The Hidden Costs of Untargeted Hydrogen Deployment

New NRDC analysis finds that an untargeted, “one-size-fits-all” hydrogen economy would require profoundly more electricity infrastructure than a pathway that prioritizes direct electrification—exacerbating the challenges faced by today’s transitioning energy system.

Governments and businesses alike are paying increasing attention to hydrogen as an emerging energy resource. Consequential, market-forming policies are already in play in the U.S.: the recently passed Inflation Reduction Act (IRA) includes some of the most generous hydrogen subsidies in the world, and last year’s Infrastructure Investment and Jobs Act (IIJA) appropriates $8 billion to the Department of Energy for the development of hydrogen demonstration ‘hubs’ across the country.

New NRDC analysis investigates the broader energy system impacts of deploying hydrogen in ‘low value’ end uses – applications where more cost-effective and efficient climate solutions exist. It finds that an untargeted, “one-size-fits-all” hydrogen economy would require profoundly more electricity infrastructure than a pathway that prioritizes direct electrification, exacerbating the challenges faced by today’s transitioning energy system. In light of this analysis and the rollout of IRA’s hydrogen production incentives – which are expected to bolster domestic hydrogen supply – it is more important than ever to pay attention to where that hydrogen will be used. Hydrogen deployment should prioritize the hardest-to-decarbonize sectors of the economy.

In light of rapidly increasing federal and state investments in hydrogen, it is essential that this funding is guided by rigorous analysis of the technology’s opportunities and risks. The stakes of this analytical endeavor are high: when deployed carefully, green hydrogen has the potential to decarbonize the hardest-to-abate sectors of the economy and support the attainment of U.S. climate goals. However, without sufficient guardrails, the production and use of hydrogen also carry significant climate and health risks. Furthermore, overinvestment in hydrogen – in the wrong sectors and at the expense of tried-and-true decarbonization solutions (like energy efficiency and electrification) – may increase the overall costs of transitioning to a clean energy economy and thereby hinder efforts to reach net-zero greenhouse gas (GHG) emissions.

Analysis Design

NRDC evaluates and compares the impacts of various techno-economic pathways towards a net-zero U.S. economy by 2050. This particular analysis focuses on hydrogen: it aims to assess the implications of diverging approaches to hydrogen deployment. It does so by comparing the results of three scenarios, designed by NRDC and modeled in EnergyPathways by Evolved Energy Research:

- A Business-as-Usual (BAU) scenario, which assumes no further interventions beyond current market and policy conditions as of Spring 2021. Under this scenario, which provides a baseline measurement for costs and emissions under the incumbent energy system, the model does not attempt to reach a net-zero GHG economy.

- A High Electrification, Targeted Hydrogen scenario, in which the U.S. economy achieves net-zero GHG emissions by 2050 via the direct electrification of end uses where feasible, improvements in energy efficiency, and a dramatic ramp-up in clean electricity generation. Hydrogen and carbon capture are reserved for the hardest-to-electrify applications, such as steelmaking, chemicals production, and low-carbon fuel production for aviation and maritime shipping. This pathway reflects NRDC’s assessment of a highly efficient pathway to net-zero, based on best available and independent techno-economic projections.

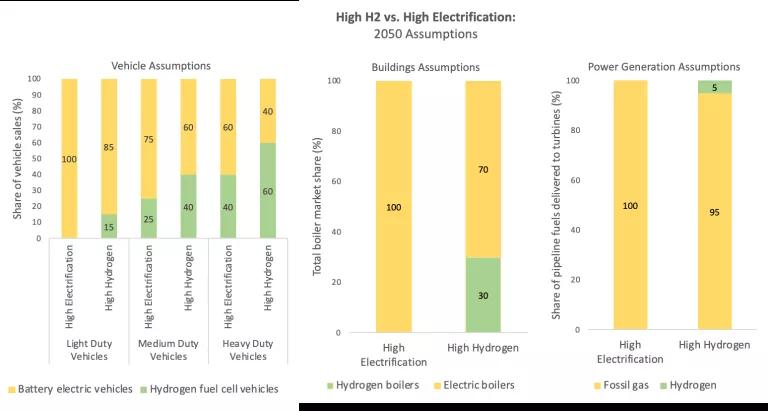

- A High Hydrogen scenario, in which the U.S. economy achieves net-zero GHG emissions by 2050 via the widespread deployment of hydrogen, even across applications with more cost-effective and efficient options for decarbonization, such as residential heating. This case is meant to capture the ‘expanded hydrogen economy’ promoted by some in the oil and gas industry, including major U.S. gas utilities with plans to deliver hydrogen-gas blends to customers in lieu of electrification. This scenario assumes expanded hydrogen deployment across the buildings, power, and on-road transportation sectors (e.g. cars and trucks), as well as in the same applications involved in the High Electrification case (including steelmaking, chemicals production, marine shipping and aviation). In the High Hydrogen case, we assume that, by 2050: hydrogen fuel cell (HFC) vehicles reach a higher market share of light-, medium-, and heavy-duty vehicle sales; a third of homes switch from fossil gas to hydrogen instead of electrifying; and hydrogen meets 5% of power generation (see Figure 1).

Figure 1: The High Hydrogen scenario is designed to reflect an expanded deployment of hydrogen relative to the High Electrification, Targeted Hydrogen scenario. These scenarios are developed by NRDC based on projections of technical feasibility, existing utility proposals, and independent expert feedback.

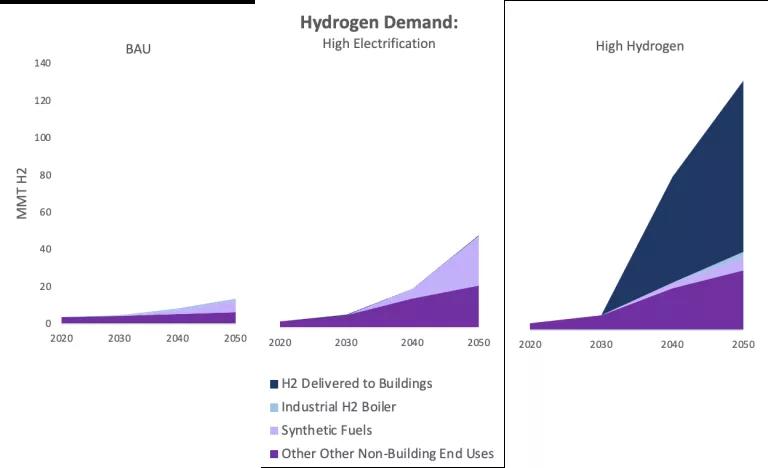

Under the High Hydrogen scenario, the widespread deployment of hydrogen in vehicles and homes creates an additional 82 MMT of hydrogen demand: over 2.5 times what is required to decarbonize only hard-to-electrify end-uses (Figure 2).

Figure 2: Under the High Hydrogen scenario, total demand for hydrogen is ten-fold that of the reference case, and more than double that of the High Electrification scenario.

Key Results

The results of this analysis suggest that a hydrogen-heavy pathway to decarbonization – as embraced by some in the gas and hydrogen industries – may lead to greater pressures and higher costs on the U.S. energy system than a pathway that prioritizes direct electrification.

Green Hydrogen Leads the Pack

In both decarbonization scenarios, the vast majority of hydrogen demand is met by green hydrogen, which is produced via the process of water electrolysis powered by renewable electricity. Even in the face of skyrocketing demand for hydrogen, the model selects green hydrogen largely because:

- It is projected to become the cheapest form of low-carbon hydrogen on a per-kilogram basis by 2035 in most regions across the U.S. Though not modeled here, the hydrogen tax credits included in the Inflation Reduction Act will only accelerate green hydrogen’s ability to achieve cost parity with both blue and gray hydrogen – which are produced from methane with and without carbon capture, respectively – in these regions.

- Green hydrogen can provide unique benefits to the grid by supporting the integration of renewables. Green hydrogen production is flexible, meaning it can be produced during times of the day with excess renewable generation. This type of flexible load can increase revenue for wind and solar projects and, importantly, reduce the costs borne by ratepayers. These benefits will accumulate as the U.S. grid approaches decarbonization and renewable penetration increases.

Figure 3: Electrolytic hydrogen outcompetes fossil-based hydrogen in pathways to net-zero emissions. i) Electrolyzer cost projections are developed by NRDC as an average of projections from IEA and BNEF. ii) Hydrogen transport was geographically limited in the electrification scenario, but not the hydrogen scenario, meaning that more blue hydrogen is deployed in the former to circumvent electricity transmission constraints.

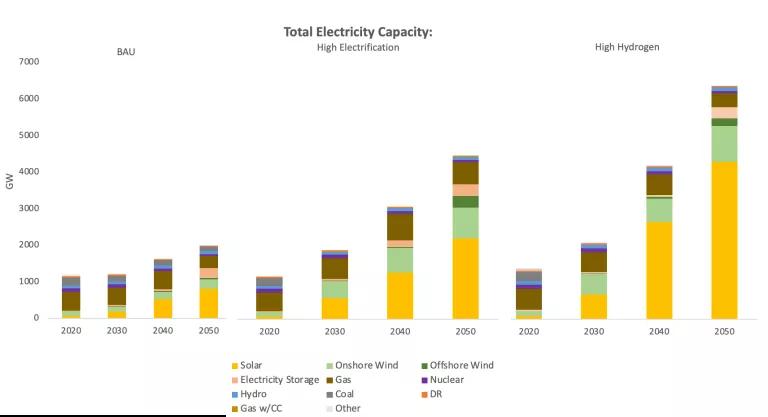

High Hydrogen Case Sees Significant Increases in Electricity Demand

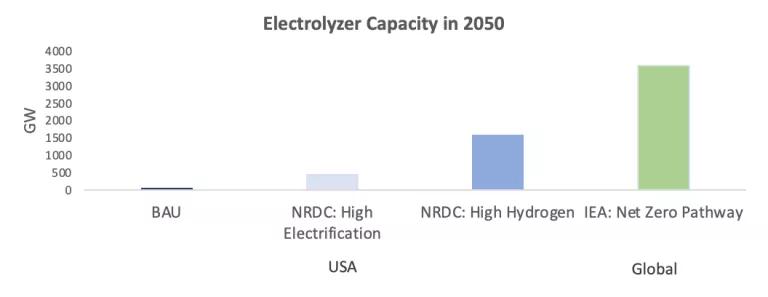

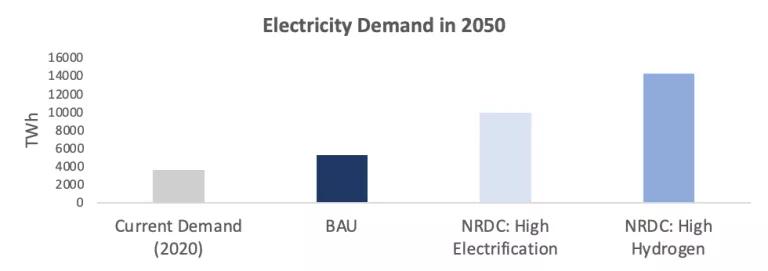

Under the High Hydrogen scenario, meeting outsized demand for hydrogen requires a profound expansion of the U.S. electricity system, even beyond the substantial buildout under the High Electrification pathway. Electrolyzer capacity grows to about 1,600 GW in 2050 – at three times that of the High Electrification case, this is nearly half of the global electrolyzer capacity projected under the International Energy Agency’s pathway to net-zero emissions (Figure 4). (As of last summer, less than 170 MW of electrolyzer capacity had been installed or under construction in the U.S.). Electrolyzer use at this scale drives an increase in total annual electricity demand to over 15,000 TWh by 2050, meaning the grid would have to generate and transmit four times as much electricity as it does today (Figure 5). Comparatively, electricity demand is 30% lower in the High Electrification case. This is because it is inherently less efficient to produce and use hydrogen in lieu of direct electrification where feasible.

Figures 4 & 5: In the High Hydrogen scenario, electrolyzer capacity is 200% higher and electricity demand is 40% higher than in the High Electrification scenario by 2050.

Solar Power Dramatically Ramps to Meet Electricity Demands…with Infrastructure Challenges In Sight

This growing appetite for electricity is met by a remarkable increase in solar deployment: under the High Hydrogen case, the model builds about 3,700 GW of solar on top of the 97 GW existing today, which translates to an average of about 130 GW of solar coming online every year for the next three decades. This capacity buildout is 70% higher than that of the High Electrification scenario. This represents an unprecedented level of solar energy buildout – constructing enough facilities at this scale compounds upon the permitting, siting, and supply chain challenges already experienced by the renewable energy industry. This reveals the risk that excess hydrogen production could cannibalize resources and ultimately complicate the task of transitioning to a clean energy economy.

At the same time, the High Hydrogen scenario demonstrates a 16% reduction in battery storage capacity by 2050, as some hydrogen is available to provide storage to the grid. In both scenarios, gas plays a narrow role in providing grid reliability. The High Hydrogen scenario keeps 40% less gas capacity online relative to the High Electrification scenario, as hydrogen is exogenously forced to replace some gas use in the power sector.

Figure 6: The model chooses to build solar resources (over, say, on- or offshore wind resources) due to solar electricity’s low levelized cost (LCOE) and the relative agnosticism of electrolyzers to solar plants’ variable generation profiles.

Public Health and Climate Risks of Hydrogen Must Be Measured and Mitigated

This analysis does not report on cost outputs due to limitations on the model’s ability to capture hydrogen distribution and storage costs, which are set to be resolved in EnergyPathways’ 2022 update. Thus, this discussion is limited in its ability to quantify and compare infrastructure costs between the two pathways, including the costs of expanding electricity transmission and distribution and building a national network of hydrogen pipelines, storage tanks, and refueling stations. Other NRDC blogs explore the risk that extensive infrastructure in service of a widespread hydrogen economy may prove significantly more expensive in the long run. Policymakers should be wary of unwittingly increasing the costs of transitioning to a clean energy economy by pursuing less efficient pathways.

Beyond costs, indiscriminate hydrogen investments carry additional risks not captured by our analysis, namely increases in greenhouse gas emissions and local air pollution. Recent studies are revealing that hydrogen leaks can exacerbate climate warming more than previously estimated and should be rigorously measured and mitigated. Similarly, emissions from both methane- and electrolysis-based production pathways must be eliminated or they run the risk of undermining the decarbonization benefits of hydrogen. Absent strong regulations and emissions controls, burning hydrogen to heat homes or generate electricity may also increase emissions of health-damaging nitrogen oxides.

Recommendation: Pair Quality Investments with Quality Assessments

This analysis is not meant to discount the climate benefits of thoughtfully scaling the hydrogen economy. Instead, it highlights the potential costs of allowing hydrogen to proliferate without direction, and thus the need to deploy hydrogen where it would deliver the most economic, climate and public health benefits relative to alternatives. In step with the supply-side push from the IRA’s hydrogen tax incentives, it is more critical than ever that investments target the hardest-to-decarbonize applications. Any other promises of hydrogen as a “one-size-fits-all” solution – as both a policy strategy and an investment – should be approached with healthy analytical skepticism.