MISO Plans for a Clean Energy Future

The Midcontinent Independent System Operator (MISO) is taking a new approach to how it conducts transmission planning, one that holds great promise.

How should grid operators plan for the shift to a clean energy future? Traditional transmission planning is based on historical experience that is extrapolated into the future. In this type of planning, yesterday is the best predicator of tomorrow. While such planning may have made sense in the past, it doesn’t work when the electric industry is experiencing rapid transformation and when clean energy resources such as wind and solar are quickly becoming the cheapest and overwhelmingly most attractive generation resources. While the shift to a clean energy economy provides many exciting opportunities for increased competition and lower costs to consumers, it also provides new technological challenges for grid operators, including significant changes in where and how much transmission is needed to operate a clean energy grid.

The Midcontinent Independent System Operator (MISO) is taking a new approach to how it conducts transmission planning, one that holds great promise. By doing so, MISO provides an important example of how to plan for and build the transmission system of the future in a way that meets our future energy needs, addresses the climate crisis, and saves customers money. Other planning regions in the U.S. should take note and follow MISO’s lead.

Most regions are not building for the clean energy future that is fast approaching

The future transmission system will look dramatically different than the one we have today, because of:

- state and utility clean energy policies

- increasing consumer demand for renewable energy

- economic trends

- the transformational change in the generation portfolio

- increased extreme weather caused by climate change, and

- electrification of the vehicle and building sectors.

Because major transmission projects often take more than a decade to build, planning that fails to take these trends and risks into account results in infrastructure that will make it more difficult and expensive to keep the lights on. And yet most planning regions, whether they are part of a Regional Transmission Organization (RTO), don’t identify potential transmission needs based on a future we know is coming. This can’t continue.

How scenario planning works and why it doesn’t try to perfectly predict the future

Scenario-based planning shifts from planning based primarily on past experience to planning based on current trends and future expectations. At a minimum, two different scenarios are created that represent opposite ends of the range of plausible futures. One end makes conservative assumptions about the various supply and demand trends and system risks. The other end makes aggressive, but still plausible, assumptions. Possibilities between these two extremes can also be evaluated. It’s important to note that scenario planning is not attempting to perfectly predict the future; rather, scenario planning seeks to identify a range of plausible hypothetical outcomes. A single scenario is almost never selected at the end of the planning effort as the “correct” scenario. Instead, “least regrets” solutions are designed to be responsive to a future that falls somewhere between the two book-ended futures.

For grid operators, these hypothetical future worlds include different assumptions concerning anticipated future generation and load patterns. The portfolio of generators in any single future are driven by assumptions such as the cost of new wind and solar projects, the price of natural gas, retirements of existing generation sources, the number of electric vehicles, growth in electricity demand, reductions in greenhouse gas emissions, and compliance with federal, state, and local climate and clean energy requirements as well as corporate and utility clean energy procurement targets.

MISO has developed scenarios for its long-term transmission expansion planning

MISO, which serves 15 states and the Canadian province of Manitoba, has been a leader in forward-looking transmission planning through its long-range transmission planning (LRTP) process. MISO began its LRTP process in 2020 with the development of three “future scenarios.” MISO has based the first group of projects (referred to as Tranche 1) on only one future (Future 1), rather than a range of plausible futures; thus, MISO’s current planning process cannot be considered formal scenario planning which requires evaluating multiple futures.

Nonetheless, the modeling results for Future 1 are significant. For example, because Future 1 assumes 85% of state and utility clean energy goals and 100% of state integrated resource plans (IRPs) are met, the model concluded that the generation mix would result in a 63% reduction in carbon emissions, obviating the need for modelers to do further analysis to determine how to achieve the Future 1 assumption of a 40% reduction in carbon emissions.

For the remaining groups of projects, MISO will be focusing on Futures 2 and 3, which include even more aggressive assumptions than those used in Future 1, including 50% or more penetration of wind and solar resources, aggressive electrification assumptions, and an 80% reduction in carbon emissions. MISO has been very clear in stakeholder discussions that it is not driving these systemic changes itself but is simply responding to trends and preferences of its utility members, consumers, and member-states.

This is not the first time that MISO has completed forward-looking transmission planning. In 2011, it embarked on its Multi-Value Planning (MVP) process. Transmission projects approved through the MVP process were required to demonstrate that they could either reliably and economically enable regional public policy needs, provide multiple types of regional economic value, or provide a combination of regional reliability and economic value.

The 2011 MVP results speak for themselves: the $6.6 billion spent on MVP projects has been estimated to provide net benefits of between $7.3 to $39 billion over the next 20 to 40 years and across all MISO zones subject to the MVP process. In other words, these projects will have paid for themselves many times over. Had these projects not been built, consumers would be paying much higher rates than necessary for their electricity.

MISO is not yet over the finish line

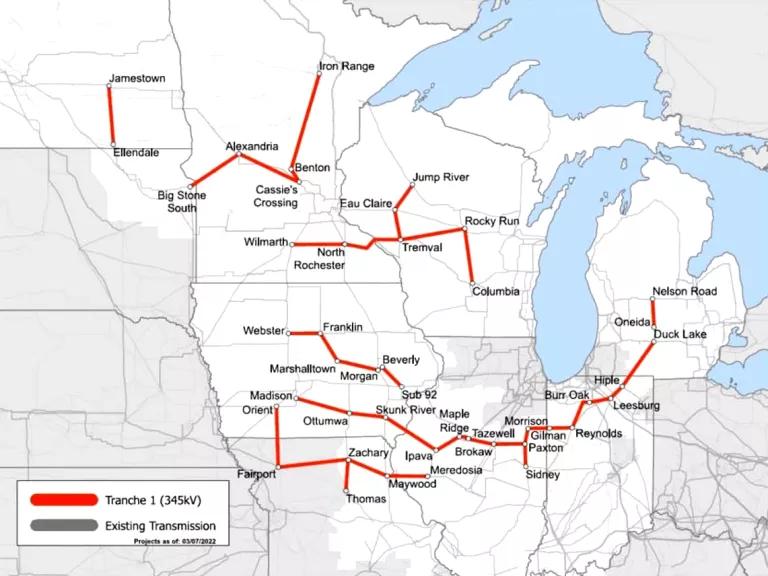

The Tranche 1 projects are located entirely within the same region that the original MVP projects were sited, called MISO Midwest. As of March 2022, Tranche 1 is anticipated to look something like this:

Under the MISO tariff, the projects in Tranche 1 must at least pay for themselves over time—which they do and then some. MISO has recently estimated that every dollar spent on this package of projects will save customers $2.60. With the total capital costs estimated at $14.2 billion, consumers will receive approximately $36.8 billion in savings over the first 20 years of these lines (and more than that over the expected 60-year lifetime of these lines).

In calculating the savings produced by Tranche 1 projects, MISO analyzed the following “benefit metrics” which typically focus on the costs that are avoided by building the project:

- congestion and fuel savings (often called “adjusted production cost savings,” this is the savings that consumers would otherwise have to pay for electricity without the proposed transmission project)

- avoided costs of local resource investments (the savings from not having to build local generation)

- avoided transmission investment (the savings from not having to address future local reliability problems and replace aging local infrastructure)

- reduced resource adequacy requirements (“resource adequacy” means that utilities have enough power to ensure that the lights stay on, particularly when demand is high; this metric looks at the savings from being able to access low-cost generation resources by building new transmission to ensure resource adequacy)

- avoided risk of load shedding (this metric focuses on how transmission will reduce the risk of outages during severe weather events)

- decarbonization (this metric focuses on the benefits of reducing carbon emissions by enabling reliable delivery of low-cost clean energy)

If approved, the Tranche 1 portfolio will be the largest single transmission investment portfolio in recent U.S. history. By comparison, the 2011 MVP project investments were approximately $6.6 billion, and the Texas Competitive Renewable Energy Zone (CREZ) projects cost approximately $7 billion.

Shortly after sending Tranche 1 to the MISO Board for final approval, MISO will immediately begin its modeling for Tranche 2 of the LRTP process, which will use Futures 2 and 3 and will also be focused on MISO Midwest. The LRTP process will then turn its attention to MISO South in Tranche 3, which is anticipated to be sent for approval to the MISO Board of Directors in 2023 or 2024. Lastly, MISO will investigate how to increase the size of the “interface”, or connections, between MISO South and MISO Midwest in Tranche 4 to allow more electricity to flow between these two subregions.

While outdated and only an illustration, the following two maps show transmission expansions for Future 1 and Future 3:

Other planning regions should follow MISO’s lead

While not perfect, MISO’s use of scenario planning for designing the grid of tomorrow should be a model for other planning regions to emulate. Below is a non-exhaustive list of items that regions should include when engaging in this type of forward-looking planning:

- Planning regions should evaluate multiple scenarios, which must create a range of plausible futures with a conservative bookend on one end of the continuum and an aggressive bookend at the other end.

- Assumptions should include compliance with federal, state and local clean energy and carbon reduction goals as well as utility goals. The most conservative future should include 100% of binding plans and goals and between 70-90% of compliance with non-binding but promised plans and goals. The most aggressive future should include 100% of all plans and goals.

- Assumptions about adoption rates of electrification in the transportation and building sectors should be based on recent and expected trends.

- Assumptions about how much new generators would cost to build, what level of efficiency they are likely to achieve, their fuel costs, and retirements of existing generators should be based on recent and expected trends.

- Assumptions should also be made concerning the likelihood of more frequent extreme weather events to ensure that sufficient transmission exists to keep the lights on in the face of severe weather.

MISO’s leadership demonstrates that scenario planning is an essential tool for designing the grid of tomorrow. In the face of a rapidly changing electric sector, grid planners should follow MISO’s lead and plan for the future. To not do so will lead to a grid that is more expensive, less reliable, and unprepared for the clean energy future we know is coming.