coal market will recover either does not understand the business or is "smoking dope." "It isn't coming back. It's permanent," he said. "Virtually all of it is permanent."

This should be good news for our climate, which could use some, as the World Meteorological Organization reported earlier this month that the amount of greenhouse gases in the atmosphere reached a new record in 2013, propelled by a surge in levels of carbon dioxide.

The conventional wisdom has it that the influx of cheap natural gas is largely responsible for the downward spiral of coal stocks. And indeed natural gas prices over the same general period as the chart above reflect nearly the inverse. (To be clear, burning natural gas still emits a lot of carbon pollution into the atmosphere and is no solution to a planet in dire need of sharp emissions reductions.)

The Great Recession of the mid-aughts (as they say) played a role in coal company market cap as well, as factories and other large energy consumers ramped down, while shale gas supplies were exploding across the nation.

International coal markets have also seen a dramatic shift as government’s around the world—with the notable exception of India—continue to move away from the dirtiest of fuel sources. Most of this shift is due to health concerns raised by the devastating pollution caused by the large scale burning of coal. (Seen any pictures of Beijing of Shanghai recently?)

China recently indicated it will put a national cap on coal consumption. That has some analysts projecting--as BloombergBusinessweek reported Sunday--that the country could hit “peak coal” as early as next year, and that this would weigh down coal demand across the globe.

As SNL reported earlier this week:

"We believe coal demand has more or less peaked in China," wrote analysts for Jefferies LLC. "Based on our analysis, future coal demand growth will be lower than thermal power production growth, lower than power production growth, which will be lower than GDP growth."

Increased market penetration of energy efficiency and renewable energy may also have played a role in the nose dive of Big Coal's stock by eating away at demand, which is more good news for our planet.

In addition, tightened air pollution limits for toxic pollutants such as mercury, along with historic proposed standards to reduce carbon pollution from power plants, are cited for plunging coal stock prices.

Although coal still provides nearly 40 percent of power in the United States, it’s hard to believe that as recently as 2007 there were about 150 new coal fired power plants proposed across the nation. Pretty much all of those are now dead.

Markets have also realized that coal companies such as Arch, Alpha, Peabody and Cloud Peak Energy were pretty much smoking dope when they painted pictures of bottom lines bulged by a massive growth in exports to Asia. That coal would come largely from mines in the Powder River Basin of Wyoming and Montana. Exporting more coal would mean more coal export facilities, and six new ones were planned in the Pacific North West. But four of those port projects are already dead or on indefinite hold, and the two remaining ones are in Washington State, where Governor Jay Inslee is no fan.

Another thing investors may be factoring in to coal stock valuations is the Social Cost of Carbon, which the Obama Administration has calculated based on a host of economic, ecological, environmental and health impacts of carbon pollution. The Administration estimated that cost to be about $37 a ton. And that cost became much more real when a federal judge in Colorado this summer denied an Arch coal mine permit, ruling that Bureau of Land Management had failed to (adequately) address the social cost of carbon in its environmental impact analysis. The landmark decision could well have a chilling effect on future coal mining permits.

All in all, that’s a lot of bad news for coal, and hopefully good news for our planet.