Building the Foundation for Industrial Decarbonization

In 2023, the U.S. government sent a strong signal for decarbonization of industry that caught the eye of private investors. 2024 will be the year to build.

Slag piles at a US Steel plant on Zug Island in River Rouge, Michigan

This blog is part of NRDC’s year-end series reviewing 2023 climate and clean energy developments.

It’s a heavy lift to decarbonize heavy industry. This year, there were several important developments advancing the production of low-carbon industrial materials, but it will be essential to continue the momentum in 2024 and beyond. Heavy industry produces many of the products and materials we rely on like cement, steel, and aluminum. These materials are critical for schools, cars, bridges, and day-to-day life, and are particularly necessary to develop the clean energy infrastructure we need like wind turbines, solar panels, and electric vehicles.

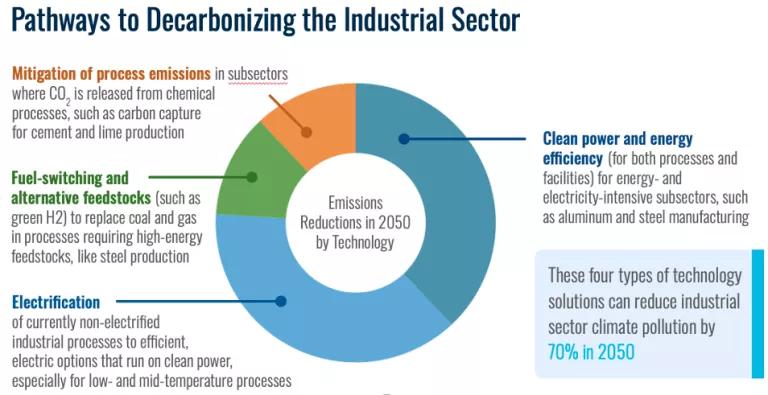

But their creation currently comes at a climate cost. The manufacturing processes by which many industrial materials are made require very high temperatures and immense amounts of energy. In the U.S., heavy industry is responsible for roughly one-quarter of economy-wide greenhouse gases (GHGs) and that percentage is expected to increase through 2050 -- the timeframe by when scientists tell us the global economy must achieve net-zero emissions if we are to avoid the worst consequences of climate change. Under business as usual, the industrial sector is on track to become the largest source of U.S. GHG emissions within the decade. Globally, by midcentury, GHG emissions from the industrial sector could exceed all emissions from power, transportation, and buildings combined, absent interventions.

The good news is that there are interventions available to us. And in 2023 the U.S. took several big steps forward to develop technologies and build a strong marketplace for cleaner materials.

Funding innovation and demonstrating tech

The key to deeply decarbonizing the industrial sector lies with the innovation: We must develop and commercialize emerging technologies that hold the potential to transform industrial production. In contrast, most industrial decarbonization efforts to-date have focused on low- to no-cost interventions—such as energy efficiency or the electrification of auxiliary processes—that are worthwhile to pursue but will ultimately only marginally reduce emissions from carbon-intensive industries like steel and cement. Fortunately, the Inflation Reduction Act (IRA) and Bipartisan Infrastructure Law (BIL) included significant and much-needed support for the demonstration of transformative technologies, and the U.S. Department of Energy (DOE) laid the groundwork in 2023 for distributing more than $6 billion in investments for such projects.

More specifically, DOE’s Office of Clean Energy Demonstrations (OCED) sought applications for demonstration projects in critical sectors like steel, cement, and aluminum, which require advanced technologies to deeply decarbonize. As the name suggests, this office is tasked with demonstrating emerging technologies that can decarbonize supply chains from materials to energy systems.

Along with partners, NRDC weighed in to shape the process through which DOE will award these funds, and encourage DOE to prioritize early-stage deployments of advanced, pre-commercial technologies that have the potential to significantly reduce or even eliminate emissions from industrial manufacturing.

Most emissions from heavy industry stem from two sources: process emissions, which include unavoidable chemical reactions induced in the creation of certain materials; and fuel emissions, which come from the energy sources used to generate materials. Solutions to our industrial carbon problem will require innovation on both sides of the emissions equation.

NRDC

Given the long time-horizons for building or retrofitting industrial sites, it is essential that we proceed full speed ahead with developing the transformative technologies of tomorrow and advancing policies to encourage their uptake. For example, we have yet to see technologies like electrified cement kilns or inert anodes in aluminum at scale, and the necessary technologies of 2030, 2040, and beyond demands extraordinary effort now to demonstrate their viability and gather market forces to invest and scale.

While promising, several of the technologies being considered—like hydrogen-based iron and steel production or carbon capture for cement facilities—still face significant project risks. To help mitigate that across the economy and ensure that we develop today the decarbonization toolset of tomorrow, it’s important that OCED and other demonstration programs diversify the portfolio of technologies and industries addressed.

In 2024, we hope to continue accelerating this work and bringing solutions to the fore. 2024 will be a critical inflection point as companies consider if and how to take advantage of unprecedented but short-lived federal funding (funding for several critical federal programs expires by 2026). Keep an eye out for OCED’s announcement of awardees of the Industrial Demonstrations Program early in 2024, which provides up to a 50 percent cost-share for big decarbonization projects.

Recent trends paint a promising picture from private investments as well. Venture capitalists and private equity firms poured close to $3 billion in heavy industry decarbonization, largely driven by the steel sector. This is all an incredibly important step in the right direction, though just an initial step since reaching net zero in heavy industry by 2050 could require around a trillion dollars in capital expenditures.

Buying cleaner products

In order to succeed at decarbonizing heavy industry, the hard work of remaking our industrial processes and piloting new technologies at scale has to be matched with buyers ready to purchase low-carbon materials and put them to use. In 2022 we saw early momentum from federal agencies and states moving forward on Buy Clean plans.

This year, we saw stakeholders and leaders begin to drill down on the details and build programs to standardize the reporting and accounting of emissions in building materials. The General Services Administration (GSA), the federal government’s procurer of goods and services, ran a six-month pilot of eleven projects buying cleaner concrete, steel, glass and asphalt. The pilot helped gain market insight and finesse how GSA will spend its $2 billion for lower carbon materials across 150 federal building projects.

States, too, are taking action to spur demand for cleaner materials. In California in August, the state’s Building Standards Commission unanimously voted to adopt mandatory embodied carbon requirements for new large commercial buildings in CALGreen, the state’s green building code. This is a big step forward, and a model for other states. The emissions associated with the production of materials used in the built environment, known as “embodied carbon,” are estimated to contribute up to 11% of all global energy-related carbon emissions and a significant portion of California’s emissions.

As we found in our report on California’s new standards, public procurement is one of the most cost-effective policies we have to bring low-carbon materials to the market. California’s net-zero cement law, SB 596, requires cement used in California to be net-zero greenhouse gas emissions by 2045. Public procurement can play a key role in bringing to market technologies—like novel supplementary cementitious materials—that will be instrumental to decarbonizing the sector and meeting SB 596’s targets.

Tackling trade

We cannot make meaningful progress on industrial decarbonization without considering the international trade dynamics in these sectors. Domestic investment in decarbonization of industry is crucial but insufficient on its own. The global market for industrial materials is massive and complex, so we need smart trade policy that centers and properly accounts for the climate, health, and financial impact of carbon pollution to help move the needle on emissions from heavy industry.

Industrial decarbonization—at least early on—often involves a green premium, a higher cost for first movers on new, low-carbon products. Without trade measures in place to recognize the financial costs and climate benefits of these products, lower-carbon goods face the risk of being undercut by cheaper, higher-emission products.

This is at the center of current negotiations between the United States and the European Union on the Global Arrangement in Sustainable Steel and Aluminum (GASSA), which kicked off in 2021. The negotiations are still active and, if successful in reaching a common conclusion, could tie market access to carbon intensity. NRDC recently joined other stakeholders in urging the Biden administration to prioritize progress on an agreement.

This year, U.S. legislators began tackling clean trade in earnest by offering competing proposals for a carbon border fee. While there remains much to be hashed out between these proposals, they are a serious step forward.

Looking ahead

A great amount of effort and energy has been spent the last several years diagnosing the problem of industrial emissions and charting a path forward. This year, we will see projects begin to take off. As grants are awarded, as more states move forward on carbon standards in materials, and as more buyers and producers begin to get skin in the game, there will be a tremendous need for coordination and collaboration to ensure investments are aligned with net zero goals.

Cheers to a productive 2024!