US Climate Finance Plan Restricts Fossil Fuel Finance

This is a clear signal the United States will move away from financing coal, oil and gas projects overseas. Now is the time to make sure the details deliver on that necessary drive to urgently shift public financing from dirty energy to renewable energy and energy efficiency.

During the Leaders’ Summit on Climate, President Biden released the “U.S. International Climate Finance Plan.” The plan provides new signals of how the U.S. intends to drive forward efforts to “end international official financing for carbon-intensive fossil fuel based energy”. The Biden-Harris administration will need to take immediate steps to deliver on this and end international public financing for carbon-intensive fossil fuel-based energy. This is a clear signal the United States will move away from financing coal, oil and gas projects overseas. Now is the time to make sure the details deliver on that necessary drive to urgently shift public financing from dirty energy to renewable energy, energy efficiency and other clean alternatives.

This is an urgent priority since the U.S. has provided over $44 billion dollars for fossil fuel projects overseas in the last decade. The plan must be followed by more concrete implementation measures for all agencies and institutions. Here’s an assessment of the announcements from the Climate Finance Plan and what needs to happen next.

More stringent criteria

This statement from the plan makes clear fossil fuel projects must be ended, but leaves excessively large potential loopholes:

Agencies will seek to end international investments in and support for carbon intensive fossil fuel-based energy projects. However, in limited circumstances, there may be a compelling development or national security reason for U.S. support for a project to continue [emphasis added].

In the past, renewable energy and energy efficiency had to prove that it was viable compared to a fossil fuel alternative. Renewable energy is already cost-competitive in the vast majority of locations and will clearly be cost-competitive over the life of any project in any location where it isn’t already (i.e., in the next 5-10 years). So, instead of renewable energy and energy efficiency (the “alternative”) needing to prove it is better than a fossil fuel source of energy (the “base case”)—we need to flip the script. Fossil fuel energy projects (the “alternative”) should have to prove that it is better than renewable energy and energy efficiency (the “base case”) and other alternatives over the life of the project. Where fossil fuel projects cannot demonstrate they are the best available technology compared to alternatives, they should not move ahead. That criteria should embedded in all policies.

Similarly, a foreign policy that “centers” climate change as a top priority, means that other priorities must prove that they are a better alternative than a climate-centered investment that drives towards the net zero 2050 objective the world is pushing towards. Again, instead of climate-focused actions needing to prove they should compete with other priorities—we need to flip the script. In a climate-centered world we must be able to find ways to both meet our development and national security objectives in a manner that drives urgently towards a net zero future. We can’t meet the world’s development and security objectives in a world ravaged by climate change.

The Plan included loopholes for projects, and it did not set a stringent standard of evaluating projects to make sure they are the best technology and the best use of financing for a host country, or that they are the best way to meet development needs. Loopholes built on finding escape valves for the surplus of U.S. gas should not be tolerated. Nor can we afford claims of national security without clear evidence-based criteria—especially when they appear to be assumptions based on political theorizing.

The U.S. must lead OECD restrictions on oil and gas finance.

The Plan commits the U.S. to leading efforts to rein in global finance for “carbon intensive activities,” and to do more to provide preferential terms for financing projects that mitigate, adapt to or protect against climate change, starting with partners in Organization for Economic Cooperation and Development (OECD) nations:

Treasury, with partners in the OECD and in close partnership with other U.S. government departments and agencies, will spearhead efforts to modify disciplines on official export financing provided by OECD export credit agencies (ECAs), to reorient financing away from carbon-intensive activities. It will also advocate to further incentivize ECA support for climate-aligned investments (e.g., broadening the scope of projects eligible for preferential terms) including in the area of adaptation and resilience, and to adopt methodologies to take climate risks into account when assessing risks to prospective loans and existing portfolio assets.

The Plan recognizes that it is not only coal driving climate change. Now, the Administration must be more explicit and proactive in tackling oil and gas, two carbon-intensive areas that require restrictions, going even further than what the OECD has already developed for coal.

The U.S. pushed for and secured restrictions around this financing for coal so there is a model. But we learned that some countries—Japan and South Korea—would find minor loopholes in the rules through which they approved a significant number of coal plants. The next OECD guidelines need to be better so that we don’t drive a large number of oil and gas projects through what appears to be a tiny opening.

The U.S. must end multilateral fossil finance, including via financial intermediaries

The Plan indicates Treasury (who oversees U.S. involvement) will rein in financing at multilateral development banks (MDBs) like the World Bank, Asian Development Bank, African Development Bank, and Inter-American Development Bank:

Treasury will develop guidance on fossil fuel energy activities at the MDBs, which it will use as part of its criteria when casting U.S. votes on specific projects. Treasury will engage with other shareholders and MDB management to shape MDB strategies and policies in line with this guidance and to align with the Paris Agreement. Treasury will post this guidance publicly.

Again, there is a model for such a Treasury Directive that was applied for coal financing. The U.S. needs to make sure that the guidance directs the U.S. board members to secure MDB strategies and financing that has no loopholes for dirty fossil fuel projects.

The Plan does not provide assurances of what the restrictions will look like, and it’s vital to ensure there are no loopholes for fossil fuel projects. Furthermore, the Plan does not mention that lending by MDBs through financial intermediaries must also limit fossil fuels. Since so much funding flows from MDBs to other financial institutions overseas, that’s an important area which must be addressed explicitly by the Treasury guidance.

Institutions (all of them) must announce fossil fuel restrictions, and actually implement them

While the Plan commits the Development Finance Corporation to net-zero emissions, it sets an unambitious deadline two decades into the future and fails to make similar commitments for numerous other U.S. government institutions enabling fossil fuel infrastructure overseas. This was the only specific institutional commitment mentioned:

DFC will implement a net-zero emissions strategy to transition its portfolio to net-zero emissions by 2040, including by increasing investment in projects that capture and store carbon

This is a missed opportunity to ensure that all of the U.S. government is directed to move in the same direction. More stringent policies are needed to ensure that the U.S. diplomatic apparatus of the State Department and other agencies don’t continue to promote U.S. financing of fossil fuels overseas. This would mean stopping fossil fuel financing and promotion by the U.S. Trade and Development Agency (USTDA), Millennium Challenge Corporation (MCC), U.S. Agency for International Development (USAID), and other institutions. There are still many mechanisms unaddressed through which the U.S. is pushing antiquated infrastructure onto others. It is not going unnoticed that the U.S. is currently more interested in subsidizing America companies exploiting fossil fuels abroad—like ExxonMobil, AES Corporation and GE—than helping host countries identify the best solutions for their energy systems.

Countries are eager for clean solutions and the U.S. is risking losing ground to other donor countries that want to promote the technologies of the present and the future rather than past. The U.S. needs to shift this dynamic quickly and create long-term technology partnerships for the zero carbon technologies we need.

We assume when the U.S. climate finance plan says “Agencies” will support the target of ending fossil fuel financing it means all of them. It will be critical to define strategies and guidelines that align all of the agencies around this shared target.

Increase scope of emissions and fossil fuel supply chain covered

One thing missing from the Plan was a focus on the full scope of projects that must be addressed. There must be explicit recognition of the need to restrict financing for the full supply chain for fossil fuels, not just at the final downstream source of emissions.

With the previous restrictions on coal there is again a model that needs to be strengthened. Groups argued that coal restrictions shouldn’t just apply to the coal power plant itself, but also to the full suite of coal projects. So, investments in the transmission line built for the coal plant or the coal mine to service the power plant should have been covered.

Restrictions on fossil fuels must not only cover power plants, but apply across the oil, gas, and coal value chain (i.e., include upstream, midstream, and downstream segments), as well as for associated facilities and related infrastructure, and should apply to all funding streams and modalities, including indirect financing provided through financial intermediaries, and, in the case of the MDBs, development policy finance.

Address fossil gas (“natural” gas)

While the gas industry and gas turbine manufacturers like GE market “natural” gas as a bridge fuel, the reality is that gas is an impediment to rapid decarbonization worldwide. Policymakers must reject false marketing that ignores the high life-cycle emissions from gas, and the unsubstantiated claims that new gas projects are the only and necessary means to complement renewables. The latter claim, based on self-interest and in contradiction to global projections for the price competitiveness of alternatives, will only harm developing nations seeking to decarbonize and grow their economies cleanly. In Brazil, America’s push to export LNG (liquefied “natural” gas) undermines renewables development. In Vietnam, the U.S. push for LNG deals would bring high price volatility risk and stranded asset risks and expensive prices to consumers. In Pakistan, projected gas facilities would have unbelievably low levels of utilization while being built at great cost. In Bangladesh, subsidization of fossil fuel projects will make it even more difficult to deploy renewables, a problem already acknowledged within government documents.

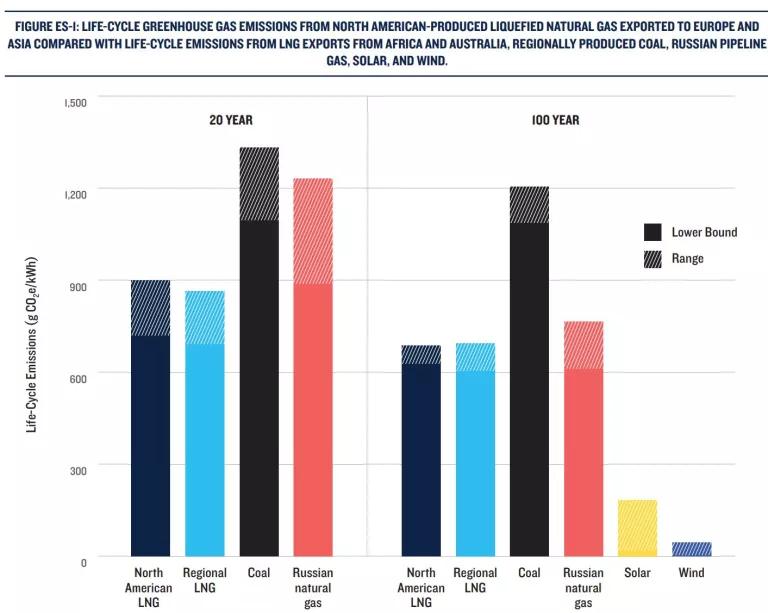

The math is quite simple (see figure) as the carbon-intensive nature of coal and fossil gas is obvious compared to solar and wind.

Time to get the details right on the restrictions of public financing of overseas fossil fuels

The signals in the “U.S. International Climate Finance Plan” need to be followed with the necessary guidelines, policies, and strategies to ensure that all parts of the U.S. government and all financing is moving us rapidly in the right direction.

Scarce U.S. overseas investments need to be moving us towards the zero emissions future we need and not dumping outdated products and infrastructure onto other markets.