Dominion’s Rising Cost to Virginia's Economy and Environment

Observers in the energy regulatory world were shocked last week at the finding of a staggering $277 million in overcollections by Dominion, the state’s largest regulated monopoly.

Something is amiss in Virginia.

That “overearning” is how much Dominion collected from its Virginia customers in 2018 alone, beyond what Dominion’s regulators at the State Corporation Commission (SCC) determined is sufficient to keep Dominion in business and profitable, in a way that is fair to both captive customers and shareholders. To put that overcollection in perspective, the average Dominion customer in Virginia gave an extra $113 into her 2018 Dominion bills, a massive transfer of Virginia wealth directly to Dominion’s bottom line.

If this opulent overcollection by Dominion were a one-time, easily corrected accounting hiccup, perhaps we could all simply cross our fingers that the SCC would summarily issue a refund and move on with our lives. However, those overcollections are on top of a nearly 30% bill increase over one decade, with significantly more bill increases Dominion hopes to add in the near future. All of these bill increases across the state make statewide household electric bills among the top ten highest in the nation. (Dominion’s “low rates” no longer register because “rates” now comprise the minority of the monthly bill Dominion customers pay.)

That larger trend of steadily increasing Dominion bills, with no end in sight, is what makes Dominion’s dramatic overcollections in 2018 truly shock the conscience. Rising bills are particularly striking, when in the wider energy market of which Virginia is a part, electricity costs have significantly declined, in contrast to Dominion’s steady drumbeat of increases and overcollections.

Dominion’s Increasing Bills and Overcollections Are Only Part of the Story

If the disparity of rising Dominion costs despite falling electricity prices elsewhere weren’t enough cognitive dissonance, next week, in a somewhat absurd bit of regulatory timing, Dominion will ask that the SCC approve another profit booster, by knocking its allowed “return on equity” profits up by 17% (from the current 9.2%, to 10.75%). (“Return on equity” is the allowed “extra” revenue Dominion may collect from its customers via monthly electric bills, above and beyond the all-in cost of providing the electricity each customer receives, to ensure that Dominion remains a going concern, capable of attracting sufficient equity investment.)

Many stakeholders have rightly opposed this request by Dominion to goose its profit levels even further, and rightly so: largely by relying on its captive Virginia customers, Dominion Energy has already transformed itself into one of the most profitable energy utilities in the nation, with that profitability rising right alongside increasing customer bills. In the same decade that Dominion’s bills increased by nearly 30% (2007-2017), so too did its profitability increase by an even greater percentage over that same period,while its ROE in 2017 reached nearly as high as a whopping 17%.

To be fair, our regulated electric companies absolutely should (and indeed must) be profitable, both to keep the lights on and to ensure investment in the best technology for customers. However, the concurrence of Dominion’s eyebrow-raising profit levels with steadily rising bills indicates something is out of whack.

Dominion itself made clear this unhealthy dynamic of rising profits alongside rising electric bills, in its recent Wall Street “Investor Day” pitch, a spending plan that could result nearly $30 per month in additional charges that Dominion customers may see tacked onto their bills in the next few years. That nearly $350 annual bill increase for Dominion customers would underwrite Dominion’s Wall Street-facing growth plan, in which Dominion touts a raft of top-dollar projects it wants Virginians to pay for. Those $17 billion projects (several of which could only be described as boondoggles), if Dominion is successful next week in its request of the SCC to increase its profitability, would also generate a 10.75% profit, also directly funded by Virginians’ electric bills.

For folks in Virginia that just want to turn their lights on as cheaply and as cleanly as possible, this is an awful lot of money to be sloshing around: $277 million in 2018’s overcollections transferred from everyday Virginians to Dominion’s balance sheet; Dominion’s request next week to boost profits by 17%; the nearly 30% Dominion bill increase over the decade between 2007 and 2017; touting Virginia electric bills to Wall Street as a $17 billion cash cow. This pattern makes it clear that in Virginia’s regulatory environment, something has to give.

Because it is unfair, unreasonable, and unequitable for everyday Virginians, particularly our fixed and low-income citizens, to underwrite such massive costs and profits, for something as straightforward (if essential) as providing electric service.

It’s important to note that it’s not all bad news. Dominion does deserve credit for some fledgling innovations in finding ways to lower both customer bills and pollution. These efforts include: an expanding effort to deliver energy efficiency technology to its customers; innovative rate structures to shift power use away from costly and polluting “peaks”; and deployment of smart meters to more efficiently use electricity and deliver customer-owned solar energy to the grid. And to foster that progress, and to keep the lights on in general, Dominion is clearly comprised of smart, dedicated employees who are and should be proud to work at a very well-run (if misguided) company.

However, those silver linings are overshadowed by the company’s increasingly narrow orientation to Wall Street and its shareholders, rather than to their fellow Virginians Dominion could far better serve.

Indeed, this current disfavoring of Virginians to the benefit of shareholders is significant enough to lead many to conclude that overpriced monopolies like Dominion must be broken apart. Given the dramatic excesses described above, that is certainly an understandable conclusion. However, societal and economic gains can be had by a well-designed monopoly utility model, one that includes diligent and circumspect oversight by regulators immune to utility influence. Utilities like Dominion, when combined with that strong, sensible oversight and appropriate incentives, are arguably in the best position to deliver the sweeping technological advances that society deems important, even essential, such as clean renewable energy and efficiency technology that lower pollution, tackle climate change, and strengthen our economy. These societal benefits might not be as efficiently delivered in a fully deregulated market. So it is for those kinds of societal benefits that we absolutely do want monopoly utilities to be profitable and, yes, attractive to Wall Street in a way that enables healthy investment, not just for Dominion, but for all Virginians. In other words, our system in Virginia can be made to be effective at delivering lower cost electricity and lower pollution.

In the meantime, many in Virginia simply long for Dominion to go back to its roots as a homegrown Virginia company that can be trusted to look out first for Virginia’s own best interests.

Virginians’ Pocketbooks Are Not the Only Casualty of Dominion’s Profit Model

The perverse financial imperatives that have taken Dominion Energy so far from its Virginia-centric roots have had another costly impact: concurrent with what may prove to be an entire generation of ceaseless bill increases, Dominion’s business model is also bad for Virginia’s environment.

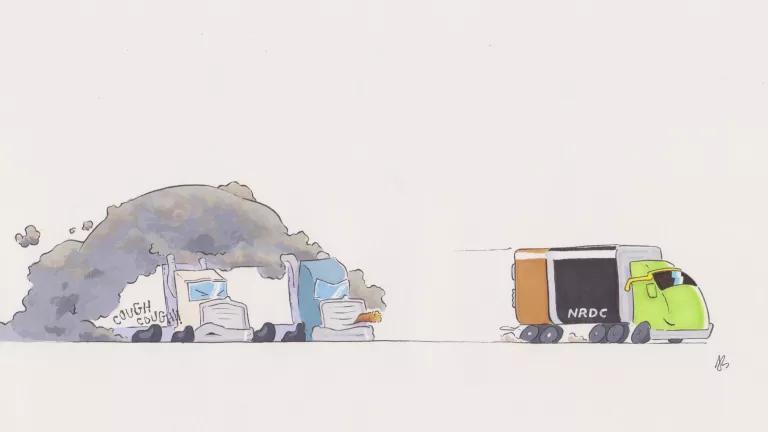

Dominion is poised to increase its carbon pollution, the primary driver of climate change, at the very moment every dashboard indicator is urgently flashing at us to decrease our carbon pollution. Dominion’s increase in carbon pollution is particularly striking, given climate change's unique impact on the Commonwealth today, already lapping at our coast with costly sea-level rise and making our weather weird, uncomfortable, and extreme.

But instead of seeking to protect their home state’s welfare and economy by lowering its carbon pollution, Dominion has gone steadily in the opposite direction and in a wide variety of ways: it recently completed a decade-long spree of building or rebuilding eight carbon-intensive coal-burning, gas-burning, and wood-burning power plants. In addition to those eight plants, Dominion plans to build 10 more fossil fuel units in the next six years. They also recently requested SCC approval of customer subsidies to prop up four coal and wood-burning plants, that are otherwise insufficiently economic to robustly compete on their own. And in what would potentially be their biggest carbon bomb of all, Dominion hopes to jumpstart their customer-subsidized, but still stalled 600-mile fracked gas Atlantic Coast Pipeline, a massive exhaust pipe that no one wanted, needed, or asked for.

And despite the current and growing threat of climate change that each of these projects will worsen, Dominion even stands in opposition to Virginia’s commonsense climate action plan, recently completed by the Department of Environmental Quality, an action that will keep Virginia on track even as the Trump administration tries to march the rest of the country backward. The DEQ’s smart, already-proven approach will rein in, by at least 30%, the destructive carbon pollution that power plants currently release in unlimited amounts. And yet, Dominion is opposed to even that modest measure.

Dominion’s damning record on the clear and present threat of climate change, just like the ongoing and dramatic cost increases shouldered by Virginia customers, is a resounding strike against Dominion. This is doubly true when one considers Dominion’s unique position, as our largest utility and biggest polluter, to instead make significant progress on both pollution and cost reductions. Dominion can and must do better for the fellow Virginians who are unique threatened by the costly climate change that Dominion, without a course correction, proposes to worsen.

Dominion certainly deserves credit for increasing its share of renewables and for directly lowering its pollution by modestly increasing deployment of energy efficiency technology. However, its ongoing spree to build or rebuild at least a whopping 18 carbon-belching units in just 15 years, as well as a fracked gas pipeline, coupled with their opposition to Virginia’s proactive approach to rein in carbon pollution, indicates that this once venerated Virginia utility may be losing its way. Rather than asking Virginians to pay more just to pollute more, what’s wrong with Dominion Energy simply being the trusty, and even endearingly sleepy, local utility known as VEPCO?

Being profitable and trusted are not mutually exclusive. Dominion can therefore be a thriving and profitable utility that dramatically reduces carbon pollution and monthly electric bills, with no need for grabbing at higher ROEs, unneeded pipelines, and multi-hundred-million dollar overcollections. But we’ll get to those promising opportunities for Dominion and policymakers to do the right thing in our third installment.

How We Got Here, and Where We Go from Here

For now, now that we’ve identified the “what” of our overly-expensive, overly-pollutive power company, our next installment will look at the “why” and “how” we got to such a surreal and costly juncture, a bizzaro regulatory scheme that is unfortunately wholly unique to Virginia.

Sometimes when you’re stuck in a very costly ditch, you need to just get out of the car and look at the big picture. Because just as so many Virginians want clean, reliable power that’s good for our pocketbooks and our environment, so too does Dominion surely desire a return to true service to Virginia, rather than controversy and rancor, so it can be a trusted partner that can grow—rather than sap—Virginia’s fortunes.