Last week, gasoline prices soared once again to an average of $3.87/gallon nationally. With drivers paying on average $60 to fill up their tank, it’s no wonder that consumers are feeling gouged. But how much is Big Oil profiting from your pain exactly?

The answer to this basic question is well, actually, pretty tough to find out. It requires sifting through various oil company annual financial reports (10Ks), talking to oil industry consultants, and mining some publically available data and sources. Well, we’ve done it and the results are as follows:

For the month of February 2012 (averaging $3.58 per gallon), we estimate that:

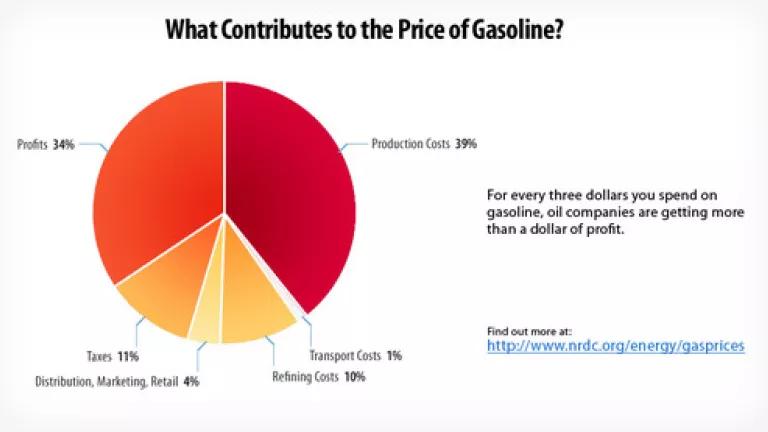

- For every three dollars you spent on gasoline, oil companies are getting more than a dollar of profit.[1]

- That means on average, 34% of what you paid or $1.22/gallon, goes to pad the bottom line of oil companies.

- The vast majority of this amount ($1.12/gallon) went to those who produce the crude oil, the main ingredient to make gasoline. That’s the ExxonMobils and Shells of the world.

- About $0.05/gallon is profit for refineries turning that crude oil into gasoline. That’s the ExxonMobil and Shell’s of the world as well.

- And that gas station of yours? Well the retailers (including distributors and marketers) on average made about $0.04/gallon in profit. Some of these are the oil companies of the world, but many of these are independently-owned and operated stations who make more money selling candy and hot dogs than gasoline.

- Those oil tankers and pipelines? They make about $0.01/gallon in profit. Many of these are owned by the oil companies as well.

Maybe $1.22 per gallon profit doesn't sound like much, until you realize that if you’re part of the average household in the U.S you own two cars and purchase roughly 100 gallons of gasoline per month. At last month's prices, this would mean the average household paid $125 in oil industry profits out of their average $366 fuel bill.[2]

Sadly, some are still misleading the public that “drill here, drill now” will somehow reduce gasoline prices. But the real factors driving up gasoline prices were well explained in this video by the Washington Post below. (I note that their breakdowns are for January 2012, as opposed to ours which are for February 2012.)

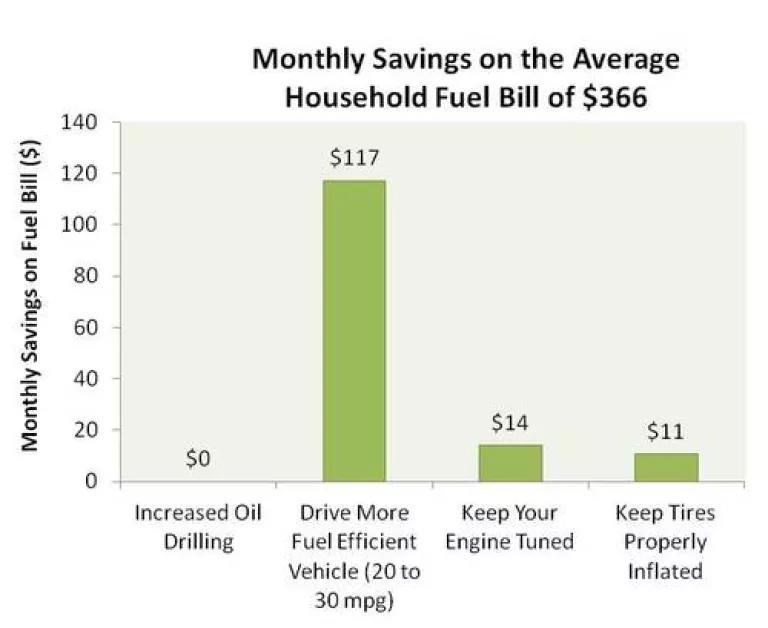

As shown below, driving a more fuel efficient vehicle, tuning up the engine, and keeping tires inflated would all save an individual driver far more at the pump than drilling ever could.[3]

Adding more drilling only increases the oil industry’s profits. How much more? One million barrels per day of additional drilling results in roughly $20 billion in profits going to the oil industry, every year. [4] That’s more than enough to pay for every single car and truck in the U.S. to get a tune-up, every year.[5]

Unfortunately, the oil industry and their drilling cheerleaders continue to try to sell this lemon to the public. Let’s make sure we don’t become the suckers by knowing who really pays and who really profits.

[1] This is calculated based on EBT (earnings before taxes) where possible. For transportation costs and retail costs, gross margins were used due to lack of sufficient data. The full methodology is described here.

Gasoline Profit Margin Breakdowns_final.pdf

[2] The estimate is based on data from the U.S. Department of Energy, Transportation Energy Data Book, 30th Edition, June 2011.(Tables 4.1, 4.2, and 8.1). Latest data available represents 2009 fuel consumption and fuel economy levels. Data available at http://cta.ornl.gov/data

[3] Calculation assumes numbers based on the U.S. DOE data above. An average fuel ecnomy improvement of 20.4 mpg (2009 estimated U.S. average) to 30 mpg. The average househodl drives 2,088 miles per month (The Polk Company and U.S. Census Bureau data). The fuel economy benefits from keeping your engine tuned and keeping tires properly inflated are based on estimates from the U.S. Department of Energy (http://www.fueleconomy.gov/feg/maintain.shtml).

[4] It is assumed that one million barrels per day results in roughly 16 billion gallons of finished petroleum product, assuming each barrel of crude oil results in 1.05 barrels of finished product due to refinery gains. Products are nominally assumed to have a $1.22/gallon profit through the entire production chain.

[5] This assumes 250 million cars and light trucks on the road, with a tune-up cost of about $80 on average. http://www.autos.com/car-maintenance/how-much-does-a-car-tune-up-cost.