Those interested in investing the solar industry may want to check out a recent NREL report on the topic: “A Historical Analysis of Investment in Solar Energy Technologies”.

The report analyzes global investment growth patterns in order to shed light on how the solar industry is developing, and offer a hint of future developments over the next few years. It’s an information-packed read. I will try to summarize some of its conclusions and tease out a few additional thoughts below, although I recommend a full read of the report for those interested.

Global Solar Investment

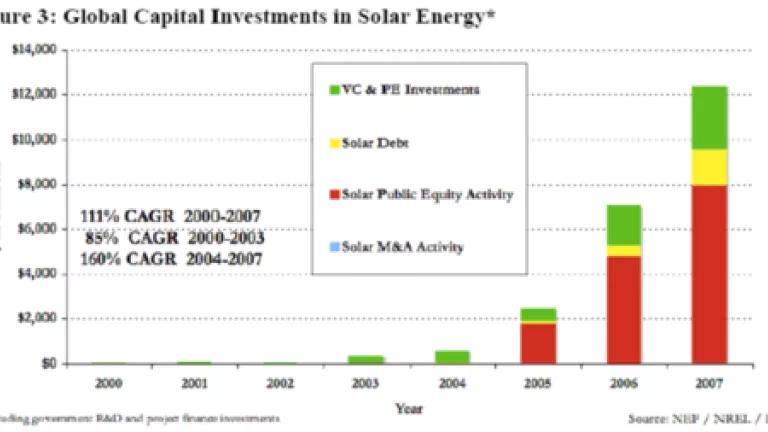

It may not be news to anyone following this space, but the numbers in this report provide ample evidence. Over the past 8 years, growth in solar capital investments (VC, PE, debt, public equity and M&A) has been astounding, rising from $66 million in 2000 to $12.4 billion in 2007.

[all charts taken from NREL report linked above]

The period from 2004 to 2007 saw almost 20-fold growth alone. Per the report, 2 main drivers have caused this explosion in growth – increasing demand for all things solar and a readily available supply. First, projected cost reductions of solar technologies have been increasingly accepted by a growing mainstream of investors, entrepreneurs and policymakers. These cost reductions point to a form of grid parity in the near future (on at least a retail basis, given location specific planning) and thus, the possibility of an extremely large market for solar. This conclusion has drawn extensive interest from all types of investors. Second, 30 years of solar R&D has provided (finally) sufficient availability of market-ready solar technologies.

As seen above, most of this global investment increase has been through public and private equity and VC. U.S. investments (chart not shown) demonstrate a similar pattern, with 2007 investment now at $3.2 billion. U.S. government solar R&D spending, which had represented 50% of total investment in the U.S. solar sector from 2000-2004, now accounts for less than 4% of total investment. Given this surfeit of private investment in solar (with accompanying innovation potential) it is important that we be as targeted and strategic as possible about where government solar R&D spending occurs.

Venture Capital Investments

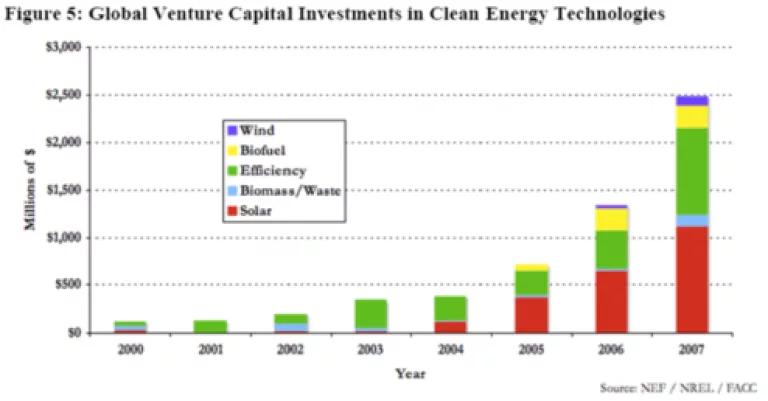

An review of recent global VC investment in solar offers additional insights. First, solar continues to receive the majority of cleantech VC, which points to a potentially large pipeline of future solar innovation.

However, given the longer timelines of traditional VC investment (exits not expected for up to 8-10 years), the results of this solar investment may not hit the market for another several years.

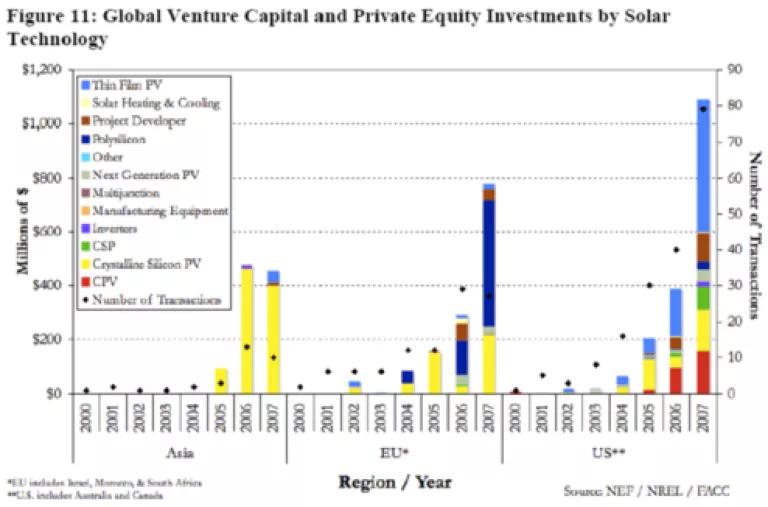

Investment by Region

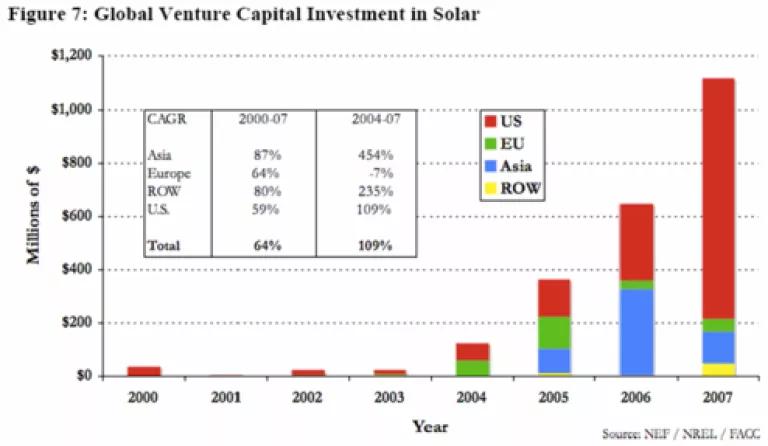

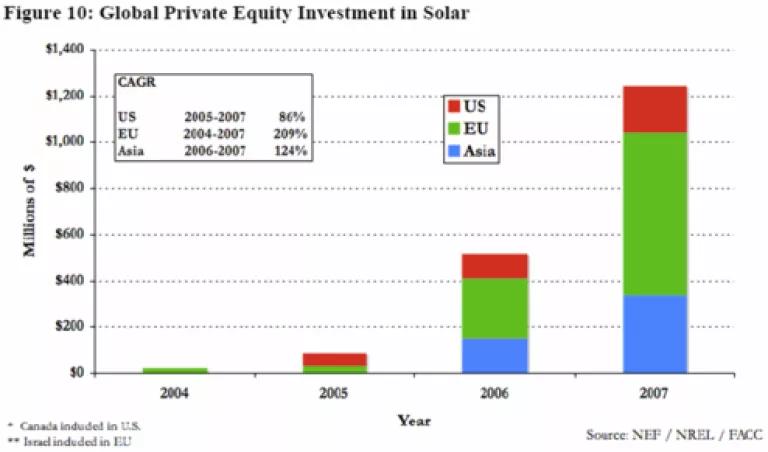

Regional differences in investment could have far reaching consequences for the development of the solar industry. As seen below, most VC investment is occurring in the U.S., while Europe and Asia are seeing mainly private equity capital. In other words, Europe and Asian investments in solar are being made with an eye towards the now, while U.S. investments are happening with an eye towards the future.

Private equity investment has been especially concentrated in Europe. This has been used to build a solid solar manufacturing base in order to respond to increasing European demand for solar (brought on by generous incentives and high electricity prices). Asia has similarly concentrated on manufacturing. By comparison, most U.S. investment has been through venture capital.

This could have significant ramifications in the next 10 years. While the next generation of solar technologies has a greater likelihood of emanating from the U.S., we will be at somewhat of a disadvantage in bringing these technologies to scale relative to the Europeans and Asians. Given the “green jobs” goals of current proposed legislation (stimulus, climate and energy) in the U.S., this may be something to watch.

It is also informative to see which technologies current investment is being targeted towards:

Here, the regional focus is even more striking. Note that Asian investment is primarily for manufacturers of crystalline silicon PV, while Europeans have focused exclusively on c-Si PV and polysilicon production. The U.S., especially in the past 2 years, has invested in a broad range of mostly next generation solar technologies. Again, this seems further evidence of the conclusion presented above – that Europeans and Asians are on the whole investing for the now, while the U.S. is focused on the future. Of course, this does not preclude Europe or Asia from future investment in solar innovation. But it does indicate that demand for solar must remain high in the foreseeable future for these U.S. investments to bear fruit.

Solar Millionaires?

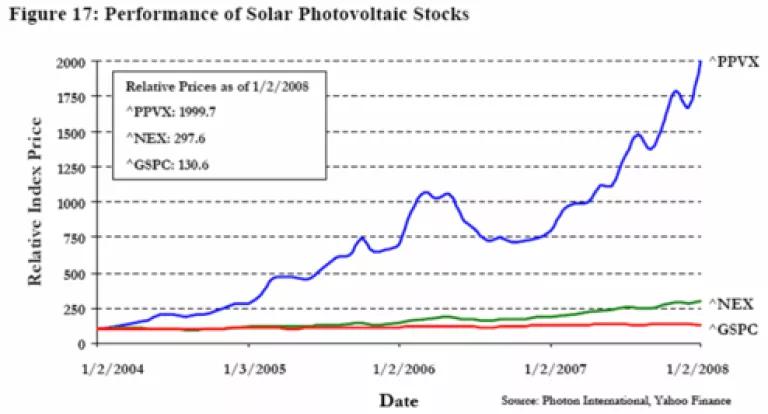

Finally, it is worth looking at the extreme differences in public equity valuations for photovoltaic solar stocks compared to other clean energy companies.

The chart above compares a PV solar index (PPVX) with a broader clean energy index (NEX) and the S&P 500. Unfortunately, current valuations are not available in this report, but it is definitely worth considering that with each index set at 100 in 2004, investment in solar would have provided a 20X return, compared to 3X for a collection of clean energy stocks and 1.3X for the S&P 500. Whether this is a good or bad sign (ie demonstrating the tremendous opportunity of solar, or a huge bubble), I leave to the experts.