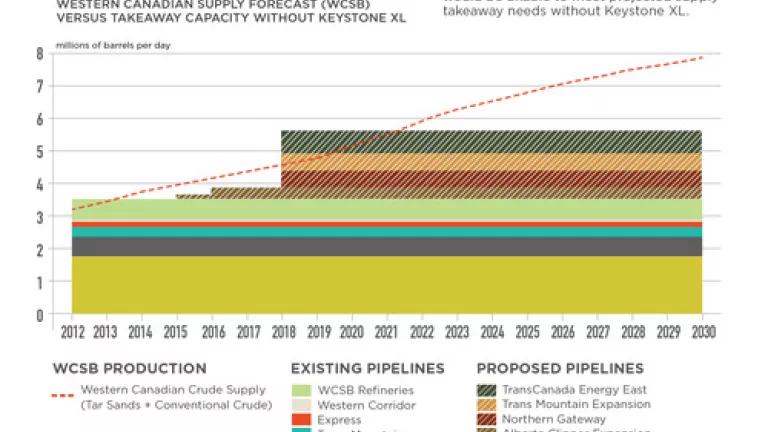

Tar sands expansion projects and associated climate emissions waiting on Keystone XL decision

While the tar sands industry has announced nearly 10 million barrels worth of production projects – a plan with an enormous carbon footprint – that new growth is dependent on whether industry can cobble together the transportation options from land-locked Alberta.[1] Limited pipeline capacity is becoming a major obstacle to the tar sands industry’s massive expansion plan, as the existing pipeline network does not have the capacity to transport the 3.1 million bpd of current tar sands production and tar sands projects which are currently in construction and will come online in the next couple of years. Keystone XL’s capacity of 830,000 bpd is a significant step towards this goal.[2] As industry scrambles to find expensive alternative transport for the tar sands production growth which is already locked in, new tar sands expansion projects (comprising over 6.5 million bpd in additional production) are waiting in the wings. It is by no means certain these growth projects will move ahead. [3] Approving Keystone XL would send the signal that many tar sands producers are waiting for to move their projects to the construction phase by assuring industry a significant new, low cost transportation. President Obama’s announcement that Keystone XL’s impact on carbon emissions would be a threshold issue on his administration’s decision on the project has focused attention on the project’s impact on carbon intensive tar sands production. As investment banks and industry recognize, Keystone XL is a linchpin for tar sands expansion and the significant carbon pollution associated with it, and should be rejected on that basis.

Setting the context: Land-locked tar sands production and limited pipeline capacity

The tar sands industry is hitting a wall. The tar sands industry, landlocked in northern Alberta, does not have sufficient export pipeline capacity to transport both the province’s 1.2 million bpd of conventional production and the combination of 3.1 million bpd of existing tar sands production and the tar sands projects which are in construction (to come online by 2017).[4] Existing tar sands operations produce about 2.2 million bpd while new projects currently under construction will add an additional 860,000 bpd of production by 2017.[5] So regardless of whether Keystone XL is approved or rejected, in 2015 the Albertan tar sands industry will be looking to line up alternative transportation options for nearly half a million bpd. If Keystone XL or the Alberta Clipper expansion doesn’t move ahead, this gap will approach a million bpd by 2017.

The truth about the tar sands industry’s pursuit of rail and barge alternatives

The tar sands industry may be dipping its toes in more expensive transportation alternative such as rail and barge but there are hard realities about the likelihood that these alternatives will replace pipelines. Small rail facilities are filling a niche created as tar sands producers, expecting Keystone XL to be operational in late 2013, moved production projects to the construction phase. As these projects come online in 2014 and 2015, there will not be pipeline sufficient capacity for them. These producers, which have already paid a significant sunk cost in their project, will pay a premium for more expensive transport alternatives to avoid the more expensive proposition of having their tar sands production shut in.

However, there is little evidence to suggest that rail or barge will replace pipelines to facilitate the massive tar sands expansion plan underway. Given the expense and thin margins associated with producing tar sands crude, companies will think twice before green-lighting new tar sands production projects in an environment where sufficient pipeline capacity isn’t assured. The companies considering whether to move forward with new tar sands production projects may be more discerning, as they are not locked into the project by a significant sunk investment in infrastructure.

Pipelines like Keystone XL far more likely to enable growth of tar sands production (according to industry)

In fact, with dozens of expansion projects amounting to 6.5 million bpd in tar sands production on the sidelines, there is already evidence that companies are thinking twice. Tar sands producers have acknowledged to their investors that pipeline access is critical to the profitability and expansion of their operations. Here are just a few statements by four tar sands producers which between them have proposed over 1.6 million bpd of expansion projects which have yet to proceed to the construction phase:

Cenovus, which has proposed 512,000 bpd of tar sands expansion proposals:

“Our ability to efficiently access end markets may be affected by insufficient transportation capacity for our production. . . . Transportation restrictions [may] in extreme situations, [lead to] production curtailment [with the greatest risk of impact being in] our crude oil production. . . .We anticipate transportation constraints will continue in the near term. The Keystone Xl project and the Northern Gateway Pipeline project, if approved, will benefit heavy oil producers.” Cenovus, 2012 Annual Report

Imperial Oil, which has proposed 260,000 bpd of tar sands expansion proposals:

“Industry bitumen production may be subject to limits on transportation capacity to markets. A significant portion of the company’s upstream production is bitumen. The company’s longer-term oil sands development plans, results of operations and cash flow may be adversely affected if, for regulatory or other reasons, necessary additional transportation infrastructure is not added in a timely fashion.” Imperial Oil, 2012 Annual Financial Statement

Syncrude, which has proposed 678,000 bpd of tar sands expansion projects:

“The entire industry is experiencing a lack of pipeline transportation to markets across North America, and this is having a significant impact on the price producers receive for their crude oil, including our SCO.” Syncrude, 2012 Annual Report

Suncor, which has proposed 200,000 bpd on tar sands expansion projects:

“Constrained market access for oil sands production due to insufficient pipeline takeaway capacity, growing inland production and refinery outages create risk or widening differentials or shut-in of production that could have a material adverse effect on our business . . . .Pipeline capacity constraints combined with plant capacity constraints could negatively impact our ability to produce at capacity levels.” Suncor, 2012 Annual Report

Industry is well aware that Keystone XL is a critical linchpin for tar sands expansion. Over two thirds of proposed tar sands expansion projects have yet to move toward that critical construction phase and then into operation. Industry wants to get many of these projects off the sidelines and into production in order to realize its tar sands production goal of 6.6 million bpd by 2030. This plan comes at a tremendous cost to the climate. But to achieve this goal, the tar sands industry needs Keystone XL. Keystone XL is inextricably linked to the tar sands industry’s expansion plans and the significant carbon emissions associated with it

[1] In addition to 2.2 million bpd of existing production, tar sands producers have announced 7.36 million bpd in expansion projects, 860,000 bpd of which are in construction; 2.4 million bpd have been approved; 2.3 million are pending approval; and 1.8 million have been announced. Oilsands Review, Volume 8, Number 10 (September 2013).

[2] Id.

[3] Id.

[4] Id.

[5] Id.