Yesterday U.S. PIRG released their latest, best analysis of national vehicle-miles-of-travel (VMT) trendlines, reiterating the finding that absolute VMT peaked in 2004 while VMT per capita did so way back in 1996. PIRG advocates a “new direction” for transportation policy, and lays out the evidence that the “driving boom” of the last half-century is over.

Overall, important factors the authors finger as drivers of emerging traffic trends are demographic, especially those involving Baby Boomers and the Millenials (although I am grateful they point to my generation, Gen X, as also reducing our driving levels), and economic (especially higher gas prices and lower incomes). A word about this second point before pivoting to the fascinating demographics driving our destiny. Many have made noise about the scrambling of the global marketplace due to amazing unconventional oil developments in the energy industry, with breathless stories such as this one on NPR this morning becoming commonplace. Take the notion that this means oil prices will plummet with huge grain of salt. What happens with those prices is as much a matter of geopolitics as geology. For a sobering perspective on this I recommend the diagnosis in this book, which convincingly shows the global oil market is not as fair or free as some think.

The PIRG report points especially to “Millenials,” the huge generational cohort born between 1983 and 2000. 77 million Millenials, or one-fourth of the population, are showing their colors as they take to the roads. As the report notes

According to the National Household Travel Survey, between 2001 and 2009 the annual number of vehicle-miles traveled by 16 to 34-year-olds (a group that included a mix of Millenials and younger members of Generation X) decreased from 10,300 to 7,900 miles per capita – a drop of 23 percent.

These same Americans also have fewer drivers’ licenses, and their use of other transportation choices is on the other hand increasing. These trends may be driven in part by the economy, but as my own colleague Justin Horner has noted on these pages, the economy and driving levels no longer march in lockstep. Plus, the trend pre-dates the onset of recession. Also, public opinion research shows that this generation values internet access and smart phones as much or more than cars, a stark contrast with previous generations, especially the Boomers.

So what about the Boomers? As they go gray, they are also likely to drive less. An empty nest means fewer trips and miles ferrying kids around. And the process of aging eventually makes driving difficult or impossible. As our Executive Director has movingly written, this is likely to become a bigger and bigger problem, with millions of seniors already stranded with few other transportation options.

The most original part of this new report, however, are the scenarios it builds for possible futures. The report plots three scenarios based on different possibilities. At either extreme – “Back to the Future” vs. “Ongoing Decline” – it posits either a bounceback to pre-peak trends or a continuation of the current line downwards. The middle scenario – “Enduring Shift” – assumes some increase in VMT as the economy recovers and population grows, but that changes we see in behavior persist.

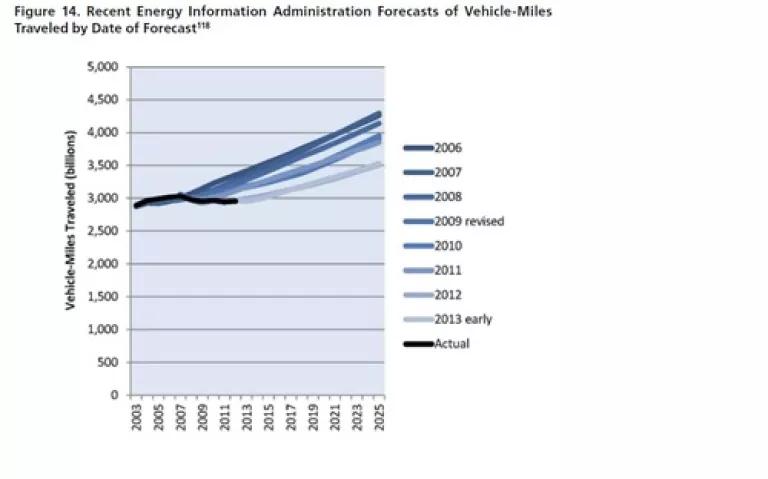

The differences in number of miles traveled can be stark. And here the authors include an amusing graph showing the consequences of getting projections wrong. VMT projections by government agencies are for the most part educated guesses based on past trendlines. Once a per-year figure has been agreed to, an agency simply plots out a straight line decades into the future. One of the most prominent agencies doing this is the Energy Information Administration. Below is a compilation of their projections for Annual Energy Outlooks (AEOs, published annually) since 2006. The authors point out that if 2012 VMT had lined up with AEO 2006, it would have been 3.3 trillion miles. That projection was off by a whopping 10 percent.

This report has a useful complement in Professor Chris Nelson’s new book Reshaping Metropolitan America. This book projects land-development trends for the nation’s 350 or so metropolitan regions. It finds that in the next two decades we will also experience a seismic shift in the housing, commercial and retail development markets. I commend the entire book to you (it’s a compact, fact-filled 120 pages long), since I'll just briefly describe the relevant residential development analysis by Professor Nelson.

He finds that demographics are also going to change the future of housing, and points more to Baby Boomers than Millenials as evidence. He calls the current century the “Baby Boom Century” (beginning in 1946) when it comes to the built environment, given that generation’s overwhelming influence on residential development. As that generation ages, their housing needs will change with sellers outnumbering buyers in most states in the 2020s in what he calls “the Great Senior Sell-Off.” He quotes a 2008 study (by Pitkin and Myers) that alarmingly sums up housing market consequences of the coming wave:

Once the large Baby Boom generation begins to decline in number and scale back its occupancy of housing (starting within 10 years)…the demographic pressure for price increases and new construction will slacken, and mismatches between housing stock supply and demand will leave substantial portions of the national housing stock subject to increased vacancy, disinvestment, and potential demolition or conversion.

One indicator of what’s to come is preference for townhouses for different age groups, as Professor Nelson points out. This hits close to home for me. As the nest emptied out, my parents traded in their detached house with two-car garage for a townhouse in a more walkable neighborhood. Turns out that’s pretty common – while only 9 percent of 24-35 year olds prefer townhouses, nearly a quarter of those 55+ do (Professor Nelson sources this to analysis by Myers and Gearin from 2001).

So housing preferences are changing along with driving preferences. And there’s no overstating the influence of the Boomer gray tsunami in this case. One eye-popping finding is that from 2010-2030 while starter households account for 10 percent of new demand and those demanding “peak space” or relatively large homes for their families account for another 16 percent, due to demographics fully 74 percent of the growth in housing demand will be driven by those 65 and older. As Professor Nelson sums up: “The era of conventional-lot suburban homes meeting the needs of Baby Boom parents and the Boomers themselves would seem to be over...”

So what does this mean for policy?

First of all, it’s really important for policymakers, planners and engineers to master scenario-building given the certainty that next-gen infrastructure needs will be different coupled with uncertainty over how different. No more haggling over a one-year trend and then simply extrapolating that out decades using a ruler. Time to put more thought into projections.

Second of all, as both PIRG and Nelson point out, regional transportation and development plans need to be revisited. Many of them contain legacy projects (and legacy zoning!) that may have made sense in the 1960s but are a poor fit for the coming decades. Professor Nelson advocates that regions should focus much, much more on infill development and redevelopment, and given both residential and nonresidential development projections finds enormous opportunities for both across the country. PIRG advises reconsidering major highway projects, including ones that rely on projected gas tax or toll revenue, given possible or probable reduced auto-travel demand.

And third, Congress and the Administration should build on the performance management requirements in the new transportation law to hold regions accountable so federal tax dollars aren’t wasted. And it really puts local jurisdictions on the hook, since they own more than three-quarters of transportation assets yet most control over transportation dollars is in state and federal hands, which leaves them holding the bag when a highway or road is underutilized, a cold, hard fact explained by Chuck Marohn in this cool video. We don't have the luxury of basing our land-development and transportation decisions on a rear-view-mirror perspective anymore.

There are several other laudable policy prescriptions in the report and book, and I urge you to take a look. The upshot is that it’s time to roll up our sleeves and get to work on real, credible plans for next generation infrastructure investments.