Making panels where the sun shines: How India's solar manufacturing policy can more effectively support the National Solar Mission

NRDC recently released our interim report “Laying the Foundation for a Bright Future”, which assesses the progress under Phase 1 of India’s National Solar Mission (NSM) through three main themes – bankability and financing of solar projects, solar manufacturing, and the enabling environment for solar in India. The NSM has created ripples in the domestic and international solar markets. One of the NSM’s ambitious goals is to promote manufacturing as a means to support and benefit from a burgeoning solar market. But the Mission’s current policy needs to be improved to be more effective.

In this two-part series, I will discuss our findings and key recommendations on the NSM’s solar manufacturing policies. This first post focuses on what the NSM set out to do and emerging shortcomings. The next part will delve more into some of our recommendations for a more effective policy.

The vision and high-level goals of the NSM are best set out in its Mission Document, which contemplates some of the policy tools to achieve the goals, but does not implement these per se. The Mission Guidelines (released later) for Phase 1 and Phase 2 implement some of these policy tools. The Solar Mission’s two overall manufacturing objectives are:

- To transform India into a solar energy hub, making it a global leader in low-cost, high-quality solar manufacturing across the value chain. The goals envision 4 – 5 GW of installed production capacity by 2020, including silicon raw materials and device production. However, the NSM seeks to be technology-neutral and defer instead to the market to determine technologies.

- To craft a policy and regulatory environment that would incentivize the creation of such a manufacturing hub, such as by investing in Research & Development (R&D) and providing customs duty exemptions for raw materials.

The centerpiece of the NSM’s manufacturing strategy is the Domestic Content Requirement (DCR). The DCR required that for batch 1 of Phase 1, silicon photovoltaic (PV) modules be manufactured in India; this was ratcheted up for batch 2, requiring both silicon modules and cells be manufactured in India. Thin film PV technologies were exempted from the DCR.

To be clear, the NSM is in its early stages yet. It is two years into a multi-phase, 12-year strategy, which was always intended to start slow, learn by doing, and ramp up in a timely fashion. But how has the NSM executed on its ambitious goals so far?

I was in India recently, including at the Intersolar India conference in Mumbai where the excitement around solar was palpable. Our team met with a large number of companies, industry groups, banks, NGOs and other stakeholders to discuss the NSM’s progress.

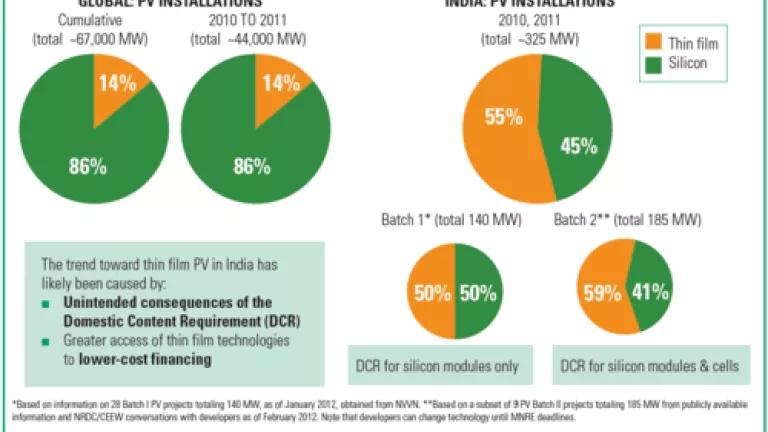

Based on stakeholder discussions and the observed thin-film dominance of India’s solar market, the DCR has not been effective. With the benefit of hindsight, an unintended weakness in the DCR’s design was the thin-film exemption, which incidentally was at odds with the Mission’s stated desire to be technology-neutral. The DCR has led to a technology bias towards thin-film, and related ramifications. The global fraction of installed PV that is thin film is about 15 percent. By contrast, the corresponding fraction was exactly 50 percent for batch 1, and exceeded 50 percent for batch 2 (see figure below). The purported suitability of thin film panels to Indian solar and weather conditions may have had a small role to play in this. But the main driver of this trend was the availability of foreign thin film products that were cheaper than silicon products required to be manufactured India. Access to lower cost financing from outside India also contributed significantly to this effect. (India’s loan-borrowing rates are typically above 12 percent, while foreign borrowing rates are typically 10 percent or lower).

The DCR’s intent is clear – to promote the development of silicon manufacturing in India, in alignment with the Mission’s intent. However, the DCR as designed may have unintentionally had almost the opposite effect. While capital investments in manufacturing have occurred, Indian silicon manufacturers have seen very few orders for their products, creating considerable unused production capacity at their factories, thus hurting manufacturers’ viability.

Finally, in almost solely relying on a DCR, the Indian Government has not developed a comprehensive and well-integrated strategy, which has a long-term vision complemented with near-term actions, and covers the entire manufacturing supply chain for solar (including ancillary equipment). There have only been piecemeal investments in R&D and manufacturing incentives through customs duties, although some of these are quite commendable in their own right. A more coordinated plan is needed.

In my next blog, I will cover the benefits of manufacturing in the Indian solar context, and how the NSM’s policy towards manufacturing could be adjusted to be more effective.